Inverted Duty Structure is a situation where the tax rate on inputs is higher than tax rate on output supplies. Inverted duty structure under Goods and services tax usually results in increase of excess tax credit and cascading cost, therefore it is the need of hour to optimize the arousal of refunds in the platform.

As per Section 54(3) of the Central Goods and Services Tax Act, 2017, any registered person can claim a refund of the unutilized ITC with relation to Inverted Duty Structure at the end of any taxation period.

Previous Scenario – Inverted Duty Structure under GST

In the pre-GST rule, any situation of Inverted duty structure arises in case where import duty on raw materials used in the manufacturing goods was higher than the import duty on the finished goods.

Refund for Inverted Duty Structure under GST

Any registered person can claim a refund of the unutilized ITC with relation to Inverted Duty Structure at the end of any taxation period where the credit has been assembled on description of tax rate on input higher than the tax rate on output supply.

Refund of unutilized ITC should not be allowed in these cases:-

- Output supplies as notified by the Government on the recommendations of the Council.

- Goods exported are subject to export duty.

- Refund of supplies claimed under IGST Act of output tax paid

- If the supplier avails refund of IGST on supplies.

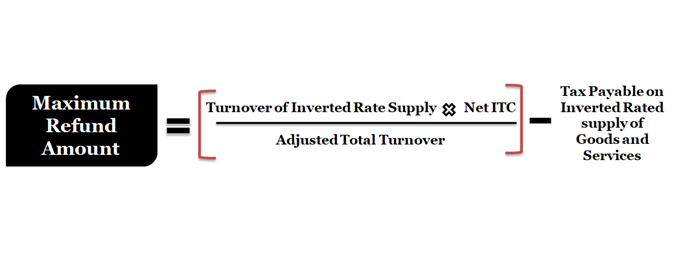

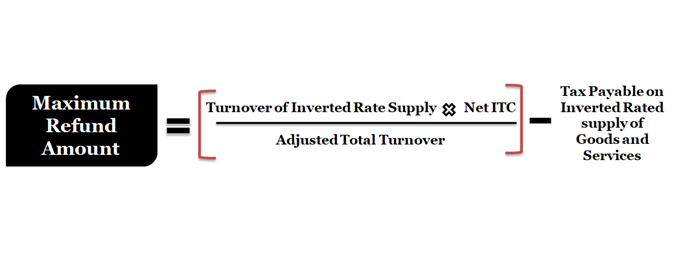

Calculation of Maximum Refund available

The formula for Maximum refund Amount is:-

Where,

- “Adjusted Total turnover” states that the turnover in a State or a Union territory, as explained in section 2 (122) of CGST Act, excluding the value of exempt supplies other than inverted-rate supplies, during the relevant period.

- “Net ITC” means ITC availed on inputs during the relevant period rather than ITC availed for which refund is claimed under sub-rules 4A or 4B.

- “Tax payable on inverted rate supply of goods and services” means the tax payable on inverted rate supply of goods and services under the same head, i.e. IGST, CGST, and SGST.

- “Turnover of inverted rate supply of goods” means the value of the inverted supply of goods made during the relevant period.

Read our article:An Outlook on Refunds in GST

Procedure of Claiming Refund

The GSTN has issued “Circular No. 125/44/2019 dated 18.11.2019 and Circular No. 135/05/2020 dated 31.03.2020”. The circular says the guiding principles and processing of refund which needs to be done electronically.

GSTR-1 and GSTR-3B forms are required to be filed for the taxation period for which a tax payer wants to apply for Refund of ITC accumulated.

The refund application should be filed in approved Form RFD-01A. It is a temporary return form introduced in place of RFD-01 for application till time the online facility is enabled for refund claims. RFD-01 is required to be filed within 2 years from the end of financial year in which claim for refund occurs.

Steps Involved-

- Fill in the RFD-01A form on GSTN portal. Application Reference Number (ARN) code will be generated by the portal.

- Take the print of the duly filed application form and ARN code generated from the portal.

- Submit the documents with respective supporting credentials to the relevant authority.

- Tax officer will process and examine the refund application. After successful process and examination of application refund will be paid out manually.

- If jurisdictional authority of the state or central is not fixed yet, the tax payer shall approach the Nodal officer of the relevant state.

