Are you wondering how to file an income tax return for the deceased person? Surprisingly, the tax authorities have mandated the filing of a tax return for the deceased person in case of a taxable income. The deceased person’s representative or legal heir is accountable for filing a return on his/her behalf against the income reaped till the date of his/her demise.

To do so, first, the legal heir has to visit the income tax online portal for registration. In this write-up, we will provide every possible detail regarding the filing of the income tax return for the deceased.

In a legal purview, a legal heir refers to an individual who represents the deceased’s assets. Any of the following certificates can be proof of the legal heir’s authenticity.

- The legal heir certificate issued by the concerned revenue authority

- A court-granted legal heir certificate.

- The certificate regarding the surviving family members granted by the local revenue authorities

- The legalized Will of a deceased person

- A government-issued family pension certificate.

The most widely-used certificate available is the surviving family member’s certificate granted by the local revenue authorities. Such a certificate is usually accessible in a regional language. Therefore, a legal heir needs to translate it into an acceptable language and then attest by the notary.

Read our article:What is the Claiming Process of Income Tax Refund?

Register as legal heir on Income Tax online Portal

The legal heir must register at the income tax online portal as a legal heir. Registration as a legal heir is a compulsion as per Income Tax norms for filing a return for the deceased person.

The e-filing portal seeks the PAN of both the legal heir and the deceased person for the registration. If the PAN of the deceased person is non-registered, the legal heir PAN can fulfil the requirement of e-filing registration.

Steps to Register as a legal heir on the IT department online portal

The applicant can use the given steps to register as a legal heir in the IT department online portal.

- Step 1 – Visit the IT department e-filing portal.

- Step 2 – Login to the e-filing portal using valid credentials

- Step 3 – Open the My Account option and register as a representative.

- Step 4 – (i) Select the type of request as a New Request (ii) Select the Register as representative – “Register yourself on behalf of another individual”. (iii) Choose the category to register as the Estate of the deceased.

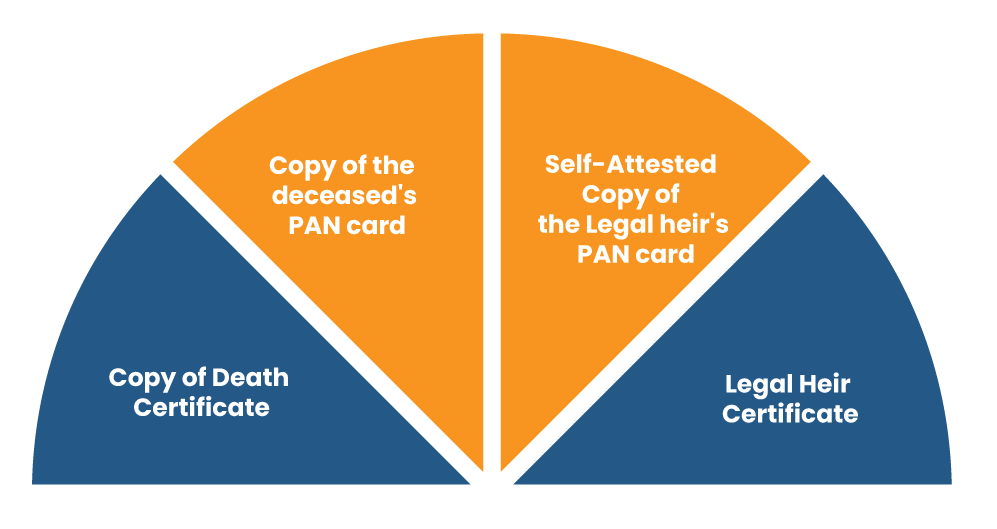

- Step 5: A page will appear on your screen, prompting you to upload the following documents.

(As cited above) The zip file size must not surpass 1 MB. Click submit, and the portal will generate an acknowledgement e-slip with a transaction ID.

Registration Approval Process

After the completion of the above steps, the request will then forwarded to the e-filing Administrator. Such an official scrutinizes the application and may reject it in case of any potential error. Once the administrator stamps his approval on the request, the applicant can use all the legal heir and deceased services.

File Income Tax Return as a Legal Heir

Upon successful legal heir registration, you can file an income tax return for the deceased person as a legal heir. The section below manifests the process of return filing on the income tax portal.

- Download the income tax return form for a deceased person.

- Fill the downloaded form with apt detail and convert it to the XML file.

- Visit the Income Tax web-based portal.

- Log in to the IT portal via valid account credentials.

- Navigate to the e-file & upload the return.

- Fill in the given information & choose the XML file:

- PAN – Opt for PAN of the deceased.

- ITR Form Name – Choose the Income Tax Return Form to upload(i.e. ITR 1, 2, …)

- Choose Assessment Year

- Next, make sure to upload the XML File.

- A legal heir can electronically sign the deceased’s ITR using his/her DSC, i.e. Digital Signature Certificate.

- Click Submit.

An overview on the Estimation of the deceased’s income

As a legal heir, you are accountable to complete the filing requirement of the deceased against income earned till the date of demise. Estimate the deceased’s income from the inception of the year till the date of demise. If you aren’t aware of how to estimate income, you must refer bank statement and other relevant documents for income tax calculation.

Any income reaped post demise of a person from the assets received from the said individual is taxable in the hands of the legal heir. The legal heir must add such income received from the deceased in his income while addressing tax[1] liabilities.

What is the Tax liability of the legal heir?

The legal heir is accountable for paying taxes liable in the ITR of the deceased. But, he/she is not responsible for the delayed taxes. The legal heir’s liability is limited to the extent to which the assets he/she received can address the liability. For example, If an individual receives Rs 10 lakhs as his share from her mother’s property and his mother liability is Rs 12.5 lakh, he is not bound to pay more than Rs 10 lakhs. The legal heir’s liability is confined to the value of the assets received.

Conclusion

The legal heir is accountable for paying tax and other sums such as fine or interest that were supposed to be paid by the deceased when he/she was alive. It means that the legal heirs should confront the penalty for a default incurred by the deceased. But again, his liability would be restricted to the extent of the assets received from the deceased.

Read our article:Income Tax Returns: Which is the Correct ITR Form for you?