In the past few years, the financial sector has witnessed a significant transformation, and Non-Banking Financial Companies, aka NBFC, plays a pivotal role in that swift. NBFCs continued to reap immense success in the financial sector and its contribution has surpassed the contribution by the traditional banks. Henceforth, NBFC registration sound like a beneficial proposition for the entrepreneurs. But, there are certain quandaries encountered by an individual while starting NBFCs. In this write-up, we shall address all those challenges individually. So, without any further ado, let get started with Challenges encountered by NBFCs.

Read our article:NBFC Registration: Step by Step Procedure

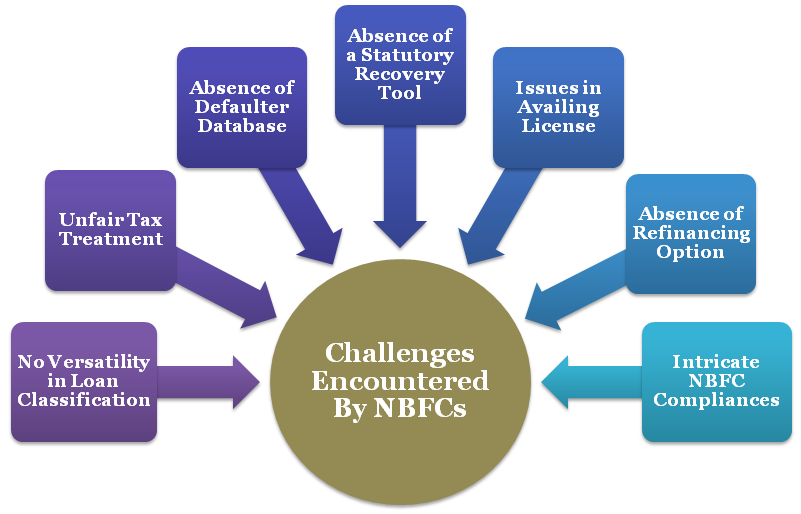

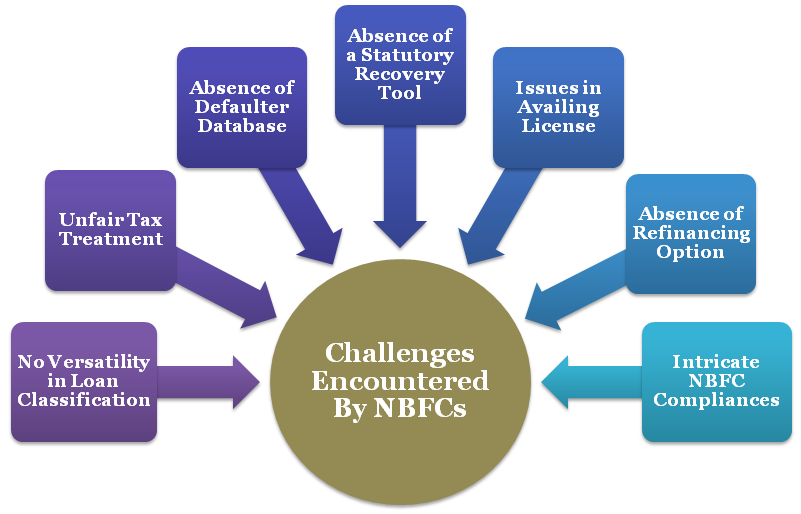

What are the Challenges Encountered by NBFCs?

NBFCs have been strengthening their presence in the market and have made significant progress than the banks. However, newer or small NBFCs encountered challenges in safeguarding their existence against their popular counterparts.

Challenge of Funding due to the absence of Refinancing Option

In India, banks are outfitted with many refinancing options. Similarly, housing financing companies also have several refinancing alternatives at their disposal and it refinances from the regulator of Housing Financing Companies.

On the other hand, the NBFCs entirely depend on the capital market or banks for obtaining resources. This acts as a resistance to the growth of the NBFCs. Furthermore, keep in mind the flows of finds from these sources can get evaporates anytime.

Challenges Related to Obtainment of NBFC license

The process of obtaining NBFC is far more complicated and cumbersome as compared to other licenses. The process involves tedious and complex documentation processes and approval from RBI. Keep in mind that RBI regulates the process which requires to be followed by the applicant to avail of the registration.

Intricate NBFC Compliances in India

After the NBFC incorporation, it is also needed to address multiple compliances. NBFC compliance differs from one company’s type to another. So the difficulty sneaked on when an individual running an organization of loans and advances, etc. it becomes increasingly tiresome to address all aspect in consolidation. Moreover, it also becomes tedious to know about the filing requirement of the prescribed returns. This is probably one of the most intricate challenges encountered by NBFCs.

