The Union minister on Tuesday render ex-post facto approval to the amendments to Finance Bill announced this year. These amendments aim to render clarification on tax proposals for 2021-22. According to the government, these amendments were imperative to rationalize the proposals & address concerns arising among the stakeholders related to proposals cited in the Finance Bill. The law came to effect on March 28, 2021, after getting a green signal from the President of India.

The government further cited that these amendments are regarding the tax proposals which were proposed to generate timely revenue for tax authorities and rationalize prevailing provisions by mending taxpayer’s grievances. The Finance Bill 2021, which bought tax proposals to life, was passed in higher house in March with 127 amendments. The most substantial change includes;

- Ten-year income tax exemption for national banks for financial infrastructure & development

- Five-year tax exemption to Private development finance institutions, which can be stretched out for another five years.

The amendment also declared that the equalization impose would not be applied on consideration of the sale of goods or services owned by individuals of India or by a permanent establishment of a non-resident in India. The final version of the said Bill has around 127 amendments. There are some valuable changes related to the following

- Business restructuring

- Depreciation on goodwill

- Dissolution or reconstitution of a firm

- Slump sale

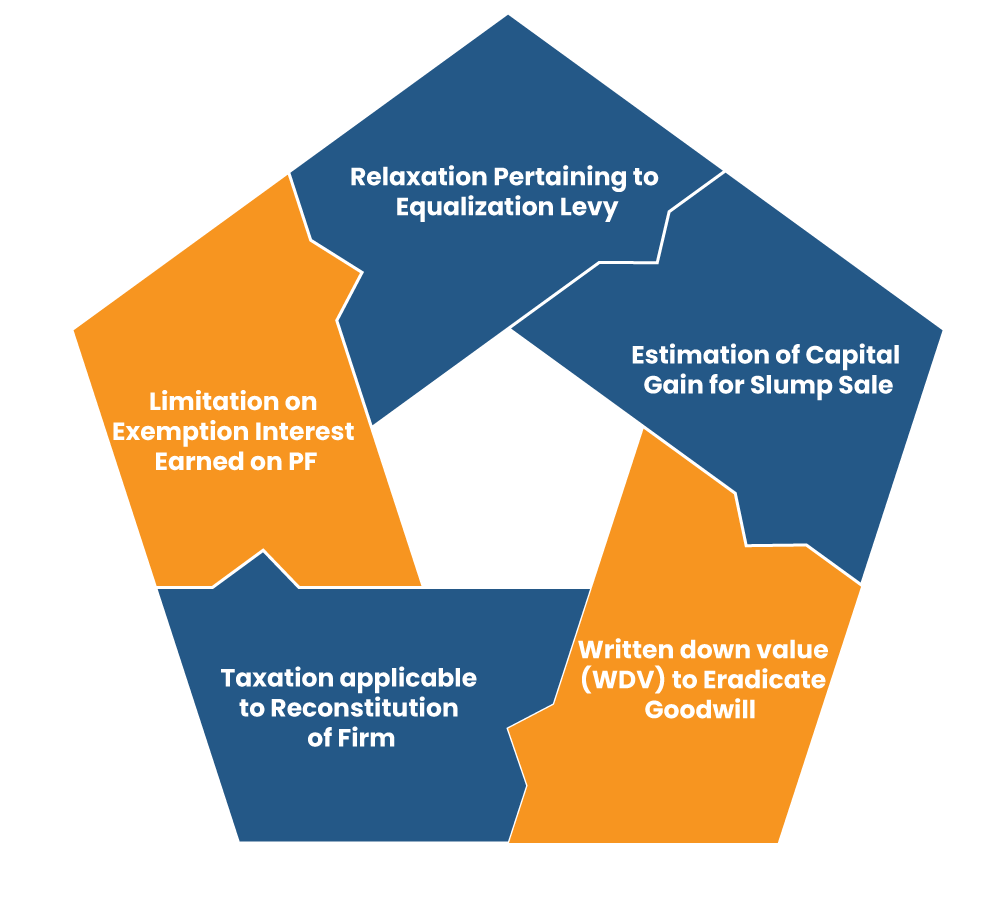

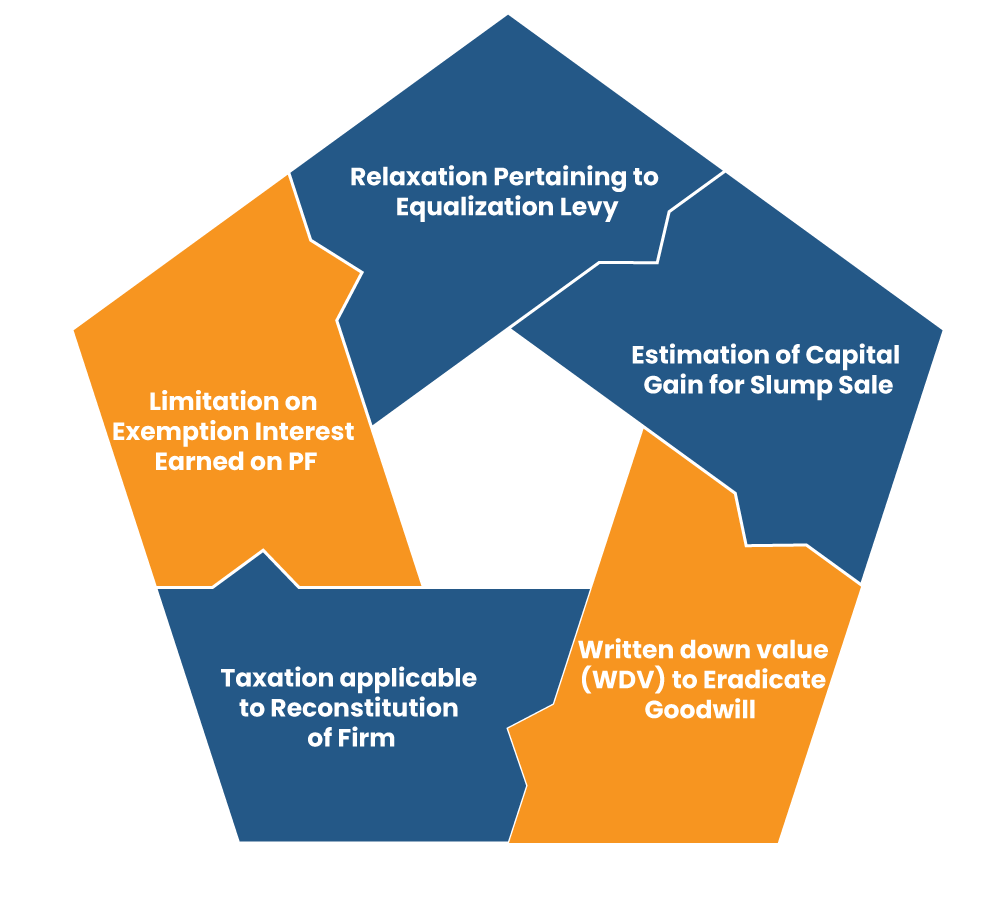

Critical changes made to the Finance Bill 2021

The Section below discusses the critical changes made to the Finance Bill 2021

Relaxation Pertaining to Equalization Levy

The Equalization Levy came to light on April 1, 2020, for non-resident e-commerce operators on deliberations received from the web-based supply or services. E-commerce supply or service was defined to include “online sale of goods” & “online provision of services.” Finance Bill 2021 striven to render an explanation to include the following activities to be deemed as the online sale of goods or services.

- Acceptance of offer for sale

- Acceptance of purchase order

- Acceptance of offer for sale

- The placing of a purchase order

- Supply of goods or provision of services

- Payment of consideration

Another amendment sought to include consideration received or receivable from e-commerce supply or services regardless of whether the business owners own the goods. While this clarification is advantageous but, there are various aspects on which there is some confusion. This includes the imposition of a levy on transactions in a case where only one aspect of the transaction is carried out; for example, inter-company transactions or online payments are made against the transactions in a physical form.

Read our article:Finance Act 2020 – Changes in GST

Estimation of Capital Gain for Slump Sale

On the slump sale transactions front, the actual consideration of the slump sale transaction, as per provision under Section 50B, is deemed as the full value of consideration for estimating capital gains. In laymen’s terms, there was no requirement for considering Fair Market Value or valuation exercise.

An amendment seeks to provide that Fair Market Value if the division/undertaking on the transfer’s date (to be evaluated depends on the rules provided later) as a full value of consideration. Therefore, FMV shall have to be deemed regardless of the transaction received by the seller.

