The Ministry of Finance, Nirmala Sitharaman has laid down the most anticipated Union Budget 2021-2022 on February 1, 2021. This time the Union budget was laid down considering various different conditions but mainly the Covid-19 pandemic and the calamities which has dangerously affected the Indian economy.

The Prime Minister headed Government has made its resources available for the most deprived sections of our society which includes the poorest of the poor, the Dalits, Tribals, the elderly, the migrant workers, and our children. The Pradhan Mantri Garib Kalyan Yojana, the three Atmanirbhar Bharat packages, and other various announcements made were like five mini-budgets in themselves.

The global economy already in slowdown was pushed to an unexpected situation due to the Covid-19 pandemic. The announcement of sudden complete lockdown after the one day planned Janta Curfew which went for three long weeks was really unexpected and mainly affected the lower class and workers who had to face the most unprecented situation. Many of them lost their jobs while many had to travel back to their home state by foot because of the suspended travel services. In this blog, you will get to know the highlight which addresses the Part B of the Union Budget 2021-2022.

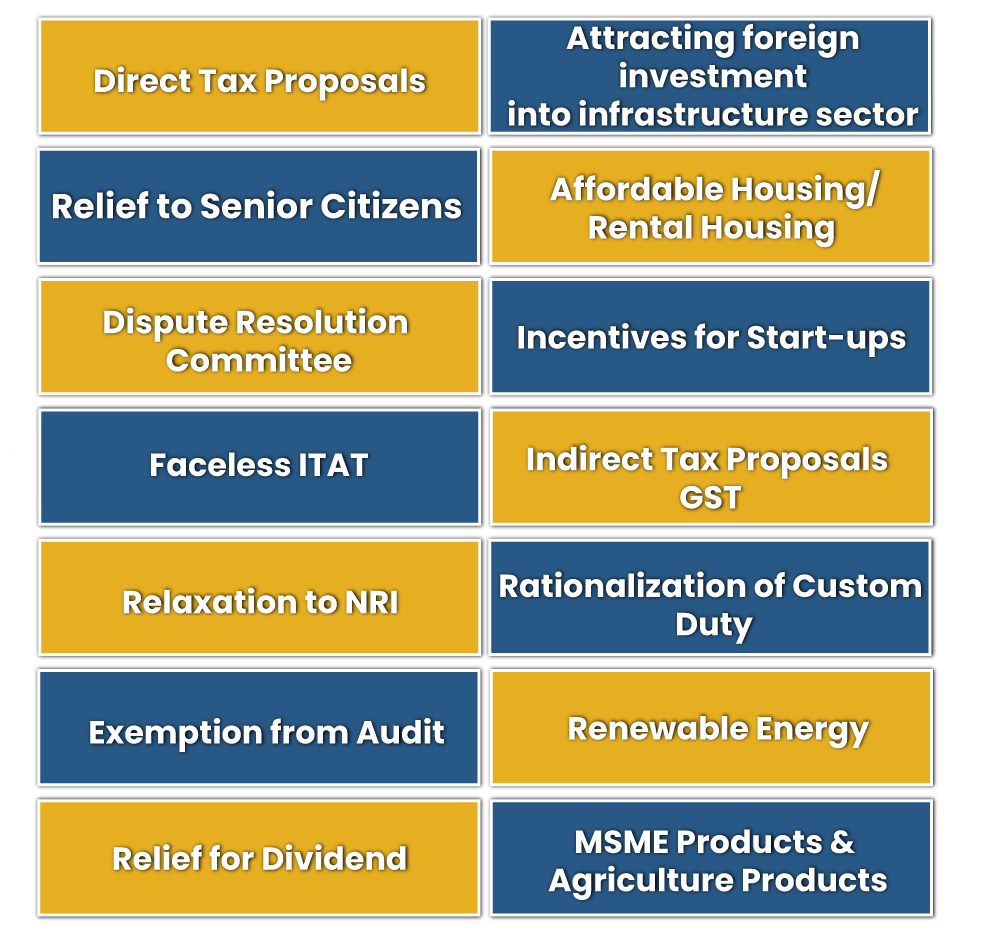

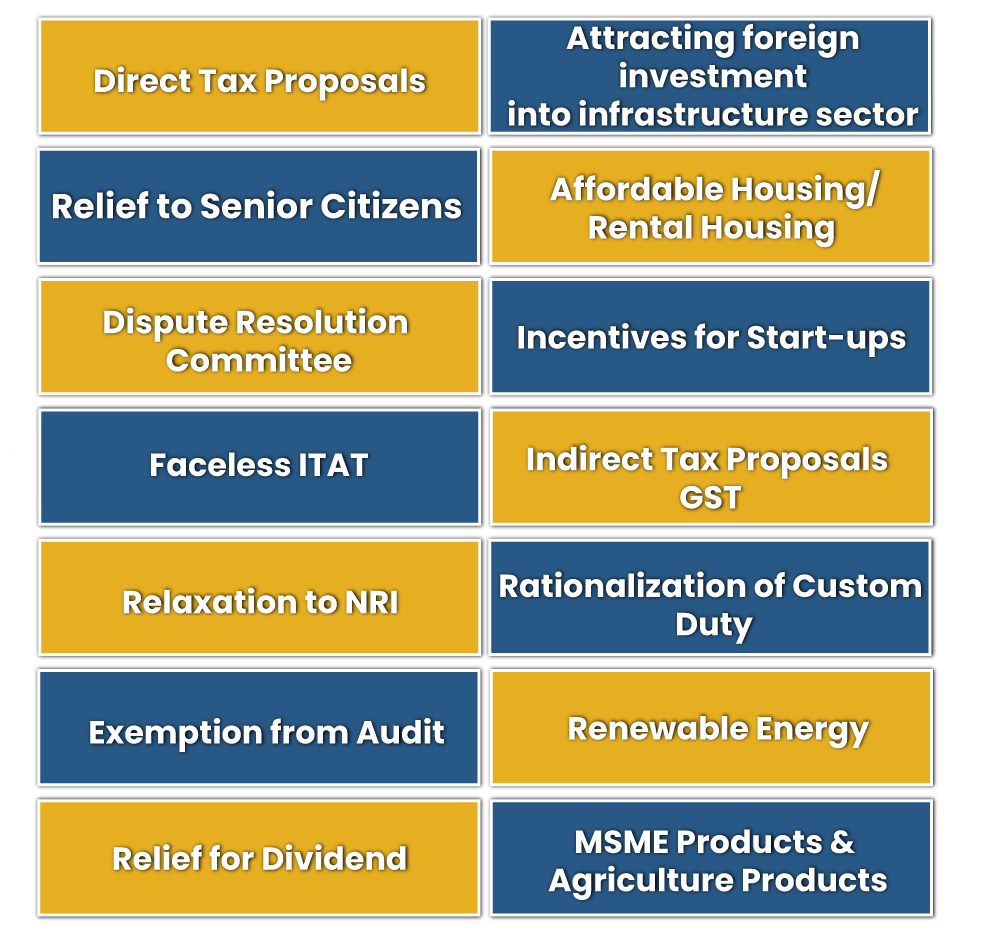

Highlights of Union Budget 2021-22 (Part B)

Direct Tax Proposals

The Union Budget 2021-2022 introduces the Direct tax system for the benefit of our taxpayers and economy. Few months before pandemic corporate tax rate was slashed to attract more investors. The Dividend Distribution Tax was removed to ease burden of tax payers. The Union Budget 2021-2022 introduced Faceless Assessment and Faceless Appeal to simplify the tax administration, ease compliance, and to reduce litigation.

Relief to Senior Citizens

The Union Budget 2021-2022 proposes to reduce the compliance burden on senior citizens of 75 years of age and above. Senior citizens with only pension and interest income are exempted from filing their income tax returns. The Union Budget 2021-2022 also proposes to reduce the time for re-opening of assessment to 3 years. In serious tax evasion cases of 50 lakh or more in a year, the assessment is re-opened up to 10 years with the permission of the Principal Chief Commissioner.

