MSME is known as Micro, Small, and Medium Enterprises which are considered as the greatest asset to the economy because their contribution is remarkably huge, unlike other sectors. At present, the MSMS sector accounted for 45% of India’s Total Industrial Employment and 50% of the country’s total exports. MSMEs operating across the country produce more than 6000 types of products.

The aforesaid figure indicates that MSMEs are the backbone of the economy and would continue to dominate other sectors in upcoming years. Even if the entity is serving the manufacturing or service sector, the MSME Act allows them to avail MSME registration without imposing any limitation. The MSME came into existence on October 02, 2006, and since then it has been playing a pivotal role in leveraging the struggling sector of the economy i.e. micro small, and medium enterprises.

What is the Purpose of MSMEs in India?

Unlike bigger firms, Small and medium enterprises are more likely to encounter economic turbulence. This is where MSME registration proves so beneficial for these entities. It allows these entities to flourish seamlessly by providing them access to a growth-centric scheme and easy financial aid. The purposes of MSMEs are as follows:-

- To enhance the fiscal advancement

- To set up regular earning sources

- To ensure self-sufficiency within small scale sectors by overcoming obstructions.

- To ensure the business growth.

- To promote technology advancement with the implementation of new technology.

- Replacing outdated technology with new ones to ensure improved growth and production.

- Attracting industries toward growth-centric schemes.

- Providing fiscal aid to industries struggling to safeguard their existence under immense competition or any other reasons.

- Rendering easy credit to MSMEs across the country with lower interest rate and repayment policy.

What are Micro, Small, and Medium Enterprises?

The existing MSME classification was purely based on the criteria of investment in equipment and machinery. Therefore, to avail the MSME benefits, the MSMEs have to confine their investment to a lower limit. The tabular representation given below explains the same.

The lower limits present in the table acting as a constraint for the growth of the entities as they struggle to scale their business further. This eventually raises the demand for the revision of MSME classification so that entities can go for expansion while continuing to avail the benefits of MSME. Fortunately, the government responds to this situation and comes up with a revised classification of MSME under the Aatmanirbhar Bharat Abhiyan[1]. The revised scheme is based on investment and annual turnover. Also, the revised scheme gets rid of the distinction that separates the service and manufacturing sectors under the MSME definition. The following table represents the revised MSME classification.

Is Registration Compulsory For MSME?

| S.No | Enterprises | Investment & Turnovers | Limits |

| 1. | Micro | A)Investment in equipment and machinery | (<Rs. 1 Cr.) |

| B) Turnover | (<Rs. 5 Cr.) | ||

| 2. | Small | A)Investment in equipment and machinery | (<Rs. 10 Cr.) |

| B) Turnover | (<Rs. 50 Cr.) | ||

| 3. | Medium | A)Investment in equipment and machinery | (<Rs. 50 Cr.) |

| B) Turnover | (<Rs. 250 Cr.) |

MSME registration is availed voluntarily and it is not mandatory for any kind of entity. But it is not wise to put MSME registration out of the equation since it offers strings of benefits to the small and medium sized industry that ensure their growth.

How Long is the MSME Certificate Valid?

MSME registration serves lifetime validity as long as the company remains in existence and carry out their operation in a normal fashion. The provision of renewal does not apply to the MSME certification.

Schemes Unveiled By the Government under MSME

Government of India under MSME has rolled out host of schemes for betterment of small and medium scale enterprises. These schemes are growth-centric and have been promulgated by taking financial standing of the MSMEs into account.

Quality & Technology Upgradation Scheme

Registering to this particular scheme will enable the MSMEs to utilize energy-efficient technologies i.e. EETs in manufacturing units. The scheme will ensure cost-efficient production and seamless business growth.

Complaint Tracking System

Registering to this scheme would allow the business owner to track the status of their complaints. With this system in place, all the business owners can overcome the unnecessary trouble of being misguided in a particular matter of concern.

Support for Managerial and Entrepreneurial Development of MSMEs through Incubators

This scheme advocates new ideas, designs, or products. This scheme has been in effect since May 2019. Its primary goal is to provide opportunities to the innovators in nurturing their unique ideas for developing new products and ensure business growth. The scheme also promotes engagement with incubators who will suggest such MSMEs in developing the business by supporting them in strategy, design, and execution. The Enablers will play’ an essential role and would be essential part of the business development in India.

