The De-linking of new invoices and credit and debit notes are registered under the GSTN portal. The same was amended in CGST amendment Act, 2018 with the effect from February 1, 2019. Still, the same is registered on September 14, 2020, on the portal.

After more than 1.5 years of the amendment in Section 34 of the CGST Act, 2017, Goods and Service Tax Network has finally allowed the facility to report consolidated credit or debit notes under GSTR-1.

What is Section 34 under CGST Act?

Section 34 of the Central Goods and Services Act, 2017, which deals with Credit or Debit note under GST regime, where a person is registered under the Goods and services tax. The registered person has to issue more than two different credit or debit notes in reference to the multiple tax invoices in a financial year under GST.

Read our article:All you need to Know about Inspection under GST

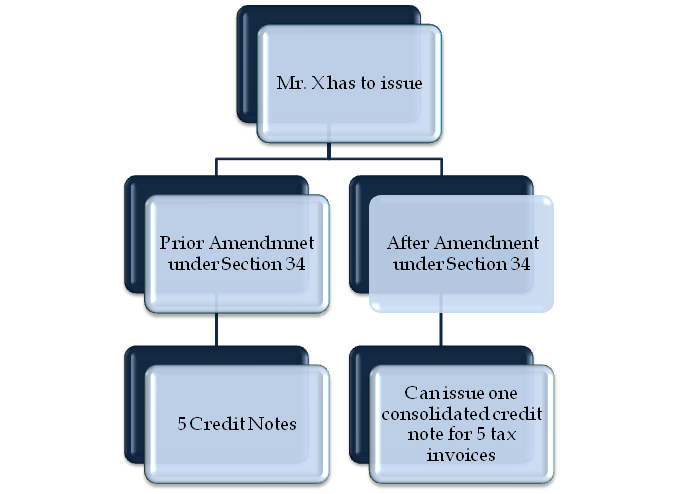

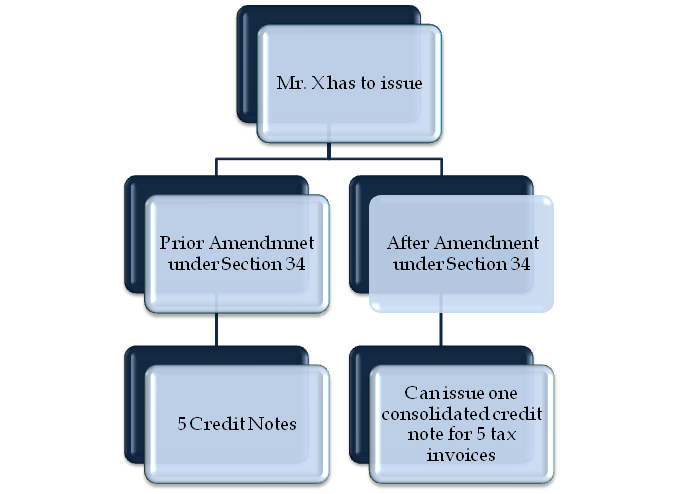

Let’s understand this amendment with help of an illustration

- The question is whether Mr. X has to issue 5 different credit notes or consolidated credit note for these 5 tax invoices.

Before the amendment in Section 34 Mr. X has to issue five credit notes, but after the amendment, he can issue one consolidated credit note for five tax invoices.

Conditions before Amendment

Before amendments under section 34 of CGST Act; a registered person needs to mention the “Original date and number of the tax invoice” in order to report for credit or debit note issued in GSTR-1 on the GST Portal.

The taxpayers selling through online platforms like Amazon, Flipkart, Paytm, etc. can claim this task to issue different credit or debit note for different tax invoices under GST law. It is burdensome compliance as they need to spend more time, money, and effort to maintain the records of credit or debit notes.

Conditions after Amendments

After the amendment, the facility to issue a consolidated or single credit note, against more than two tax invoices raised in a financial year which has executed on the GST portal[1].

One can easily understand that the GSTN portal does not ask for “original date and number of the tax invoice” as credit or debit note is delinked from original invoice on the portal. This helps the taxpayers to account single credit or debit note with reference to multiple tax invoices raised in a financial year in GSTR-1 form.

Despite of the amendment in the CGST Act, 2017, the GSTN portal did not have a functionality link for multiple tax invoices with a single credit or debit note.

Conclusion

The much-awaited de-linking of original invoices and credit or debit notes has now been allowed on the GSTN portal. The Amendment says that the facility to issue a consolidated or single credit note, against more than two tax invoices raised in a financial year, are now allowed.

Read our article:List of Goods and Services where GST is Applicable: Latest Rates