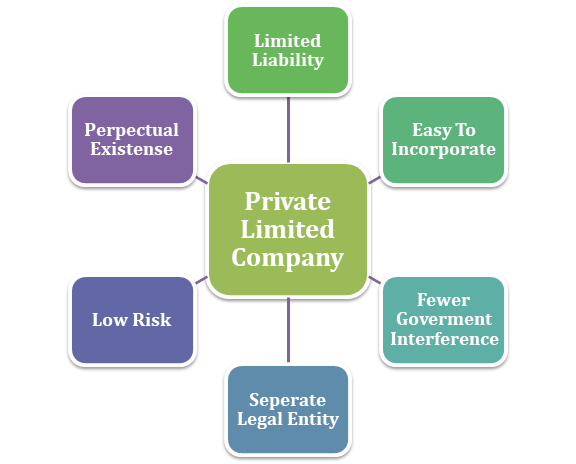

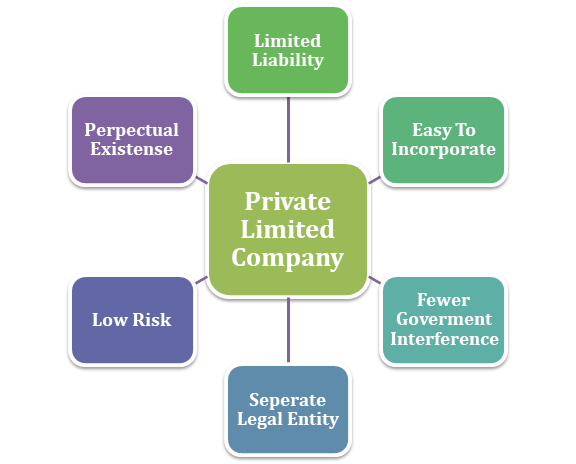

Although a Private Limited company is the antiquated business model, it is still preferred by thousands of entrepreneurs for its countless advantages and popularity. Unlike other business models, a private limited company seeks less compliance and offers better reliability. In this article, you will come to Know about Private limited company.

A Private Limited Company runs as per the provisions mentioned under the Companies Act 2013 and Companies Incorporation Rules, 2014. This article will brief you on everything about the private limited company, its traits, advantages, documentation pre-requisites, and registration process.

Things you must Know about Private limited company

The following section will let you know about Private limited company.

A private limited company is a type of business form that runs by a group of individuals known as shareholders. A maximum of 50 shareholders can run the Private Limited Company. The liability arrangement in a privately held business entity is similar to a limited partnership, wherein the shareholder’s liability is equivalent to the number of shares held by them. Identifying the business objective is the first step toward the registration of the private limited company. The Ministry of Corporate Affairs (MCA) is a regulatory body that governs the privately held entities in India.

Here’s how section 2 (68) of the Company Act, 2013[1] define the privately held entities in India:-“A Company having a minimum paid-up share capital as may be prescribed, and which by its articles”

(i) restricts the right to transfer its shares

(ii) except in the case of One Person Company, limits the number of its members to two hundred; (iii) prohibits any invitation to the public to subscribe for any securities of the company.”

What are the Traits of a Private Limited Company?

The following section would explain the traits of the private limited company.

Membership

A minimum of the two members i.e. shareholders is required to lay a foundation of a Private limited company. Apart from that, a maximum of 200 shareholders can exist in such a business model. Also, a minimum of two directors is required to execute the operation of a private limited company.

Separate Legal Entity

A private limited company is an autonomous business entity and follows the notion of perpetual succession, which means that even after the demise of the member, the company will continue to exist. Also, insolvency doesn’t affect the existence of the company. Such companies can only dissolve by the way of a resolution passed in the general meeting under the supervision of the core members.

Minimum Subscription

Subscription is referred to as the amount availed by the private limited company via issuance of shares. Every company that seeks private limited company registration is under the regulatory obligation to raise such an amount equivalent to the 90% of shares issued within a certain time limit.