Credit Linked Capital Subsidy Scheme

Under this scheme, the latest generation of technology is provided to the entrepreneurs to supersede the outdated technology. This scheme allows business owners to obtain a capital subsidy to revamp their old technology. The MSMEs seeking capital subsidy for technology up-gradation can reach out to designated banks.

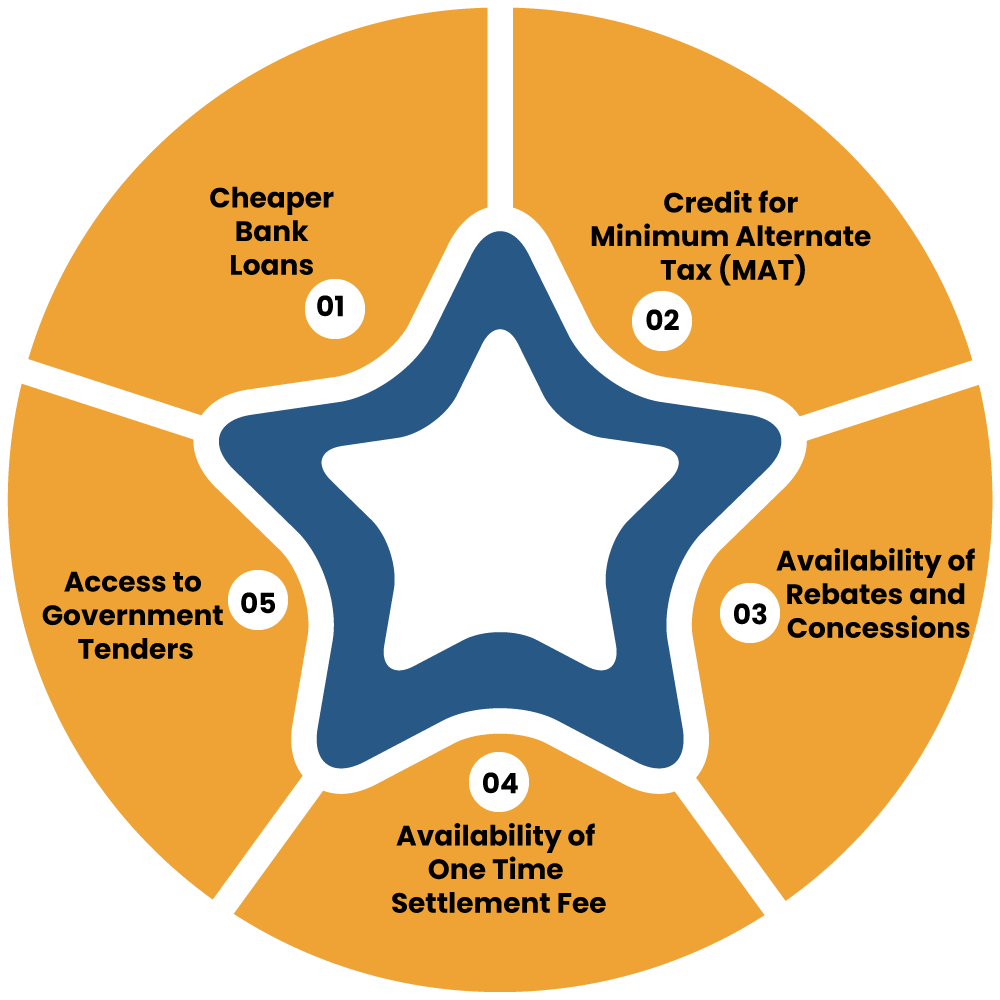

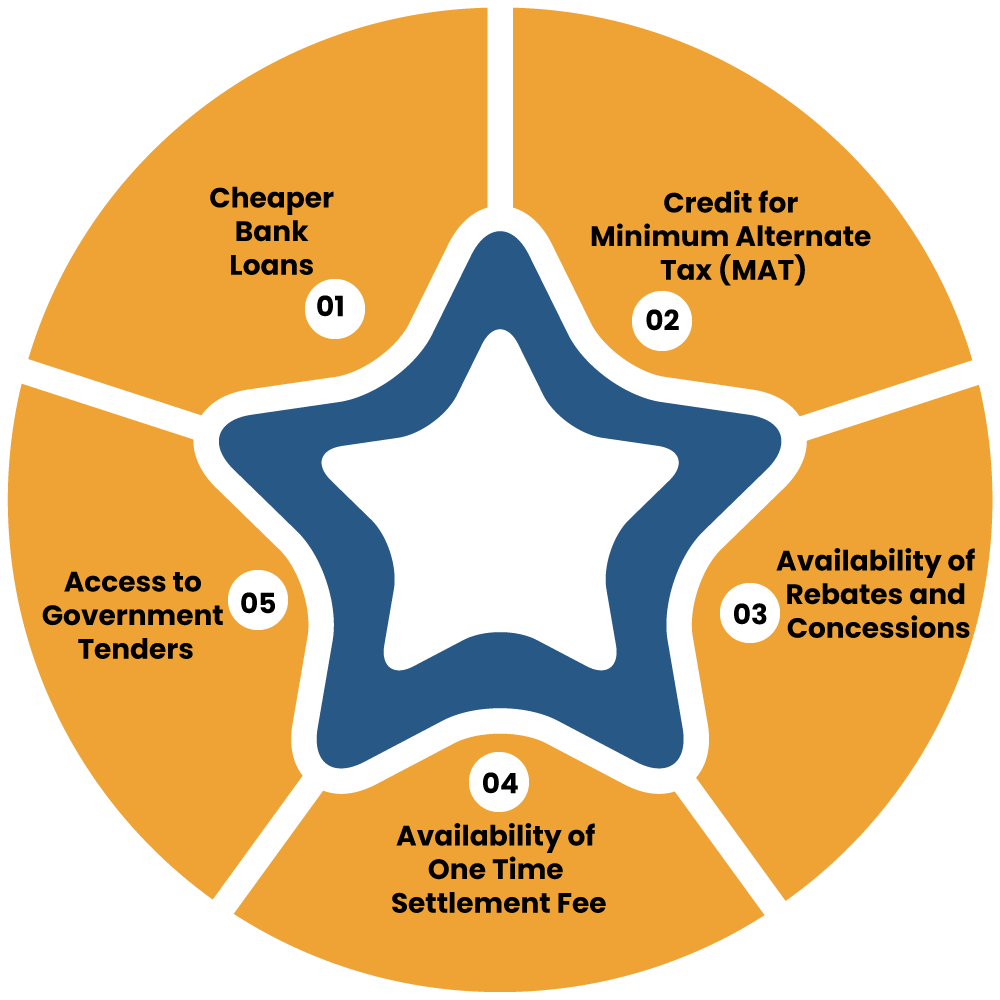

Benefits of MSME Registration

This section explains the arrays of benefits offered by the MSME registration, which are as follows:-

Cheaper Bank Loans

The entities having MSME registration are eligible to avail of easy credit from designated financial institutions at a cheaper rate of interest. At present, the interest rate for MSME registered entities has been capped within a range of 1 to 1.5%.

Credit for Minimum Alternate Tax (MAT)

MSME registration enables entities to avail credit for minimum alternate tax, which can be carried forward for up to fifteen years.

Availability of Rebates and Concessions

MSME registration offers rebates and concessions to the registered firm, which in turn allows them to rejoice reduced cost on account of filing a patent application for new technology.

Access to Government Tenders

With the integration of the Udyam Registration Portal with Government e-Marketplace, the MSME registered entities become eligible to access the e-tenders.

Availability of One Time Settlement Fee

MSME registered firms can opt for One Time Settlement Fee in case of the repayment defaults against the loans.

Conclusion

MSME registration aims at uplifting the small entities from a financial and growth viewpoint. Since it packs a host of productive benefits, one can opt for this registration to trigger the development of their business. Apart from that, MSME also takes care of the financial well-being of the small entities by providing easy credit at a nominal interest rate.

Read our article: MSMEs to Incorporate New IT system that Support e-invoicing