Recently, honorable Finance Minister Nirmala Sitharaman takes stock of the situation about outstanding payments or Dues to MSMEs , particularly by central government agencies and CPSEs (Central Public Sector Enterprises). The meeting was attended by the top official including MSME Secretary A.K. Sharma, Secretary of Department of Financial Services Debasish Panda, among others, were present in the meeting.

Dues Amounting to Rs 21,000 Crores has been Cleared Up till Now

Since the arrival Aatmanirbar Bharat package, concerted efforts and regular follow-up has been made by the Indian government for the payment of these dues. Major stress was placed on central government agencies and CPSEs for payment of dues to MSMEs. Consequently, over INR 21,000 crore of dues to MSMEs have been cleared in seven months by CPSEs and central government agencies.

As per MSME Ministry, the highest level of procurement was obtained in October of over INR 5,100 & payment of over INR 4,100. The subsequent month also witnessed the same level of performance as the amount of procurement and payment account for INR 4700 and INR 4000 respectively. Ministry further cited that the efforts made concerning clarification of dues to MSME include several rounds of written correspondence with CPSEs and GOI ministries followed by in-person meetings and persuasions.

Read our article:An Outlook on the New Structure of MSME Classification

Government Confronting CPSEs and Government Agencies for Prompt Disbursement of Dues for MSMEs

The efforts were strongly supported by the Cabinet secretary and PMO who endeavor to confront CPSEs and Government agencies to resolve the said matter. A web-based reporting system was deployed by the MSMEs ministry for CPSEs and central government agencies to submit information regarding the transactions, payment, and pending dues on the monthly basis.

The report of 7 months reflects that the procurement by CPSEs & central government agencies from MSMEs is on the rise & has escalated by almost 2.5 times since May 2020. The dues to MSMEs also witnessed proportional growth. Meanwhile, the dependency of payment has reduced to a significant level in terms of percentage against procurement value. However, reports in December manifest an improved trend in November as per just ten days of reporting, the statement said.