Dispute Resolution Committee

The Union Budget 2021-2022 introduces the Direct Tax Vivad Se Vishwas Scheme to give taxpayers a chance to settle long pending disputes. And a Dispute Resolution Committee would be setup to reduce litigation for small taxpayers.

Faceless ITAT

The Union Budget 2021-2022 propose to introduce the National Faceless Income Tax Appellate Tribunal Centre for electronic communication between the Tribunal and the appellant where through video conferencing the matters could be solved.

Relaxation to NRI

Non-Resident Indians when they come back to India they have to face few issues with respect to their accrued incomes in their foreign retirement accounts so the Budget 2021-2022 aims to remove their hardship of double taxation.

Exemption from Audit

Those who carry out 95% of transactions digitally their tax audit limit shall be increased to 10 crore. The Union Budget 2021-2022 proposes such digital transaction to promote digital India.

Relief for Dividend

Dividend payment to REIT/ InvIT is exempted from TDS for further easing of compliance. After the dividend is declared or paid then only the Advance tax liability shall arise. The Union Budget 2021-2022 has proposed deduction of tax on dividend income at lower treaty rate for Foreign Portfolio Investors.

Attracting Foreign Investment into Infrastructure Sector

The Union Budget 2021-2022 provided for relaxation of certain conditions in 100% tax exemption for attracting more foreign investment in the infrastructure sector.

Affordable Housing/Rental Housing

The additional deduction of interest on 1.5 lakh for loan taken to purchase an affordable house shall be extended 31st March 2022 by the Union Budget 2021-2022.

Incentives for Start-ups

Eligibility for claiming tax holiday and capital gains exemption for investment is extended for the period of 1 year more to incentivize start-up.

Indirect Tax Proposals GST

The Union Budget 2021-2022 proposes further simplification of GST like it has validated input tax statement or pre-filled editable GST return with the plans to enhance the capacity of GSTN system. There is a launch of deep analytics and Artificial Intelligence to identify tax evaders and fake billers.

Rationalization of Custom Duty

It has been propounded to fulfill the double objective of helping India get into global value chain and promoting domestic manufacturing and export. Union Budget 2021-22 proposes to renovate the Customs Duty structure & eliminate 80 outdated exemptions.

Renewable Energy

To build up domestic capacity in solar energy, a phased manufacturing plan for solar cells and solar panels will be made. Duty on solar invertors is raised from 5% to 20% and on solar lanterns from 5% to 15% to encourage domestic production.

MSME Products

The Budget 2021-22 has plans to rationalize import exemption of duty-free items which shall serve as an incentive to exporters of leather, garments and handicraft which is all domestically made by our MSMEs in order to promote domestic manufacturing.

Agriculture Products

Customs duty on cotton is increased to 10% and increase in raw silk and silk yarn from 10% to 15% for the purpose to benefit farmers. The Budget 2021-22 proposes plans for improving agricultural infrastructure to have more yields in production and also in conserving agricultural output efficiently. This will ensure enhanced remuneration for our farmers. The budget also plans to launch an Agriculture Infrastructure and Development Cess (AIDC) to have resources for this purpose.

Conclusion

The Budget 2021-22 aims to balance the next quarter century by continuing the monetary benefit and revolution that aims for higher efficiency for citizens of India especially the lower and labour class, retired person, companies, businesses, and empowers them to take advantage of a global shift in economic.

Health and well being is considered the top most priority in the Union Budget which will help the people to come out of the major outbreak of pandemic. The major investment plans of the Government[1] shall yield higher productivity and growth in the socio-economic condition of India. The fiscal and structural policy shall be significant for boosting the collection of revenues and increasing the GDP of the nation. Hence, the overall Budget is a rise in the economic slowdown.

Read our article:CBIC: Extension of deadline for GST Return Filing FY 2019-20