It is well-known that establishing trust is a method of passing on any wealth or assets that you may own. It will essentially bypass your state’s probate process, which is consisting of assets accumulated by the grantor of the trust. These instruments are then managed by a third party (the trustee) for the recipient.

Trusts are not just storage containers for assets. Likewise, the money held in a trust doesn’t require being in static, but it can be put to work unless particularly forbidden from performing so.

What are the Modes for Investing Funds under Charitable Institutions?

- Investment of Funds by Trusts under Section 11(5):-The Uniform Codification of investments got laid down from April 1, 1983. It was for all categories of funds relating to charitable and religious trusts or institutions. The Codification of investment will apply concerning the accumulation of income above 15%.

- Fund Doesn’t Invested by Trusts in Section 11(5):- Income of trust/institution doesn’t get qualified for exemption if reserves get invested in an inaccurate manner other than in the modes prescribed under section 11(5).

What are the Investments of Funds by Trusts under Section 11(5)?

The Categorization of investment will apply concerning the accumulation of income above 15%. Moreover, the uniform modes for investing funds of charitable Institutions trusts and institutions have provided below:

- Any investment certifying Government Savings or any other Securities

- Any investments Certificates issued by the Central Government under its Small Saving Policies

- Any investments Securities by Post Office Savings Banks

- Any investments with Scheduled Banks/Co-operative Banks, which may constitute a Cooperative Land Mortgage Bank or a Cooperative Land Development Bank

- Any investments in the covered system of Unit Trust of India

- Any investments deposited in Central Government or State Government

- Any investments kept in debentures circulated by or on behalf of any company or corporation.

- Any investment kept in any public sector company.

- Any investment in bonds of approved financial corporation providing long term finance for industrial development

- Any investment deposited in bonds of approved public companies whose primary objective is to produce long-term finance for construction or acquisition of houses in India for domestic/residential purposes.

- Any investment kept in fixed/immovable property, excluding plant and machinery/Factories.

- Any investments deposited with the Industrial Development Bank of India

- Any investments held with bonds published by a public company registered in India. It should get acknowledged with the main object of long-term finance for urban infrastructure in India. The explanation to this clause are:-

- It provides for repayment along with interest thereof during not less than five years;

- The project should get consisted of potable water supply, sanitation, sewerage, solid waste management, roads, bridge-whist and flyovers, or urban transportation.

What are the Funds that don’t get invested by Trusts under Section 11(5)?

Income of trust/institution doesn’t get qualified for exemption if reserves get invested in an inaccurate manner other than in the modes prescribed under section 11(5). The following points should get noted in regards–

- The exemption given under section 11(1)(a) is accessible only if at least 85 % of the income gets applied for charitable or religious purposes in India. It should be during the year, and the outstanding amount should get invested in the modes stipulated under section 11(5) of the Act.

- For Instance: –A trust receives income from property held for charitable purposes around Rs. 60000 in a year. In accordance with section 11(1)(a), it has to utilize at least Rs. 51,000 (i.e. 85% of Rs.60,000) on the charitable purposes of the trust. The balance of Rs. Nine thousand will have to get invested in the forms/modes guided under section 11(5) of the Act. It is only then that the whole income of the trust will get exemption.

- Reservations – Exemption will not get denied even if funds are invested contrarily than in the Modes specified in section 11(5): only if these following criteria gets into the context.

- Exemption does not get rejected for the assets held by the trust or institution only if they form a portion of the corpus fund of the trust as on June 1, 1973.

- Likewise, the exemption does not get denied concerning any addition to the assets. Hereby, the shares should form a part of the corpus of the trust or institution as on June 1, 1973. Such accretion should get arises by way of allotment of bonus shares of the trust.

- Exemption does not get waived off in association with debentures that received by the trust or institution before March 1, 1983. The exemption from tax under section 11 shall get rejected only in respect of interest on such debentures, if such debentures are not disinvested by March 31, 1992.

- Exemption will not get rejected concerning any funds expressing the profits and gains of a business, if the trust/institution manages separate books of account in respect of such business activity.

- Any acceptance of donations in kind or acquiring any asset not adhering to the provision of section 11(5) will not make the fund or trust or institutions miss the tax exemption. The trust or institution should get bound to dispose of or convert the asset relying on the requirement of section 11(5) into permitted investment.

