The lower house of the parliament finally passed the Foreign Contribution Regulation Amendment Bill, 2020. The Act governs the utilization and acceptance of overseas contribution by companies, individual, and associations. Foreign contribution is referred to as transfer of any security or currency by the overseas source.

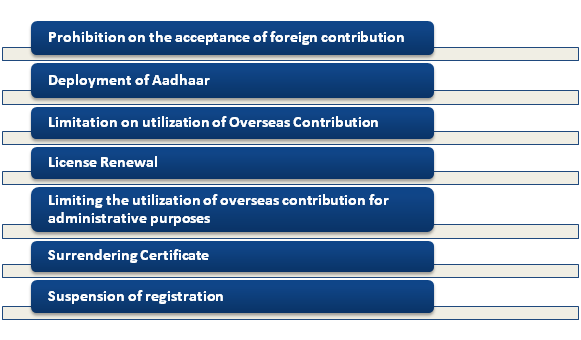

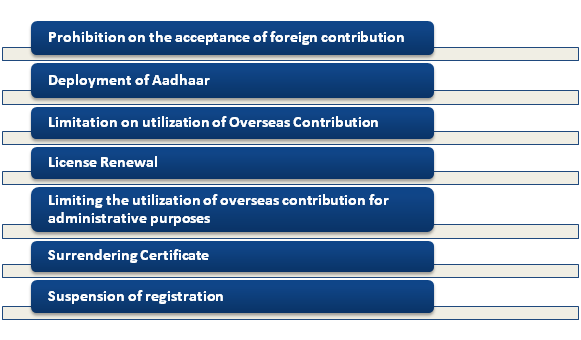

Prohibition on the acceptance of foreign contribution: The Act cut off the exposure of the following individuals to the foreign contribution:-

- Government servants

- Editor

- Judges

- Election candidates

- Members of legislature.

- Publisher of the newspaper.

The bill also incorporate public servant to the list as defined under the Indian Penal Code. Public servant is defined as any individual who involve with the services or pay of the government or paid by the government[1] for performing certain public duties.

Read our article:How FCRA Registration Makes Foreign Contributions Process Hassle-Free for NGOs?

Deployment of Aadhaar

The Act has deployed certain stipulations for the acceptance of the overseas currency. These are as follows:

- Any person willing to accept overseas currency must availed a Aadhaar registration certification from the central government

- In the absence of the registration certification, the individual must availed prior permission from the relevant authority to serve the same purpose.

Any individual intends to avail registration or prior permission for the acceptance of the overseas contribution must file a detail application to the central government in a predetermined format. The bill further states that inclusion of the Aadhaar is must in such cases as it act as an identification document. In case of the overseas applicant, they must furnish the copy of Overseas Citizen of India card or passport for identification purpose.

The Act requires the registered person to accept the overseas contribution only in a single branch of a bank prescribed by them. However, the Act doesn’t impose any limitation over the utilization of the contribution as the person is free to transfer such contribution to any other bank account.

The bill amends to confirm that overseas contribution must be routed only to an account tagged as “FCRA account” by the schedule bank in a branch of State Bank of India, as per the notification of the central government.

Limitation on utilization of Overseas Contribution

As per the Act, if an individual accepting overseas contribution is found guilty of infringing any regulations of the Act or the Foreign Contribution (Regulation) Act, 1976, aka FCRA, the unutilized or unreceived overseas contribution might be received or utilized, only with prior permission of the central government.

License Renewal

As per the law, the registration certificate must be renewed before six month of its expiry. The Bill also states that the government may arrange an inquiry prior renewal of the registration certificate to make sure that individual filing an application: (i) is not fabricated or Benami (ii) has not been found guilty of raising communal tension or engaged with activities related to religious conversion, and (iii) has not been convicted for diversion of the funds, and among other stipulates.

Limiting the utilization of overseas contribution for administrative purposes

As per the Act, an individual who receives overseas contribution must not deviate from the purpose for which it has been received. Moreover, the individual are now only permitted to allocate 20% of the contribution for meeting administrative related expenses.

Surrendering Certificate

The bill incorporates the provision permitting the central government to allow an individual to surrender their certificate. In the purview of the above, government may conduct investigation to ensure that concerned person has not infringed any regulation of the Act and management handling its foreign contribution has been vested properly in an authority.

Suspension of registration: As per the Act, the government reserved the right to suspend the registration of an individual for a period of one hundred and eight days. The bill states that additional 180 days may be deployed in this regards.

Conclusion

The Foreign Contribution Regulation Amendment Bill, 2020 would definitely impart transparency and increases the reliability overtimes. Inclusion of Aadhaar is much needed move by the government which in turn reins the invalid activities regarding the overseas contribution.

Read our article:An Outlook on Banking Regulation (Amendment) Bill, 2020 Passed by Lok Sabha

FCRA-Amendment-2020