The financial year 2020 started with an outbreak of COVID 19 that hampered the world economy to a great deal. Due to this pandemic, millions of professionals have been lost their job or routed back home on unpaid leave. By this time, at least one thing has been cleared to all of us that we aren’t going reap extra monetary benefit from our respective income source until this pandemic gets in control. Fortunately, there are ample methods you can implement in your regime to secure the finances.

Read our article:CBDT notifies Income Tax Exemption in State RERA of Goa and Telangana

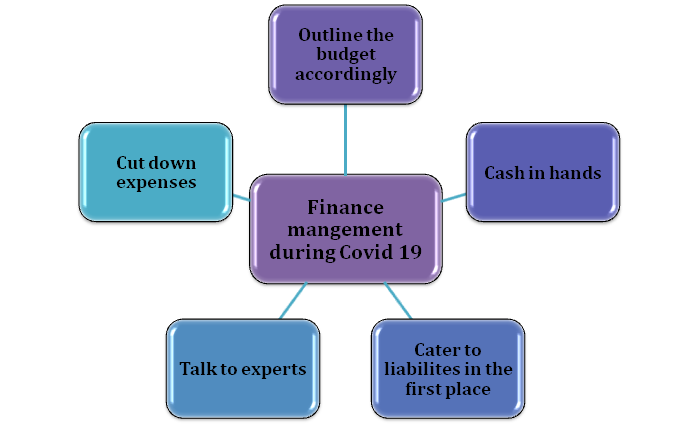

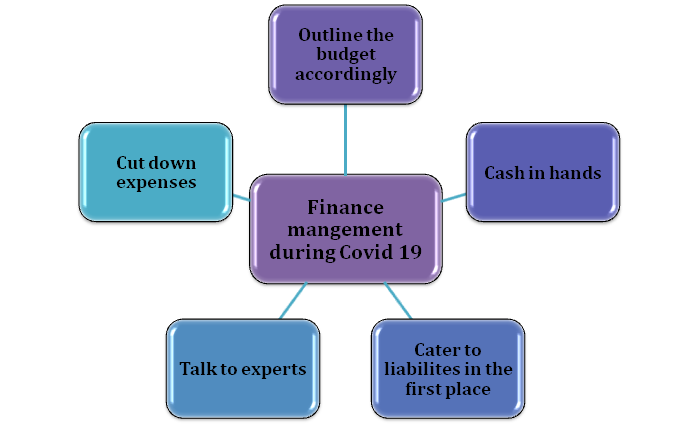

Reconsider the budget

When was the last time you have outlined the budget against all the expenses? If it has been a month or so, then it’s time to revise it now. While enlisting all possible expenditures in your budget, make sure to rank them on the basis of priority. It would render a better picture of your prominent expenses and enable you to cater to liabilities with authority. I have to consider this method without exception if you wish to secure the finances from this situation.

Cut down unnecessary expenses

The market shift would erode your investment and savings to the point until the thing gets stabilize. And this is when you have to act smart and cater to your liabilities in the most efficient manner. Constant saving from your income can put in the commanding situation and let you secure the finances with ease. Also, keep eyes on unnecessary expenses and avoid them whenever possible.

Take advice from lenders

If your budget won’t allow you to cater to financial obligations, expert consultation is a way to go. Feel free to connect with your lender and ask them for advice on managing the existing debt. Also, look out for new policies regarding late payments that you might have missed out in the meantime.

Address your liabilities on time

Of course, it would be a daunting task to address financial liabilities in the current situation. We suggest you cut the unnecessary expenses and prioritize debt-based obligations in the first place. Pay your credit card bill and loan debt on time to avoid spoiling of credit score. Don’t take a step backward if you fail to address any financial obligations. Instead, try to tackle the situation with the experts’ help who has a profound knowledge about investment and taxation.

Keep more cash in hand

It is perhaps the best way to address the urgent financial needs in the pandemic. Keeping real cash under the possession could help overcome the emergency crisis related to health, money, or anything that bothers you greatly.

Conclusion

It all boils down to safeguarding of cash reserves against unnecessary expenses and plan the finances accordingly. There is no denying that the ongoing pandemic could squeeze out your saving and investment in no time. If you want to stay ahead of curves, you have to adopt the strategies as mentioned above. As of now, there are no substantial speculations that could confirm economic stabilization[1]. So, it better for you to gear up and emphasize parameters that impact your earning and help you secure the finances.

Read our article:CBDT extended the Filing of ITR deadline till 30th September