Private Limited Company is one of the oldest forms of business that exists in our country for ages. It is preferred by the privately held small business entity that has higher growth aspirations. More than 90% of the Companies in India have adopted this business model. There are significant numbers of Benefits of Private Limited Company as it remains the top choice for the majority of businesses and entrepreneurs around the globe. Now, some of you might be wondering why companies across India are attracting towards this business model. Let’s dive into the notion of this business model and try to explore the benefits of a Private Limited Company.

Overview of Private Limited Company

A Private Limited Company is a legal entity managed by a small group of individuals. Its registration is based on the pre-defined objects and is governed by a group of members known as shareholders. The liability of the members in such a business model is limited to the number of shares held by them. Only 200 members can exist in a private limited company and trading of shares is also restricted within the organization’s scope, meaning- the members are not allowed to sell the share to the outsider or the general public.

All these technical jargon’s mean nothing to an individual who is just about to launch a business. At this stage, we should be questioning ourselves -why such a business model adherer so much of the importance of our business? Why should we opt for private limited company registration over a proprietorship business model? The following section would answer all these questions and let you make an informed decision.

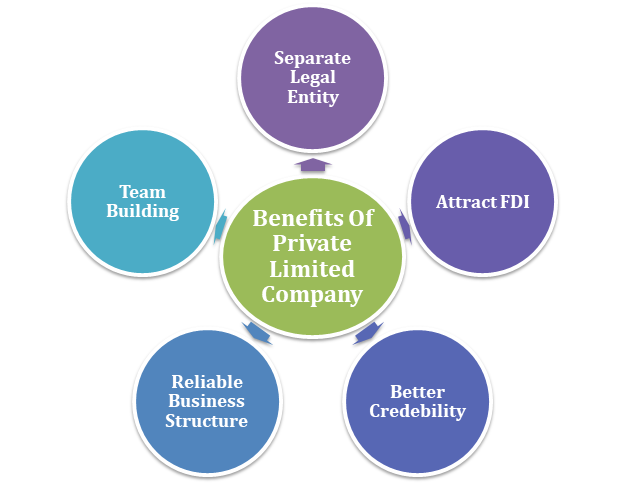

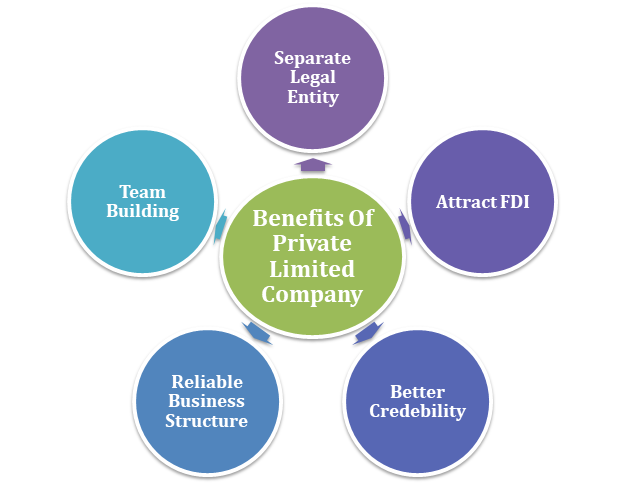

Benefits of Private Limited Company

Let’s dive into the benefits of a private limited company and see what it offers to businesses and entrepreneurs having higher growth aspirations.

Minimum Members

The minimum of the two members is required to lay the foundation of the private limited company. Having a partner in a company could let the business unleash its full potential. The additional partners can prove to be a valuable asset for the company as far as the business ideas and expansion is concerned. However, there is one constraint. You are not allowed to add more than 200 members. Besides, individuals, even a corporate body, could act as a member of a Private Limited Company. Other business models lack on this front.

Read our article:Steps for Private Limited Company Incorporation In India

Limited Liability of Shareholder

The liability of each shareholder in a private limited company is limited to the number of shares held by them. It may not sound like an obvious benefit on the surface, but it really comes handy in a demanding situation, especially when a company experiences financial burden.

Example: – Let’s try to understand the notion of limited liability through an example.

In a sole proprietorship business model, the owner reaps all the benefits along with losses. Whether it’s a question of repaying a loan or buying expensive machinery for a plant, the proprietor is only responsible for addressing such liabilities. In case of failure to repay, the creditors can even acquire the personal assets and leave them deserted forever.

The partnership firm is even worse in this context. Here the partner is equally liable to repay the entire loan amount even if another partner raises the loan amount without his permission. The financial liabilities[1] in partnership and proprietorship firms are incredibly fragile and unorthodox.

On the contrary, in a private ltd company, things don’t work like that. In the case of loan repayment, the liability is divided among the company members depending on how much they own towards the unpaid share value. In short, the members are not liable to pay debt for something that they were not accountable for. This is one of the eminent Benefits of Private Limited Company.

Perpetual succession

Due to legal status, the private limited company won’t lose its existence even after the demise of a core member or in case of bankruptcy or insolvency of any of its members. Let’s understand this notion through the following example.

Example: – In the case of a partnership business or a proprietary business, the members and the company are not treated as separate entities. As soon as the member incorporates the company under the company law, it immediately transforms into a legal entity. Due to legal status, the company will continue to exist even after the insolvency of its members.

Separation between Management and Ownership

A private limited company draws a thick line between the Management and Ownership; thus, managers are accountable for-profit and losses of the company. If you think that one of your team members has the potential to turn things around then you can appoint him/her as a Director of the company. Such a person shall be liable for the company’s growth and shall also be accountable for the profit you earn as a shareholder.

Let’s compare this scenario with the LLP business model

Comparison: – In an LLP, if you decide to appoint an employee as a partner in the company, you might regret such a decision sooner or later. The reason being the existing law won’t allow you to limit the intervention of the appointed partner into the company’s affairs. In short, such appointments could lead you to an unnecessary and intolerable intervention of your partner that might go against your liking.

No minimum capital required

Private limited companies can be established with any amount of capital, regardless of the nature of business. Frankly, this is an advantage of someone whose pocket won’t allow him/her to invest a large sum of money in setting up a business.

Conclusion

A private limited company has a lot to offer to the business owner and it is still regarded as one of the popular business models in India. If you are thinking of establishing your firm as a private limited company then you would require following legal procedure. In order to ease out the thing, we suggest you hire an expert that can offer professional-grade assistance on the registration procedure.

Read our article:Private Limited Company: Funding & Sources