What are the Authoritative Prescriptions (2020) underlining Investments?

- The Central Board of Direct Taxes has issued a ‘Notification No. 15/2020 dated 05.03.2020’ to amend Rule 17C of the Income Tax rules, 1962. It is to recommend the form and mode of investment deposits by a Charitable Trust or an Institution under section 11(5) of the Income Tax Act, 1961[1].

- Moreover, according to the Section 11 of the Income Tax Act, it provides that any income, profits, and gains derived from assets and investments held under trust should be solely for religious and charitable purposes. It shall not get included in the total income of the trust or institution of these incomes applied or accumulated for application for the trust.

- If 85 % of the income does not get applied to charitable or religious purposes of the trust, they can accumulate or set apart either the whole or part of its income for later application for such purposes.

- Chapter III of the Income Tax Act, 1961, is related to the provisions contained in sections 11, 12, 12A, 12AA, and 13. After the amendment by Finance Bill 2020, now 12AB also got included.

Read our article:Business Income & Taxation of Charitable Institution U/s 11(4) and 11(4A): In-depth with Case-Laws

What are the Planned Considerations specified u/s 11(5) Treating of Investments?

Application of Income

- We are aware that Section 11(1) requires the application of income of the year for the objects of the trust or institution. Similarly, the section 11(5) deals with investment of the existing funds of the trust.

- For that reason, it can get said that the investment need not be out of income. However, even if such investment gets made out of income, it cannot be interpreted as an application of income under Income Tax solely.

Interest-free loan

- According to the case ‘CIT V. Kanpur SubhashShikshaSamiti [2013] 36 (Allahabad)’, theInterest-free loan provided by one charitable trust to another does not get deposited or investment under section 11(5).

Subscription to chit fund

- According to the case, ‘SethuValliammal Educational Trust v. ITO (Exemptions)-III [2013] (Chennai-Trib)’, theSubscription to chit funds amounted correct to use of funds, since the right of the assessee was only to prize a chit or play a part in the draw of lots.

- On the other hand, it is not an investment or deposit of money which was available as a surplus with the assessee. As a result, AO was wrong in determining that such invested subscriptions have violated the modes specified under section 11(5).

Shares towards Corpus

- According to the case, “Sera Foundation v. ITO (2012) 79 DTR 210/150 TTJ 537 (Delhi) (Trib)”, it has held thatthere is no restriction on accepting shares by a charitable trust. The trust can receive equity shares from another trust for corpus donation.

- Nevertheless, as per the clause (iia) of proviso to section 13(1)(d)(iii) trust should hold the shares for a maximum period of 1 year before, which they have to be converted into the modes of investment as prescribed in section 11(5).

Sale and purchase of mutual fund

- According to the case, ‘ITAT, ITO v. Jesuit Conference of India (Delhi) – [2011]’, it was held that sale and purchase of mutual funds do not get treated as business activity of the trust. Therefore, all the benefits of sections 11 and 12 do not get denied.

- As a result of the judicial pronouncement, any invested surplus money in mutual fund units entering into frequent transactions related to purchase/switchover from one such mutual fund policy to another is invalid.

- The investments get made to grow a better yield upon appreciation, and incomes of mutual funds get applied for charitable purposes. It could not say that assessee had been auctioning on business activity, which was not incidental to its charitable activities.

Fixed Deposits and Capital Assets

- According to the ‘Central Board of Direct Taxes’ vide ‘Instruction No. 883, dated 24/09/1975′, has explained that investment in Fixed Deposits with a term of more than six months are reflected as capital assets for the purposes under section 11(1A).

- On the other hand, in ‘CIT v. Hindustan Welfare Trust [1994] 206 ITR 138 (Cal)’, it has opined that the term of the deposit could not be the test of assessment of being an asset of the trust.

- Apparently, in the case of ‘DIT (Exempt) v. DLF Qutab Enclave Complex Medical Charitable Trust [2001] 167 CTR (Delhi) 120′, it has opined that the investment and deposits of assets for a fixed term in ‘Scheduled bank’ is an adequate criterion.