Minimum Paid Up Capital

Prior to the amendment, the private limited companies were entitled to maintain a minimum paid-up capital of Rs 1 lakh. In order to make this business model more conducive for entrepreneurs, the government has waived off this provision. As of now, the entities are not under a legal obligation to procure such capital to incorporate a company.

Limited Liability Structure

In the privately held business entity, the shareholder’s liability is limited. The personal assets of the shareholder are not taken into account when it comes to counteracting the business loss and compensating the same.

What are the Registration Prerequisite for a Private Limited Company?

The following section explains the registration prerequisites for a private limited company.

Members and Directors

As mentioned earlier, the privately-held entity must possess a minimum of the two and a maximum of 200 shareholders, which is a regulatory prerequisite cited in the Companies Act, 2013. Every company seeking to be transformed into a private legal entity should meet this requirement without exception.

How to Calculate the Members of a Company?

To calculate the number of shareholders in a privately held entity, the stipulations should be met. If two or more persons jointly hold the company’s shares, they cannot be treated as an independent shareholder on that ground. ESOP, aka the employee stock ownership plan, is a way to issue equity to individuals working as a full-time employee. Such individuals are not a part of such a calculation. This doesn’t include the company’s existing or former employees who never serve as a member during the employment tenure.

Likewise, a minimum of the two directors is required for the incorporation of a private limited company. The directors must satisfy the given stipulations. The directors of the company must have DIN, i.e. director identification number issued by the MCA. At least one of the directors should be an Indian national, and he/she should have stayed in the country for not less than 182 days in the preceding calendar year.

Name of the Company

Identifying the name of a company is a complicated task. Privately held entities should address the three aspects given below while selecting a name for them.

- Main Name;

- The task to be carried out in the company

- Inclusion of the term ‘Private Limited Company’ at the end of the name of the company.

The applicant seeking a new name can visit the MCA’s portal and use its particular services to identify the unique name. Keep in mind that companies cannot opt for the name that isn’t unique or resembles other entities’ names. In such a case, we suggest you forward 5-6 names to ROC for approval purposes.

Registered Office Address

After successfully registering the company’s name, the applicant needs to approach ROC for the registration of a place of business. The place of business is the vicinity where all the company’s main tasks and responsibilities are carried out and where the official documents are placed.

Availing digital signature certificate + professional certification – To submit the documents electronically, every firm should avail of a digital signature certificate to authenticate the documents. Also, a company should have comprehensive data of its employees along with a certification stating their qualifications.

How to register a Private Limited Company?

Once the company’s name is finalized, the given instructions have to avail by the applicant.

