MSME is Micro, Small and Medium Enterprises enacted by Government of India under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006. The objective behind introducing this Act was to encourage the promotion and growth of MSME in production, manufacturing, processing or preservation of goods and commodities and boosting the competitiveness of micro, small and medium enterprises in the market along with the development of rural areas. Government comes up with the scheme for MSME for furthering goals aiming growth and development of the nation. One of such scheme is Interest Subvention Scheme for MSME.

MSME as the Foundation of Indian Economy

These industries or enterprises are the foundation of Indian economy and they need proper aiding and security from other big companies as they are still developing and they lack capital and advance technology. Thus, the aim of the Government of India is to come up with some schemes, rebates or guidance for the development of these enterprises.

Because of MSME we have approximate 8% of India’s GDP, it has employed over 110 million people, and it has a huge share of 40% in the exports market and 45% in the manufacturing sector. Therefore, the Government in a new scheme has come up with subvention of interest scheme for MSME with the broader aim for boosting the sector.

Read our article:How MSME Registration Can Ensure Business Growth?

The Interest Subvention scheme for MSME

The Government of India has to ensure from time to time that scheme for MSMEs should continue to advance the economic growth of the country. So, Hon’ble Prime Minister has announced 2% interest subvention scheme for MSME i.e. for all GST registered MSMEs, on fresh or incremental loans

- The interest subvention will be 2% per annum on the outstanding balance from the date of drawal or the date of notification of the scheme, whichever is later.

- It has to confirm to the Code of Ethics and Fair Practices Code as according to the respective institutions and RBI guidelines.

- At the date of filing the claim amount the amount of the loan should not be declared as a Non-Performing Asset (NPA)

- The scheme for MSME “Interest Subvention Scheme for Incremental credit to MSMEs 2018” has to be implemented from 2018-19 and 2019-20 as has been decided by The Ministry of MSME.

Purpose of the Interest Subvention Scheme for MSME

The purpose of introducing this Scheme for MSME is to encourage for increasing productivity for manufacturing and service enterprises and availing of incentives to MSMEs for enlisting it on GST platform which will further help in organization of better economy and reduce the credit cost.

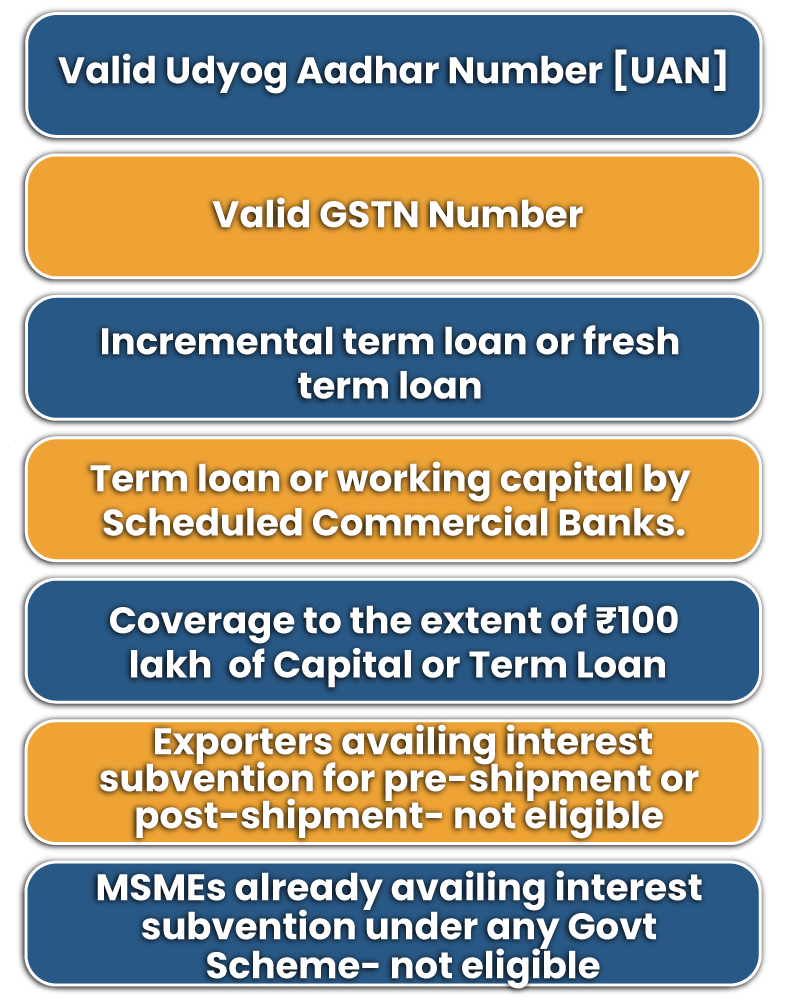

Eligibility Criteria

When the scheme was introduced its eligibility criteria included, which are as follows:-