The seller has to re-estimate capital gains depending on Fair market value and would be accountable for paying the taxes and interest, as required advance tax would not have been addressed by the taxpayer. While the government adheres to its pledge of no retrospective changes, this explicitly is a retroactive amendment that affects transaction that has been undertaken till March 23, 2021.

Written Down Value (WDV) to Eradicate Goodwill Forming Part of Assets

Finance Bill 2021 sought to amend the legal definition of “intangible asset” to put goodwill of business or profession out of the equation, thus; making goodwill ineligible for depreciation from the financial year 2021- both for prevailing and new goodwill obtained on or after April 1, 2020.

It also provided to amend capital gains norms to provide that the acquisition’s cost of self-generated goodwill obtained in tax neutral transfer will stand nil. The amendment encloses norms to tweak the closing written down value of assets by reducing the tax WDV of goodwill estimated as the difference between the real cost of goodwill & depreciation permitted on such goodwill till March 31, 2020. However, the reduction shall not surpass the closing written down value of intangible as if assets March 31, 2020. This ensures clarity on how one is required to estimate WDV in case of goodwill.

Taxation Applicable to Reconstitution of Firm

The provision about the taxability of receipt of a capital asset or dissolution of partnership firms or stock in trade at the time of reconstitution proposed in the Bill has been amended. The complete clauses have been revamped by the inculcation of an additional Section 9B.

The new Section inculcated to ensure that the stock–in trade by a partner/member (in case of Body of Individuals/ Association of Persons) or receipt of a capital asset on dissolution or reconstitution of the firm shall be considered to be transferred in hands to such firms. The profit margin reaped from such transfer based on the Fair Market Value of such asset is open to taxes as capital gains as business income.

Section 45(4) has also stands revamped to provide for the estimation of capital gain in the hands of the member/partner at the time firm’s reconstitution. The capital gain’s amount will be Fair market value[1] & money obtained, surpassing the capital amount balance of the partner.

Limitation on Exemption Interest Earned on Provident Fund Contribution

The Finance Bill 2021 declared that no exemption should be made accessible to interest income accumulated during the preceding year in the recognized provident fund to the extent it relates to the employees’ contribution over Rs 2.5 lakhs made in the previous year. Now, this condition is revamped by increasing the threshold sum to Rs 5 lakh if the employee makes no contribution to such fund.

Conclusion

On the whole, while some changes made to the supplementary amendments are proposed to clarify the ambiguity of the taxpayers, several adhere to practical importance. This mitigates the ambiguity amongst the taxpayer regarding any transaction undertaken. With the amendments equalization levy, slump sale, the taxpayer would stand accountable for paying taxes related to transactions undertaken before enacting the same.

Read our article:Union Cabinet Approves Amendments to Companies Act

PIB1712856