Read our article:5 Eminent Benefits of Private Limited Company

New SPICe+ Form for Company Registration

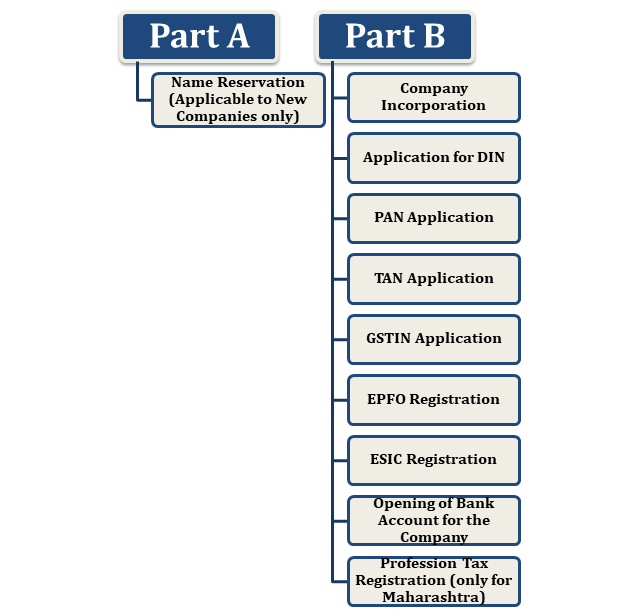

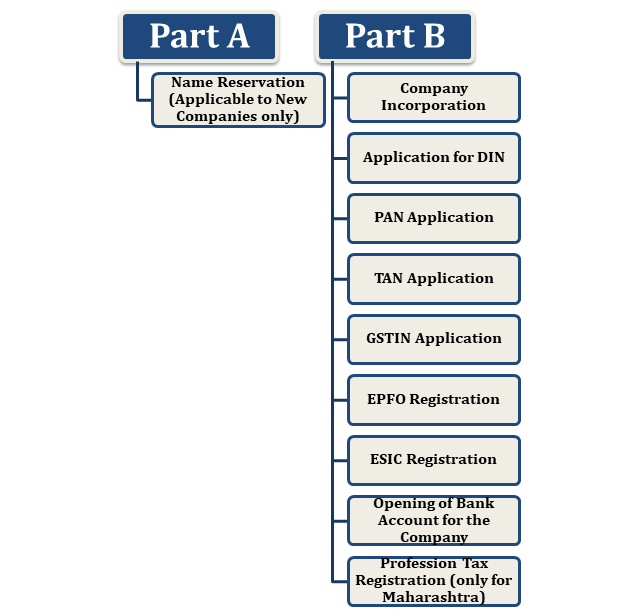

SPICe+ Form renders vital obligations for company registration like name reservation, incorporation, DIN allotment, issue of PAN, ESIC, TAN, Profession Tax (Maharashtra), EPFO, and Opening of Bank Account. It must be noted that the GSTIN number can also be availed through SPICe + form.

Documentation Prerequisites for Online Company Registration for SPICe+ form

Following is the list of companies

- Articles of Association (AOA)

- Memorandum of Association (MOA)

- Subscriber’s Declaration

- Directors’ Declaration

- Proof Regarding the Office Address

- Utility Bills (recent copy)

- Copy of incorporation regarding foreign body corporate [If applicable]

- A recommendation in written form from the “Promotional Company” [If applicable]

- Copy of a Resolution passed by the International Company [If applicable]

- Proof of interest of the directors from other Legal/Political bodies [If applicable]

- Nominee’s approval in the Format prescribed by the authority.

- Address proof as well as an Identity proof of the subscribers and the nominees.

- Identification proof of the applicant, along with the residential address.

- The Declaration or resolution from the Unregistered Company/ies

- Any other applicable document [If required]

Documentation prerequisites for Online Company Registration regarding AGILE-PRO:-

- Address proof of the Principal Place of business operation

- Appointment proof of Authorized Signatory regarding Goods and Services Tax Identification Number

- Resolution copy or Letter of Authorization from the Board of directors.

- The resolution copy authenticates by the managing committee, along with the acceptance letter.

- Identification Proof of the Authorized Signatory for the purpose of opening of a bank account

- Signature of an Authorized person for EPFO

Prerequisites for Online Company Registration regarding Declaration in form ‘INC-9’:-

The Declaration of the directors and subscribers are presented via the electronic medium in auto-generated in PDF format. The applicant seeking registration must furnish the certification and recommendation sanctioned by the professional, such as Company Secretary, Chartered Accountant, and Cost Accountant.

Documents that work as address proof for Online Company Registration

- Voter Card

- Passport

- Aadhaar Card

- Electricity Bill

- Telephone Bill

- Ration Card

- Driving License

Documents that work as a residential proof for Online Company Registration

- Bank Statement

- Phone Bill

- Electricity Bill

Conclusion

The private limited business model is an obvious choice for most of the business entities and startups across pan India. It is easy to establish and operate as compared to public limited companies. where members are under tremendous legal pressure to maintain transparency without exception.

Read our article:All you need to Know about Private Limited Company