A documentation of tax return filed with the tax authority is income tax return. The documentation that is filed has the reports of the taxpayer’s income, the expenses and other pertinent financial information. The Income Tax Act, 1961, makes it mandatory for an Indian citizen to file returns at the end of every financial year.

There are various kinds of forms for filing Income Tax Return which is important for the assessee to decide and accordingly the assessee files his Income and tax information in the ITR Form to the Department of Income Tax. In this article, we will let you know about the Income Tax Returns and which is the Correct ITR Form for you.

What are the Various Kinds of ITR Form?

The Income Tax Department of India processes only those Forms which are filed by the eligible assessees. Therefore, it is imperative to know the particular form that is suitable in different cases. ITR Forms differs according to the criteria of income source of the Assessee and also depends on the category of the Assessee.

Every year on 31 March the financial year ends and the taxpayers have a period of four months to make their Income Tax Returns. The due date for filing income tax return Form with the Income Tax Department is 31 July every year.

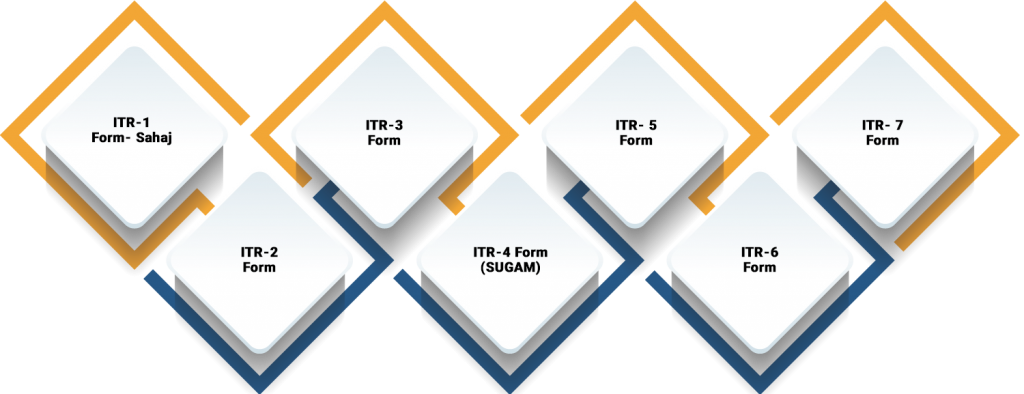

Income tax return is an ITR form and the department of income tax has notified with seven different forms that are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7. Every tax payer has to file with these ITR form before the specified due date. The various forms and the taxpayer eligible to apply in the particular form are given below:

ITR-1 Form- Sahaj

The eligible individual for ITR-1 “sahaj” which means “easy” in hindi terminology are the Indian citizens. So, the Resident Indians having income less than 50 lakhs from the given below are eligible under this ITR Form –

- Income through Salary or Pension

- Income through One House Property (this shall have an exception in cases of preceding years losses brought forward)

- Income through other sources besides income from Lottery, Legal Gambling, Racehorses, etc. Other sources of income shall include FD interest, pension of spouse etc.

ITR-2 Form

The individual’s eligible for ITR-2 Form is the Indian citizens as well as Non Residents to file their ITR form with the Income Tax Department of India. Indian citizens shall include both Individuals as well as Hindu Undivided Families. Therefore, following are the individuals eligible to file under this Income tax return form :-

- Every income from ITR-1 greater than 50 lakhs.

- Earning of Income through a salary or pension.

- Income through more than one House Property.

- Income through capital gains (this shall include both Short Term and Long Term)

- Earning income through Other Sources (like Lottery Winnings, income from bets on Racehorses, and gambling by Legal methods)

- Income from foreign assets or any foreign income.

- This shall also include individual holding directorship in a company and holding unlisted equity shares.

ITR-3 Form

This form is mainly for businesses with partnership deals or professions that should particularly be partnership profession. It specifically applies to those Individuals and Hindu Undivided Families registered as Partners in a firm. The taxpayers eligible are:-

- Presumptive income greater than 50 lakhs.

- The taxpayer is a Partner in a firm

- The income is through ‘Profits or gains of profession or business’.

- Income gain by means of remuneration, interest, bonus, salary, commission as a partner.

ITR-4 Form (SUGAM)

The ITR Form is applicable to individual and Hindu Undivided Family who are interested in declaring their income from Profession or Business that are under Presumptive Income Scheme of Income Tax under Sections 44AD , 44ADA and 44AE of the Income Tax Act[1]. The individuals eligible under this ITR form are:-

- Total income greater than 50 lakhs

- Income from salary and pension account

- Income from other sources

- Income from one house property

ITR- 5 form

The ITR form is applicable to:-

- Income through LLPs (Limited Liability Partnership),

- Income of AOPs (Association of Persons),

- Income of AJP (Artificial Juridical Person),

- Income of BOIs (Body of Individuals), including business trust and any investment fund for deceased estate and from the Estate of insolvent. There is no bar in the extent of income or profit-loss in this case.

ITR-6 Form

This Form is particularly for companies other than those companies that are exempted under Section 11 of the Income-tax Act, 1961, i.e. the companies whose income from property is held for the religious purposes or charity. This Income tax return form is the one filled electronically.

ITR- 7 Form

This Income tax return form is generally used by business trusts and the persons and company’s eligible under this Income tax return form is to furnish return under:-

- Section 139(4A) – by every person who derives income from property held under trust or other legal obligations for charitable and religious purposes.

- Section 139(4B) – filed by political party if the total income exceeds the maximum amount not chargeable to tax without giving effect to the provisions of section 139A not chargeable to income-tax.

- Section 139(4C) – Scientific research association, any news agency, association or institution referred to in section 10(23A), 10(23B) and fund, university or institution or other educational institute and hospital or medical institute.

- Section 139(4D) – filed by every college, university or other institution not required to furnish income tax return under any other provision of this section.

- Section 139(4E) – Filed by every business trust which is not required to file income tax return or loss under any provisions of this section.

- Section 139(4F) – filed by any investment fund as has been referred to in section 115UB and not required to furnish income or loss return under any other provisions of this section.

Conclusion

The taxpayers can download the relevant form from the official website of the Income Tax Department. Depending upon the kind of income the individual is making, the taxpayer has to decide and select the respective Income tax return form. The taxpayer has to apply for the income tax return in the correct ITR form so as to make a valid ITR filing.

Read our article:Mistakes While Filing Income Tax Return: Procedure of Rectification