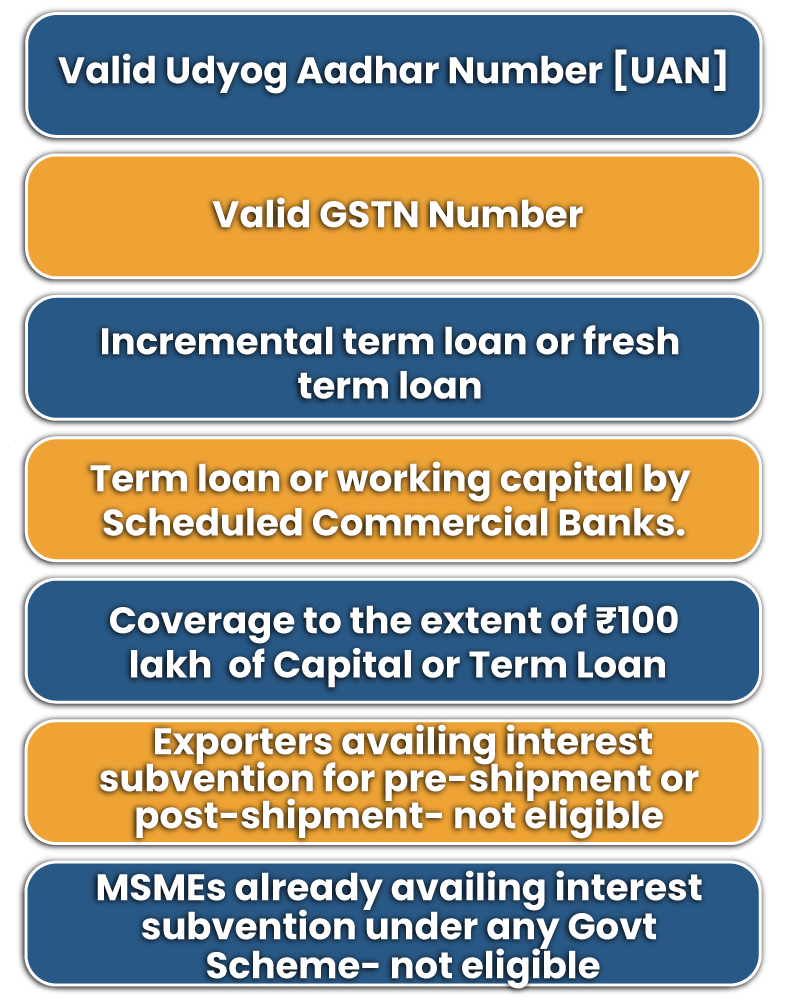

Changes in the Eligibility Criteria

But later on, the Government of India[1] brought changes to its eligibility criteria so that the benefit of the scheme is properly availed. The modification in the scheme was done with the hope that it will result in fulfillment of the objectives of the scheme.

- Removed the requirement of Udyog Aadhaar Number (UAN) for units eligible for GST

- Both the UAN and GSTN numbers are not mandatory for availing this scheme

- Ease the flow of credit to MSMEs

Latest: Further Extension in the Validity Period

The government of India has further extended the validity of the order for the provision of interest relief of 2% per annum to MSMEs under the Interest Subvention Scheme to March 31, 2021.

Accordingly, it will cover fresh or incremental term loan / working capital limit under the scheme which is extended by co-operative banks with effect from March 3, 2020 only. The announcement of the government on November 2, 2018, to offer interest relief on loans for Rs 1 crore will further be implemented for till 31st March, 2021.

Which is the Authority to implement this Scheme?

- The sole national level authority to implement this scheme is Small Industries Development Bank of India (SIDBI)

- The lending institutions shall be responsible for their own submission and that their data must be accurate according to the scheme.

- Ministry of MSME, Government of India will be the highest authority for all the matters related to interest subvention and their decision would be binding and final.

Who are eligible to submit the claim?

- Nodal office of the lending institution

- Loans disbursed data and claims of interest relief should be in excel sheet soft copy by lending institutions.

- The lending institutions will submit their claims of disbursed loans and claim interest every half yearly to the Small Industries Development Bank of India (SIDBI). The MSMEs will have to submit a notarized affidavit to their respective banks for availing the benefit.

- The statutory auditors should have certified all the claims.

- The Chief General Manager, Institutional Finance Vertical, SIDBI will be the appropriate authority to submit the half-yearly claims.

- Only after the availability of funds by Ministry of MSME it shall pay the particular institution accordingly.

Impact of Interest Subvention Scheme under Budget 2021-2022

It was expected that the two percent interest subvention scheme for micro, small and medium enterprises (MSMEs) on loans should be extended with improved & more coverage of three-four per cent to the extent of ₹ 300 lakh.

Moreover, because of the recent unemployment due to the Covid-19 pandemic there was a need to increase the interest rate of the scheme for MSME so that the scheme can generate more employment and could have attracted more MSMEs on board but nothing went according to the expectation.

As the government has earlier already extended the time period for applying for loans under Interest Subvention Scheme for MSME which is valid till 31st March so the Budget 2021 had no plans to come up with any further relaxation in the scheme for MSME. However, if the Government is satisfied that there is a need to increase the interest rates then it can come up with the guidelines anytime soon.

Conclusion

The Government of India will keep planning out schemes for the growth of MSMEs and the Interest Subvention Scheme is one of the most crucial schemes to boost the development of MSMEs in India. By including co-operative banks it has further widened the approach for the MSMEs to receive credits which is equally beneficial for the development of Co-operative Banking Sector due to their small customer base.

Moreover, the subvention of interest at 2% per annum will further prove to be beneficial because MSMEs are emerging and generating more and more employment in India. Since the major plan of Interest Subvention scheme for MSME on-board with Goods & Sales Tax, this relaxation of 2% will make the work done in an easier way.

Thus, this will also give an opportunity for different eligible units to enlarge their businesses with the help of Government and hence this will in turn contribute to the growth and development of national economy.

Read our article:Procedure to Avail MSME Registration Certificate in India

ISS5D09963F430140329CD88683ACC7707F