Budget 2020 has amended specific provisions of the Income Tax Act, 1961 that has a great impact on the performance of the registered Charitable Trusts and NGOs. The charitable trusts and NGOs are loaded with the setting an expiry date for registration, renewal of existing registration, filing of statement for donation receipts and other formalities in the performance of Charitable institutions & NGOs.

Still, relaxations are being provided in new registration of trusts or societies formed for social well-being like educational, religious or any other activities done in the public interest. In this Article, we are going to discuss about the Jurisprudential Views of teaching under NGO by budget 2020.

Impact of Budget in Teaching under NGO

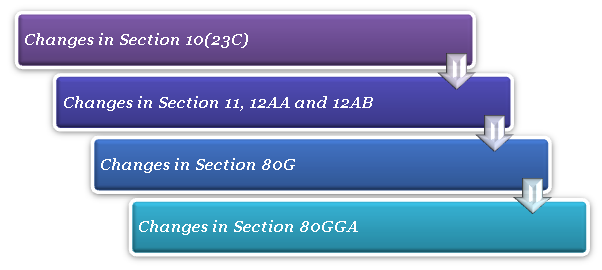

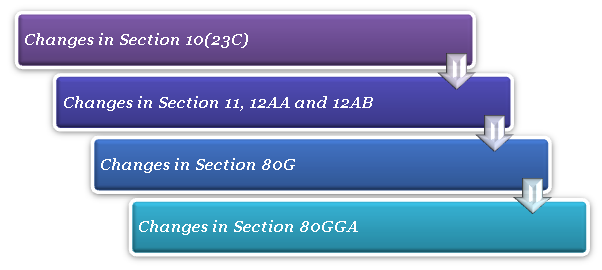

Budget 2020 proposed various changes related to societies and educational institutions. The budget has laid down few provisions that affects teaching under NGO. All such proposed changes are explained below-

Changes in Section 10(23C) of Income Tax Act, 1961

Every permitted trust institution, university or educational institution & hospital or medical institution specified as per Section 10(23C) has to make a fresh application for grant of approval by 31st August 2020. These fresh approvals are valid for five years only.

Income Tax Department should pass an order for approval of such grant within three months from filing of the application. All assessee are required to make a fresh application for grant of approval after completion of five years.

Changes in Section 11, 12AA and 12AB of Income Tax Act, 1961

Every NGO registration as well as educational institutions has to make a fresh application for grant of approval by 31st August 2020. Validity of fresh approval is for five years only.

Income Tax Department has to pass an order for approval of grant within 3 months of the filing of the application. Moreover, an NGO having approval under Section 10(23C) as well as Section 12AA can apply for registration.

Every NGO as well as educational institutions having registration under Section 12AB will be granted a provisional registration for 3 years. Provisional registration holder are required to make a fresh application for registration at least 6 months earlier to the termination of the provisional registration or within six months of beginning of its activities.

Section 12AA will cease to exist effective from 1st June 2020 and Section 12AB is effective from 1st June, 2020. Section 12AB administers the registration process, effective from the above mentioned date.

Changes in Section 80G of Income Tax Act, 1961

Every NGO as well as educational institutions will make a fresh application for grant of approval by 31st August 2020.

Every NGO as well as educational institutions has to file for an application for registration under section 80G. The institutions shall be granted a provisional registration for 3 years. Provisional registration holder are required to make a fresh application for registration at least 6 months earlier to the termination of the provisional registration or within six months of beginning of its activities.

Every NGO as well as educational institutions will prepare and provide a statement as may be prescribed that consists of the details of donors along with donation received by the trust or any institutions. After providing such statements, NGO will issue a certificate to Donor specifying the donation details.

Explanation 2A has been inserted under section 80G(5D) by the Budget 2020 that mandates providing details of donors by the NGO to claim deduction under Section 80G by the donor while ITR filing.

Changes in Section 80GGA of Income Tax Act, 1961

The changes in Section 80GGA of Income Tax Act are as follows-

- Limit for donation in cash has been reduced from INR 10,000 to INR 2,000;

- Deduction under section 80GGA to the donor shall be allowed on the basis of statement furnished by the payee to income tax department from time to time.

Read our article:Shedding Light on Subjects and Benefits of Educational NGO

Things to keep in mind while forming Educational Institutions under NGO

The points to keep in mind while forming Educational Institutions for Teaching under NGO are-

- As per The Emblems Act, 1950 use of any name, emblems, official seal, etc. without prior permission of the competent authority is prohibited. Additionally, the act also forbids the use of the name of any ‘national heroes’ and other names mentioned in the act.

- If the suggested name is used by any other registered society should be avoided.

- You should be careful about the Memorandum of Association (MoA) that should contain the following-

- Name of Educational Society;

- Objects of Educational Society;

- Details such as the name, address and professions of the governors, council, directors, committee or other governing body;

- Certified copy of the rules and regulations of the Institution by no less than 3 of the members of the governing body.

Documents Required Registering Educational institutional for Teaching under NGO

The documents required for registration of educational institutions for teaching under NGO are as follows-

- An affidavit has to be provided regarding the ownership and No Objection Certificate for the registered office of the proposed educational institution;

- An affidavit has to be provided related to the persons not related to each other stating the name of the institution;

- ID Proofs have to be submitted of all the members of the proposed Educational Institution;

- All the members of the proposed Educational Institution has to provide their Address proof;

- Cover Letter stating the objective or the purpose of the Educational Institution signed by all the founding members;

- Property papers copies related to the proposed Educational Institution;

- Provide the Minutes of the previous meeting of the proposed educational institution;

- Provide the Bank Statements of the proposed Educational institution;

- Declaration has to be provided by the chairman of the proposed institution stating that he is willing as well as competent to hold the position of the chairman;

- Memorandum of Association (MoA) has to be prepared and it should consist of the following clauses and facts-

- The work and the objectives of the proposed educational institution;

- The details of the members forming the proposed educational institution;

- It will include the address of the registered office of the proposed educational institution.

11. Articles of Association (AoA) have to be prepared and it should contain the following facts:-

- The Rules and regulations related to the operation of the educational institution;

- It has to include the rules for taking the membership of the proposed educational institution;

- It has to insert the details about the and the regularity in which they are going to get held;

- It should include the information related to the Auditors of the proposed educational institution;

- It has to include the ‘Arbitration Clause’ in case of any dispute between the supporters of the proposed educational institution;

12. The MOA and AOA documents have to be signed by every member of the proposed institution, observed by a notary with the address and official stamp.

13. It is desirable to hire a professional to figure the clauses on Memorandum of Association (MoA) and Rules and regulations under Articles of Association (AoA) of the proposed institution. It makes sure that you have what the registrar is searching for approval.

14. After the arrangement of Rules and Regulations if you want to change the rules but the new set of rules will have to sign by the Chairman, Vice President, and the Secretary of the educational institution.

15. Beside requisite fees, two copies of the above-mentioned documents are to be submitted to the Registrar and signed by the registrar. One copy is submitted and the other one is kept for further use.

16. After the approval on the documents, the registrar will issue Registration Certificate by assigning a number of registrations to the proposed education institution.

Conclusion

It is visible that all operations under educational institution depend on the managerial control of the founders. It is just because the educational institution can be created as a Non-Profit Organization so that the purpose of teaching under NGO can avail advantages delivered by the Central or the State Government[1]. Contact our Corpbiz Professionals to know more about NGO Registration.

Read our article:What are the Exemptions given to Educational Institution as NGO?