The Lok Sabha on 19th September, 2020 has passed The Companies (Amendment) Bill, 2020 that decriminalizes several compoundable offenses. It also allows direct listing of Indian companies on Foreign Stock Exchanges and withdraws the criminal provisions in the Companies Act for violations of provisions of CSR rules. It also promotes ease of doing business. In this article we described about Lok Sabha passes Companies Amendment Bill, 2020.

Around 48 Sections of Companies Act, 2013 will be amended for decriminalizing compoundable offenses and 17 Sections for ease of doing business. The bill has come at a time when companies are stumbling under stress due the COVID-19 pandemic. The (4th amendment) Bill was introduced in the Lok Sabha in May, 2020 by Finance and Corporate Affairs Minister Nirmala Sitharaman.

Company Law Committee Report

The Company Law Committee Report in November 2019 has provided for revoking of 46 penal provisions in the following way-

- Re-classifying of 23 offences out of 66 compoundable offences to in-house adjudication framework in which penalty will be imposed by adjudication officer

- Exclude 7 compoundable offences

- Restricting 11 compoundable offences to fine (by eliminating imprisonment part)

- Recommending 5 offences to deal with an alternative framework

Read our article:Implementation of Delinking Credit/Debit Notes on the GSTN Portal

Major Changes in Companies (Amendment) Bill, 2020

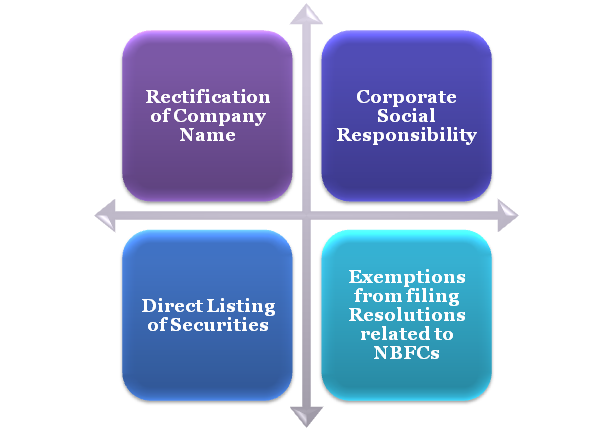

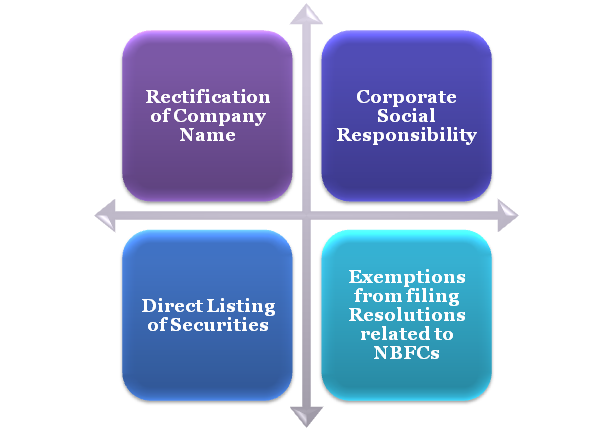

The Major Changes in the Companies (Amendment) Bill, 2020 are –

Changes in Companies (Amendment) Bill, 2020

The Companies (Amendment) Bill, 2020 based on the Company Law committee report, which provides the following changes-

Decriminalize Offenses

The Amendment Bill seeks to decriminalize various offenses under The Companies Act, 2013 in relation to defaults which can be determined objectively or otherwise lack any element of fraud and does not include large public interest.

The Finance Minister Nirmala Sitharaman said that the Government is paying attention on decriminalizing provisions in companies act to promote ease of doing business; mainly for small companies. The penal provisions will be brought down from 134 to 124. On the other hand, there will be no transformation in the non-compoundable offences provisions.

Corporate Social Responsibility

The Amendment Bill provided that spending obligation up to INR 50 lakhs will not be required to form a CSR Committee. Eligible Companies under Section 135 (Corporate Social Responsibility Provision) are allowed to set off any amount spend in excess of CSR funding obligation.

Direct Listing of Securities

The Companies Amendment Bill has enabled the provisions for direct listing of securities of Public Companies with consultation of Securities Exchange Board of India. It was done to exempt the Private Companies to issue specific securities on exchange from the definition of listed Companies.

Reduce penalty for Offense

The amendment bill extends the applicability of Section 446B that is related to fewer penalties for small and One Person Company with relation to all the provisions of the act that allows monetary penalties.

Jurisdictions

The Amendment bill clarifies the jurisdiction of Trial Court on basis of place of commission of the offense (Section 452) for wrongful withholding of the property by the employees or officers of the company.

Incorporation of a New Chapter related to Producer Company

A New chapter XXIA related to Producer Company has been incorporated, which was earlier part of Companies Act, 1956.

NCLAT Benches

The Amendment bill seeks to establish more benches in the National Company Appellate Tribunal (NCLAT) to ease the burden and to decrease the delay in cases.

Relaxation in the Provisions related to additional fees

The Amendment Bill clarifies relaxation in provisions related to charging of higher fees for default in registering, submitting, and recording or filing any fact, information as well as documents as provided in Section 403 of the said Act.

Exemptions from Complying

The Amendment Bill has exempted any class of persons from complying with the requirements of Section 89 related to the concept of beneficial interest of the shares. It has also exempted companies incorporated outside India or any Foreign Company from Provisions of Chapter XXII.

Further issuance of shares

The Amendment Bill reduced timelines for applying for rights issued to speed up the process.

Exemptions from filing resolutions related to NBFCs

The Companies Act required companies to file some resolutions with the Registrar of Company (ROC), excluding NBFCs from filing resolutions passed to provide guarantees for a loan or to grant loan. The Amendment Bill has extended these exemptions from filing resolutions under Section 117.

Periodical Financial Results filing

The Amendment Bill requires the following-

- Specific classes of unlisted companies are required to prepare and file periodical financial reports;

- Unlisted Companies are required to obtain approval from Board of Directors;

- Unlisted Companies are required to file a copy for financial reports within 30 days of completion of specified period.

Provides window for delay in filing

The Amendment Bill provides a window within which penalties should not be imposed for delay in filing financial statements and annual return.

Companies to have Board of Directors

The Amendment Bill provides for a new insertion for Independent as well as Non-Executive Directors can receive any sort of remuneration, excluding when there is no profit or inadequate profits in the company.

Rectification of Company name

The Amendment Bill says that if any company was registered involuntarily with any registered trademark and the name is identical or similar to an existing trademark then the company is required changing the name within 3 months from the issue of the direction by the Central Government[1].

Conclusion

The Central Government by virtue of stable amendments through Act or Ordinances or is determined to constantly keep the Law dynamic and compliant to changing conditions. The Lok Sabha on Saturday night passed The Companies Amendment Bill, 2020 to decriminalize several compoundable offenses and to promote ease of doing business in India.

Amendment_18032020Read our article:Supreme Court Recommends Comprehensive System of Advance Tax Ruling to Reduce Litigation