No Versatility in Loan Classification of NPAs

The Non-Performing Assets (NPA) bears significant importance for the major players, but businesses with inconsistent cash flow encounter a negative impact on payment related delays.

Classification under Non-performing assets and flexibility in scheduling is vital. The classification of NPA ought to be based on assets financed rather than the borrower’s profile.

Absence of a Statutory Recovery Tool

The inadequate statutory recovery tool is another complex issue taunting the NBFCs for a long.

Several Representative Bodies

At present, multiple representative bodies govern NBFCs activities across the country. It must be noted that NBFC is in the initial phase and still far away from being acknowledged as a well-established entity. Hence, it would be an ideal proposition if these entities are curbed by a single representative body. It is also crucial that every segment is acknowledged sufficiently in the apex body that ensures the seamless growth of NBFCs.

Lacking in Capacity Building

Non-banking finance companies must establish a receptive ecosystem for capacity building on an individual as well as a collective basis. Then the majority of the NBFCs still lack the said potential, thus; it should be addressed as swiftly as possible.

Undue Tax Treatment

There exists a tremendous variation within the tax structure for banks vs NBFCs such as TDS, double taxation on the lease or hire purchase, etc.

Absence of Defaulter Database

NBFCs are more vulnerable to credit risk under the influence of inadequate information. In addition to that, there is a requirement of vital legislative changes to leverage the utility payments database in the process of the credit assessment.

Stripping of Priority Sector Status to Bank Lending To NBFCs

This is one of the critical obstacles encountered by Non-banking finance companies. The restoration must be deployed for the priority sector, bank lending, and NBFCs. Henceforth, the synergy model between banks and NBFCs ensures uninterrupted financial backing to the underprivileged section of the society. It will empower the NBFCs to create wealth and assets in the rural parts of India. The RBI can implant a provision to route a fixed percentage of bank lending priority via NBFC.

Minimum Mandatory Credit Rating for NBFC

It is now mandatory for the NBFCs (deposit-taking ones) to obtain investment-based credit. It will empower them to accept deposits without any legal obstacles. If the rating of the NBFC is degraded below the minimum rating, it cannot obtain deposits in any case whatsoever. Furthermore, the NBFCs must intimate the Reserve Bank regarding its position.

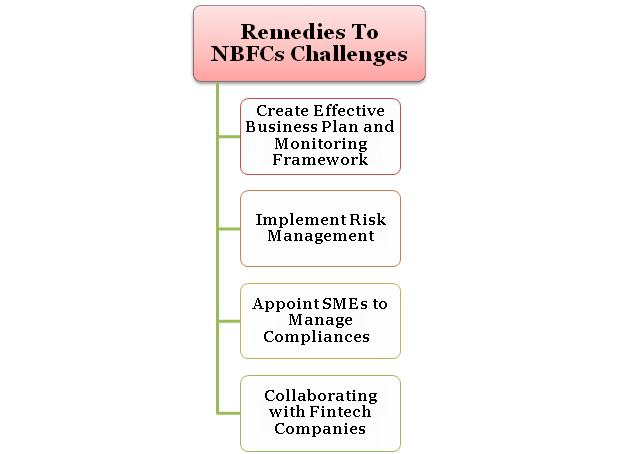

What are the Solution to the Challenges faced by NBFCs?

The following section consolidates some practical strategies to overcome the challenges encountered by NBFCs.

Collaborating with Fintech Companies

- The NBFCs can collaborate with Fintech companies since their services are cutting-edge and affordable in terms of payment, brokerage, and credit scoring.

Create Effective Business Plan and Monitoring Framework

In case if an NBFC is in its initial phase, it essential for them to outlines a comprehensible business plan along with a monitoring framework to keep eyes on disparities.

Implement Risk Management

A company must deploy a framework related to risk management[1] since there are multiple complications that the company might encounter. It will empower the entity to pinpoint the potential loopholes with ease.

Appoint SMEs to Manage Compliances

A professional team of SMEs (Subject Matter Experts) can be appointed for NBFC license, documentation, and compliances. It will let them overcome disparities through a holistic approach.

Co-originating Lending

Co-originating lending will let these companies overcome funding related risks along with other issues

Conclusion

The challenges encountered by NBFCs are countless, but it is not something that cannot be overcome. The RBI has looked into the challenges and is about to make some measurable decisions for NBFCs. These entities are essential for the existence of the financial sector in India. Keep texting us if you need any sort of advice, be it a matter of availing government license or addressing intricate compliances. We would be pleased to assist you.

Read our article:Procedure for Appeal against Cancellation of NBFC Registration by RBI