A gift deed is a statutory document that encloses the details about the asset being transferred to the beneficiary from the donor in the form of a gift. A gift deed is executed between the donor and the donee. Though it is not mandatory to implement a gift deed while transferring the property, it does act as a valid documentary record. The gift deed can be used to transfer both movable and immovable property. A gift deed acts as a legal declaration stating the donee as an absolute owner. Let’s move ahead and see what the Advantages of Gift Deed registration are.

Read our article:Relinquishment Deed: Key Elements and Registration Process

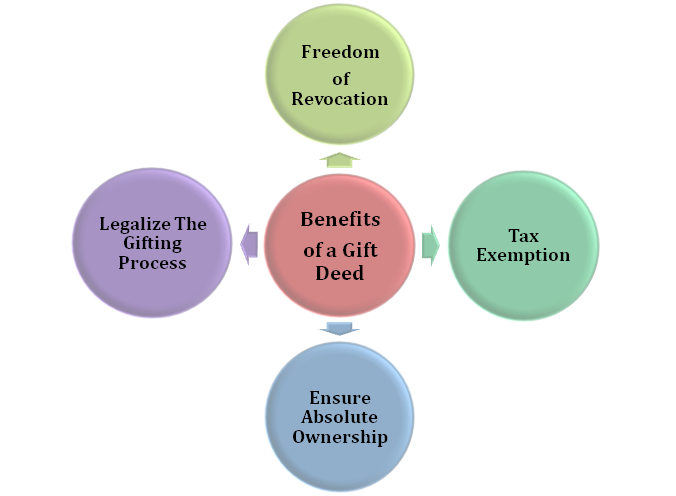

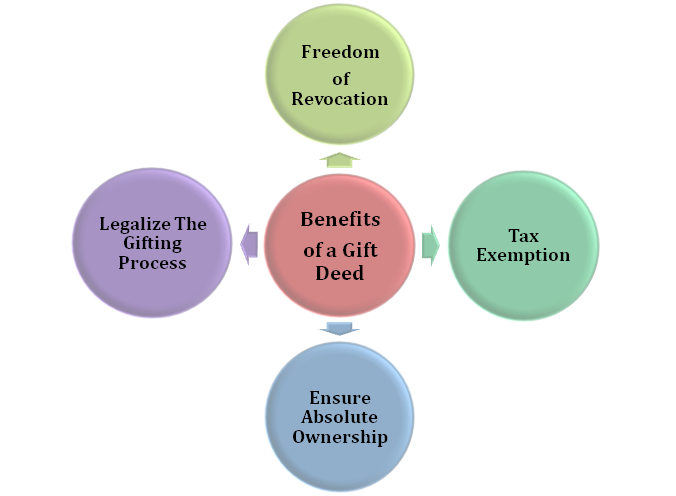

Advantages of Gift Deed Registration

Here are the six most important advantages of executing a gift deed:-

Legalize the Gifting Process

Executing a gift deed will legalize the process of gifting. Typically a gift deed encloses complete details regarding property and the candidates involved in the agreement thus; leaving no scope of dispute that may arise in the future.

Act as a Legal Proof

The parties involved in the enactment of a gift deed is less likely to confront legal dispute as it acts as sole proof of the transfer of the asset. It generally empowers the parties to use the legal right to opt for the court proceeding in case of legal dispute.

Tax Exemption

Another biggest advantage of Gift deed is that it won’t attract taxes to a certain limit. The tax authority shall not impose any taxes on the gift recovered by the donee during a year if the total worth of the gift lies under the threshold limits i.e. Rs 50,000. Also, the gift of any property (movable or immovable) made to relatives is exempted from income tax, without any upper limit.

The following list encloses the list of family members eligible for tax exemption for a gift deed:-

- Parents

- Siblings

- Spouse

- Lineal ascendants

Freedom of Revocation

The gift deed can be canceled by its owner with an immediate effect. Transfer of Property Act, 1982[1], under Section 126 allow the involved parties to revoke the deed whenever they want, provided the clause for the same mentioned in the deed. Similarly, the gift deed can be irrevocable in nature, which is probably the most enticing.

Advantages of Gift Deed registration

Ensure Absolute Ownership

As soon as the owner transfers the property to the concerned relatives through a gift deed, it ensures the absolute ownership to the donee.

Quick Transfer of the Property

Transfer via gift deed is the viable option in case if you wish to transfer the property on an immediate basis. Unlike Will, where the property transfer takes place after the death of the owner, the gift deed cannot be executed in the absence of the donor and donee.

List of Gift Deed Essentials

- A gift deed is a legal declaration; thus, it must consolidate the details in clear and unambiguous legal language.

- Clearly indicates the relation between the parties in case of inter-family transactions.

- Date and place for gift deed execution.

- A Gift Deed must contain the signature of the involved parties and two witnesses.

- A gift deed is typically executed on a voluntary basis, and it doesn’t include any monetary transaction.

- A gift deed is applicable to the existing movable or immovable property only.

- The acceptance of the donee is vital to legally validate the gift deed.

- Transfer of property shall not be deemed fit from the law’s perspective until it gets legally registered.

- The registration lures fees in terms of a stamp duty that is paid through the non-judicial stamp paper.

- The stamp duty fluctuates according to the market value of the property.

- A gift deed can be challenged in court on the ground of legality related to the law of limitation.

- The owner of immovable property can gift it to a relative or a third person. A gift is considered valid only if it is made voluntarily and without consideration.

- Just like sale deeds, the gift deed comes into effect immediately.

Points worth Your Attention Regarding Gift Registration

- Gifting can be utilized to transfer property, be it movable or immovable, during the lifetime of a person.

- Unregistered gift deeds are not irrevocable in nature.

- It’s a good idea to check the state-wise tax liabilities before executing any gift deed.

- The gift deed lures no taxes in case if the donee is the relative. However, the applicant still has to pay stamp duty and registration charges to make the transfer legal.

- A Gift Deed is merely a legal instrument that records the transfer of property to the donee. The complete details of the property and the details of the parties to the transaction make this document a legal proof to the title of the property.

- A Gift Deed is of evidentiary value before the Courts in the event of any future disputes that may arise.

- A Gift Deed serves as statutory protection to the concerned parties in the event of any contradictions that may prompt up in the future.

- The agreement legalizes the entire transaction.

Conclusion

We have put our effort into breaking down the concept of gift deed to make it as simple as possible. Hopefully, you will appreciate as we believed that this blog has strengthened your understanding regarding this topic. In case if you have second thought regarding this topic, let our professional clear your doubt. CorpBiz shall be happy to serve you in any way it is possible for Gift Registration.

Read our article:Procedure for Gift deed registration: A Step By Step Guide