Investment other than Specified manner

- Any violation connected with s. 11(5), i.e., investment in non – specified securities/deposits, should always be read with S.13 (1) (d). It is for the reason that, if any violation of S.11 (2) takes place, only the infringed portion of the income will be taxed. But then for violation u/s 13(1)(d), the entire exemptions may get vanished/lost.

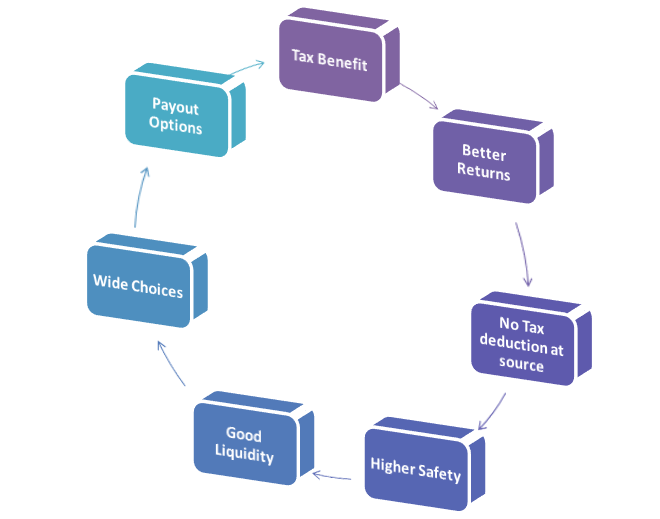

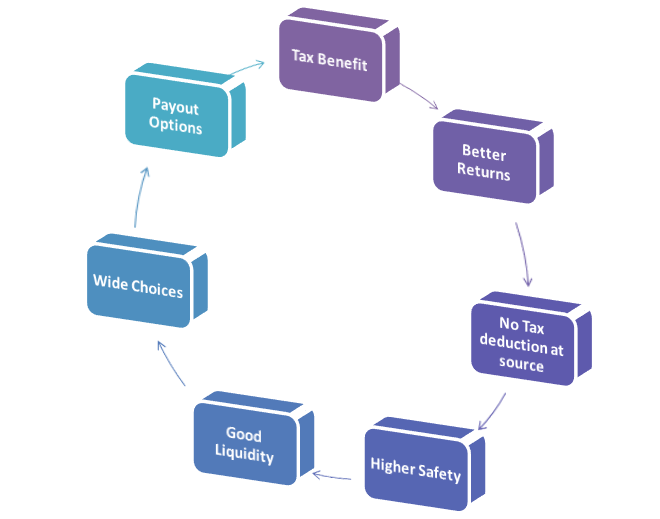

What are the Assistances of Investment Trust?

Investments by trust generally tend to get advance in a range of individual securities. Though, if the securities are all in a similar kind of asset class, then there is a precise risk that all the shares could get harmed by the adverse market changes. To avoid these changes, investors might hold their assets in equal shares in equities and securities. Few ranges of Investing Funds by Trust are as follows:-

- Flexibility

The fund manager of trust can invest and sell assets when they feel the time is right, not when investors participate or leave the reserve. It depicts that the underlying capital investment sector is relatively stable.

- Borrowing Commands

Trusts can borrow money to take benefit of investment possibilities. Borrowing can improve the returns for sharers, but if the assets fall in utility, it can also raise the potential for losses.

- Administration and Income

Each investment trust has a self-governing board of directors. They’re accountable for safeguarding shareholder benefits. Investment trusts can hold up to 15% of their income in any year. It can get used to supplement income in later years.

- Sharer Powers and Liquidity

When you advance in an investment trust, you become a shareholder in that institution. It provides you the right to vote on matters. Moreover, the investment can quickly get transformed back to cash.

Conclusion

Trust also called ‘closed-end’ trust, a financial organization that pools the funds of its shareholders and invests them in diversified holdings of securities. Moreover, the trust’s invested income and capital gains are usually not taxed within the limited measures of the trust. Indeed, we understand that these approaches are quite sophisticated by its nature; therefore, it is essential to examine the issue in-depth based as per the latest circulars and get hold of stated case laws and Illustrations given above. Corpbiz professionals are equipped with the essential knowledge and skill sets to support your Investments Deposits held by trust and its business targets.

Read our article:Accounting and Tax Treatment of Inter-NGO (Trust/Society/Company) donation