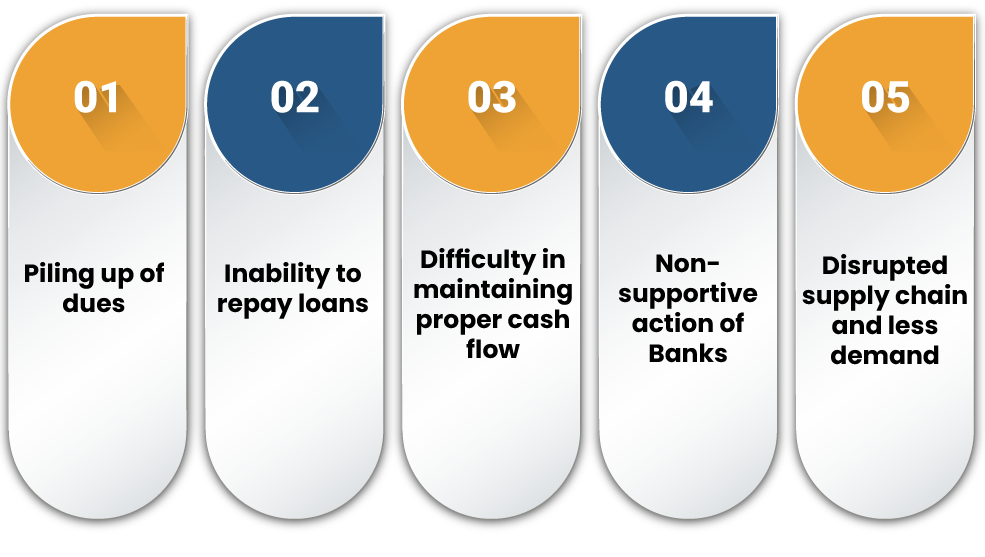

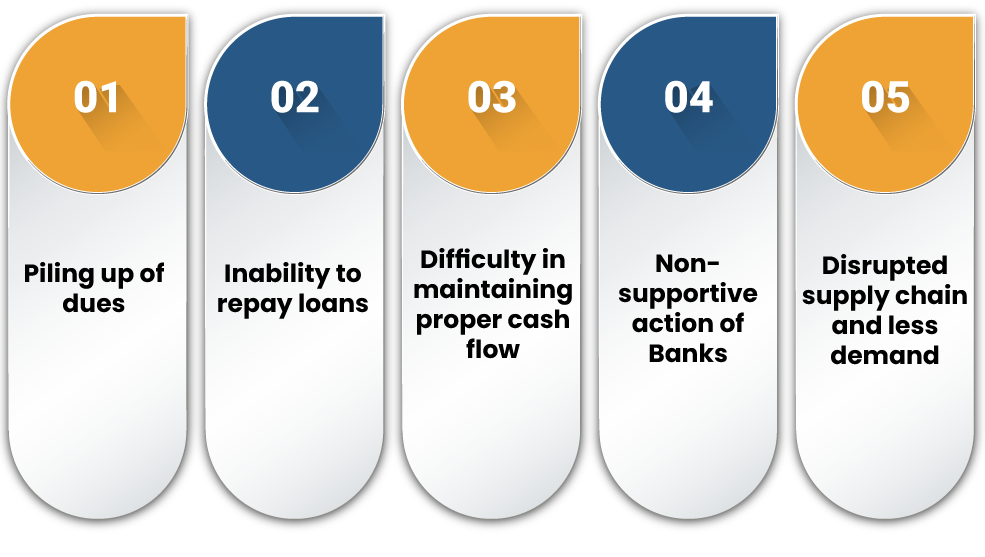

Why MSMEs Across the Country Encountering Receivable Issues?

The MSMEs sector has been distressed by the long-lasting impact COVID 19 pandemic. The sector is still in the recovery phase and it finding it hard to sustain longer owing to the financial crisis. The deficit of cash flow has created a big margin of mismatches in the balance sheet, enforcing MSME to cut down their production rate to meet the existing liabilities. With dues toward MSMEs has piled up every passing day, the government is making every possible attempt to contained the situation.

Due to consistent endeavor in association with the MSME ministry, the government has successfully recovered Rs 21,000 crore of dues from the central government agencies. The continual effort of the MSME ministry is now paying off as the cash flow for MSMEs has now seemed to shift towards the stabilizing phase. Recent measures taken by the Indian Government to restore the normal cash flow for MSMEs might intensify in upcoming months if the procurement level encounters some dip. These efforts were made to speed up the dues collection process which in turn helps MSMEs to continue their operation and address the existing liabilities with ease.

Impact of COVID 19 on MSMEs Performance

The announcement of a nation-wide lockdown hampered MSME owners, workers, and stakeholders in unexpected times, where no one had the clues to counteract such a situation owing to lack of experience. The extended lockdown has severely affected the supply of goods, procurement of raw material, and availability of manpower. From April to June 2020, the sector encountered obstacles related to wages/salaries/debt repayments, & statutory dues, etc.

According to the survey report, the earning of MSMEs was reduced by 20-50% due to the disruptions triggered by the Covid-19 outbreak. Companies dealing with the production of essential commodities were better off in terms of cash flows. Many companies laid-off their manpower because of inability to pay salaries, vacated workplaces due to escalating expenses & stopped production owing to lack of demand.

Non-Supportive Action of Bank making MSMEs more Vulnerable to Liquidity Crunch

Uncertainty in future trade is making financial institutions reluctant to extend any new fiscal lending or protect potential risk. And in the light of the fact that dues for MSMEs were piling up gradually, banks may no longer remain supportive as they were in the post-pandemic phase.

This all-around ambiguity required a push by the Indian government to boost market confidence and stabilizing regular cash flow. The economic slowdown has dragged us to pay attention to self-sustainable values, the Swadeshi dream.

The Atmanirbhar Bharat Mission was rolled out to encounter two burning issues collectively; one being a boost to MSMEs and the other reducing the dependency on overseas countries

Conclusion

The government of India[1] is already aware of the deteriorating situation of MSME and is continually striving to counter that loss by implementing relevant measures. The disruption of the cash flow for MSMEs created due to the non-payment is certainly a major issue that seeks expeditious solutions. GOI in association with respective authorities has taken some proactive measures for prompt clarification of dues to MSMEs. Approaching the bigger organization individually and insisting them to release the payment towards MSMEs is a part of their strategy to speed up the dues collection process.

Read our article:An Overview on MSME Samadhaan to Recover Unsettled Debt