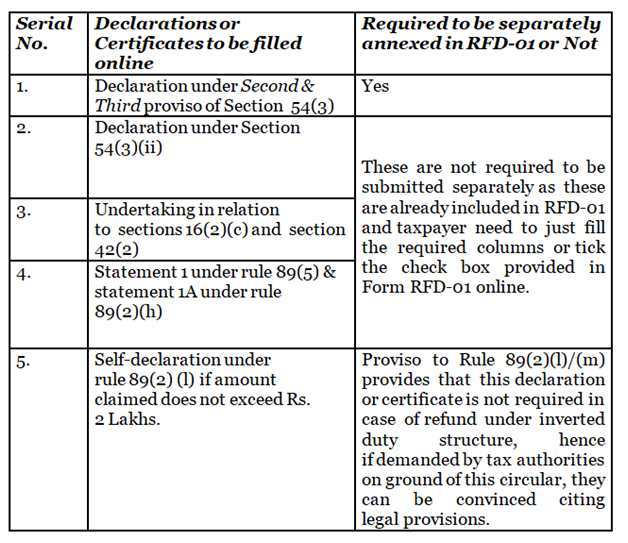

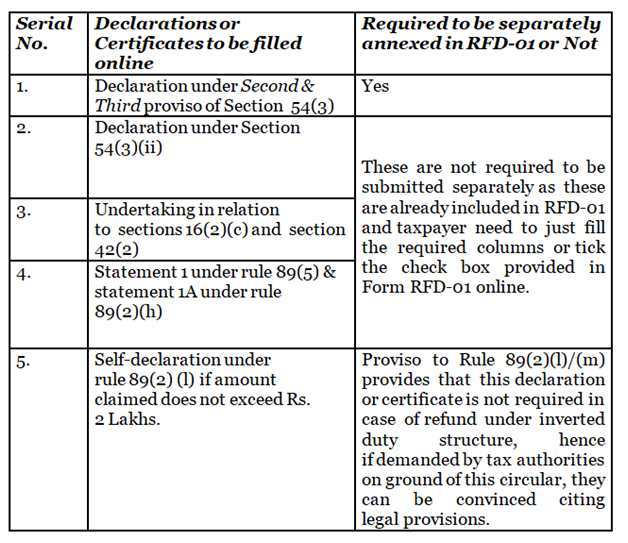

Documents required to be uploaded with the Refund Application

Relevant Clarifications Issued so far

The relevant Clarifications regarding Inverted Duty Structure under GST by recent Notification are as follows-

From Circular No. 125/44/2019 dated 18th November 2019

The agendas presented by Circular No. 125/44/2019 dated 18th November 2019 are given below. Those are as follows:-

Multiple inputs involving multiple GST rates

It has been simplified that for the purpose of refund, Input Tax Credit accumulated on all the inputs used in making outward supply needs to be considered. It can be the inputs which are obtained at equal or lower rate of GST than the GST rate on outward supply.

Refund of accumulated Input Tax Credit

Refund of accumulated Input Tax Credit is applicable on supplies made to merchant exporters at reduced or concessional rate of 0.05% or 0.1%.

Input Tax Credit of invoices

Input Tax Credit of invoices issued in prior period, and “availed” in succeeding period can’t be barred from the calculation of the refund amount for the succeeding period.

Refund of Input Tax Credit on Inputs

The refund of Input Tax Credit on inputs includes inward supplies and should be available as long as:

- They are used for the business purpose and for completing taxable supplies, including zero-rated supplies;

- Input Tax Credit for such inputs is not restricted under section 17(5) of the CGST act[1].

Calculation of Refund amount to be claimed

The observation of the circular says that the common portal calculates the refundable amount at the least of the following amount. Those are as follows:-

- Maximum refund amount calculated in accordance with Rule 89(5) (Formula is to applied on combined amount of ITC i.e. CGST+ SGST/UTGST+IGST);

- Amount in electronic ledger at the time of filing for refund application;

- Amount in electronic credit ledger at the end of taxation period for which refund is being claimed

From Circular No. 110/29/2019 dated 3rd October 2019

The agendas presented by Circular No. 110/29/2019 dated 3rd October 2019 are given below. Those are as follows:-

When NIL application is filed inadvertently

It does not allow re-filing the refund claim for that period under the same category. Taxpayers can file the refund claim under “Any Other” category and once the application is examined entirety by the proper officer the refund amount claimed has to be separately debited from Electronic Credit Ledger through Form DRC-03.

From Circular No. 135/05/2020 dated 31st March 2020

The agendas presented by Circular No. 135/25/2020 dated 31st March 2020 are given below. Those are as follows:-

Refund of accumulated Input Tax Credit on account of reduction in GST Rate

It has been explained that the refund of accumulated Input Tax Credit under inverted duty structure will not be applicable in case where the inversion is due to decrease in the GST rate on the output goods.

Conclusion

The Budget 2018-19 has mentioned that specific duties on some medical devices have been reduced to nil from 2.5% to correct inverted duty rate. Moreover, some taxpayers are confused due to issues in various GST laws which require attention and one of them is refund of accrued credit in case of inverted duty structure under GST. Contact CorpBiz for more information regarding the same.

Read our article:Elucidation on GST Refund Issues – Recent Updates