The number of NBFC across India is reducing drastically, mainly due to the revised criteria for the net owned funds. The cancellation rate has been escalated significantly in the past few years making it harder for the existing entities to carry on their business. There is a provision for surrendering the NBFC license. In this article, you will learn about the NBFC License Cancellation.

RBI is on high alert ever since it has choked out dozen of NBFCs pan India for unethical business practice. Besides tightening the compliances, RBI is also focusing on setting up revised criteria through amendments to avert illegal practices.

What is Net owned fund?

A company can appeal to the respective judiciary against the cancellation order communicated by the RBI. The concerned entity can exercise such authority under clause 7(I) of section 45-IA The Reserve Bank of India Act, 1934[1]. The term “net owned fund” under this clause is defined in the following way:-

Total paid-up equity capital + free reserves -(Accumulated balance of loss + Other intangible assets + Deferred revenue expenditure)

Read our article:NBFC Registration: Step by Step Procedure

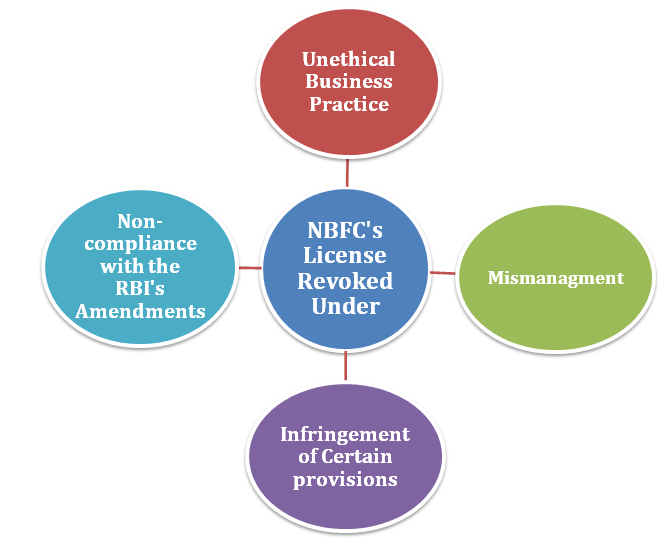

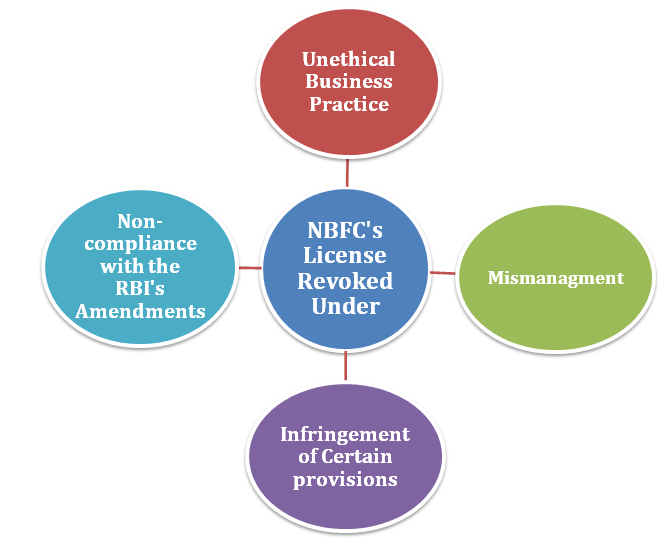

Prominent reasons for the NBFC License Cancellation

Following are the reasons for the NBFC License cancellation:-

- In case the NBFC terminates and ceases to continue its business operations in India. The NBFCs are only permitted to conduct their financial activities as per the principal business. This means a firm’s financial asset gets formed more than 50% of its total assets, where cash inflow from the financial assets is greater than 50% of its gross income. The firm that satisfied this condition can carry on their business operation as an NBFC.

- In the case of NBFC toils to maintain conformity with norms of registration mentioned under the Act or additional conditions of the RBI when the Certificate of Registration was granted. For example, if the firm cannot meet the requirement pertaining to paid-up capital, it could result in NBFC license cancellation.

- In case, NBFC struggles to keep up with the compliances regarding the capital of the company.

- If the NBFC ignore to meet the directions communicated by the Reserve Bank of India. Upon the release of guidelines, RBI’s personals can make a surprise visit to the business premises to determine whether the order has been followed or not.

- In case of the mismanagement of the account book or other records.

- In case if NBFC fails to surrender the account book or other vital record during the inspection conducted by the RBI’s audit team. (non-furnishing of account book and the document can encourage the authority to revoke the license).

- In case if the NBFC alters the rate of interest for the loan to avail of personal benefits. This is a severe felony as it could sabotage the future of business and its operation forever.

- In case if the NBFC is accepting the deposit that has been tagged unauthorized by RBI.

- In case if the NBFC tagged as a defaulter by a depositor on account of repayment of the deposit. In such cases, the depositors can approach to Company Law Board or consumer to file a complaint against the defaulter to retrieve their deposit.

- The RBI is less likely to take immediate action on defaulter upon receiving the complaint. Its because they are bound to offer equal opportunity to either of the parties to clarify their stance over the disputes. While processing the compliant, RBI takes various factors into account such as the financial status of the NBFC before reaching any decision.

- Every NBFC in India is liable to conduct its business activities in the public interest. Under no circumstances, NBFC can deviate from existing RBI policies, whether it’s a question of implementing an amendment or following an urgent order.

RBI’s takes on NBFC license cancellation

- If any of the business entities found in the state of misconduct pertaining to financial services that defy RBI’s provisions, then RBI can issue a revocation order for a license.

- Before ceasing the business activities, RBI communicates the matter with the defaulters through a notification illustrating the grounds on which revocation occurred. Being a legitimate legal body, RBI ensures the juridical framework’s fair manifestation through the accurate interpretation of the dispute. To adhere to the transparency, RBI often intimates the defaulters via a show-cause notice regarding the issuance of a revocation notice and seeks their feedback.

- It allows the concerned entities to put their matters in front of the judicial system. As soon as the RBI interprets the case and conclude that revocation is in favor of the public interest, it will issue an order of revocation.

- It should be kept in mind that there is penalty provision as per the provisions of Section 58 B (6) of the RBI Act for the infringement of the RBI’s policies. Hence, under no circumstance, RBI can bypass any of its laws regarding license revocation.

Key takeaway

- NBFC can opt judicial assistance under sub-section (7) of secrion-45-1A of RBI Act, 1934.

- NBFC can file the appeal with the central government.

- The appeal ought to be filed within one month from the date on the NBFC was notified by the RBI’s license revocation.

- The decision-making regarding such a matter is in the hand of central government.

Conclusion

The NBFCs have a considerable impact on the financial setup in the Indian economy. It has garnered the scope of easy credit accessible to the underprivileged section of the society. It has also eased out the processing of a typical loan disbursement that previously available to wealthy entities. All in all, NBFC is crucial for the country’s development.

However, that doesn’t mean that these financial houses got the liberty of bypassing the law. Henceforth, keeping contravention of the law in mind, RBI is now taking some proactive measures to deter unethical business practices.

Read our article:Procedure for Appeal against Cancellation of NBFC Registration by RBI