The Board in pursuance of the Taxation & Other Laws (Relaxation & Amendment of Certain Provisions) Act 2020 & in supersession of order under section 119 of Income-tax Act dated 18 Sept 2020 has issued directions for the “Income-tax Authority” for exercising the power of survey under section 133A of the Act.

Power of Survey to Income Tax Authority

The CBDT while exercising the powers under section 119 of the Act issued directions regarding the following:

Read our article:Guide on Section 2(15) of the Income Tax Act and its Impact – Get the Complete Outlook!

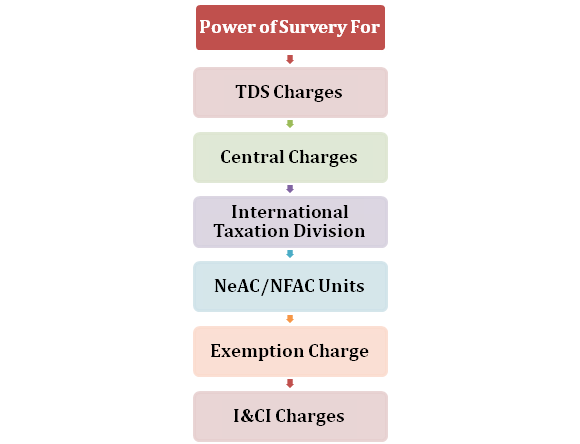

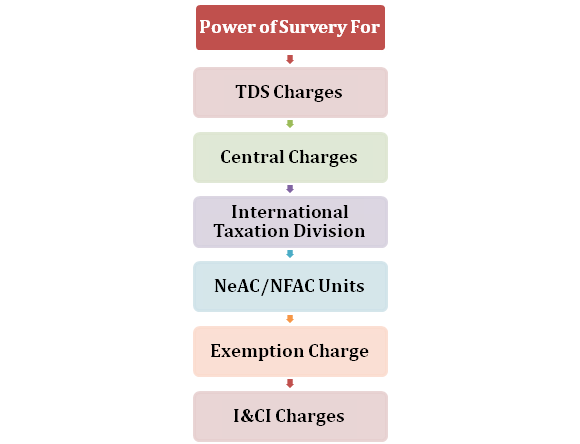

TDS Charges

Any verification or survey under section 133A of Act done by the TDS charge will be conducted by its own officers.

Central Charges

Any survey conducted under section 133A of Act done by Central charge headed by the CCIT will be conducted after the approval of a collegium consisting of CCIT concerned.

International Taxation Division

TDS surveys done by the International Taxation Division will be approved by collegium of Pr.CCIT (IT&TP)/CCIT (IT and TP) as one member of the collegium and CCIT (TDS) or the Pr.CCIT of the region

NeAC/NFAC Units

Any action under section 133A of Act did by the National e-Assessment Centre or the National Faceless Appeal Center through the PCIT (Verification Unit) is concerned.

Exemption Charge

Any survey action under section 133A of Act is conducted by Exemption Charge and the same will be approved by the collegium consisting of Pr.CCIT (Exemption) as one member and DGlT (Inv.) as the other member.

I&CI Charges

Any verification by I&CI charge for enforcement of various compliances of Section 285BA of Act and related rules will be done only through the electronic means by the officers of I&CI charge.

Highlights of the Notification

- The Board clarified the recovery surveys should be conducted as per an order u/s 119 of Act issued vide F.No.275/29/2020-IT (B) dated 16 Oct 2020.

- It has further directed that the collegiums must consist of 2 officers of the level of Pr.CCIT/CCIT/DOlT and has to operate only where more than one officer are available to take decision regarding the surveys.

- The PrCIT/CIT/PDIT/DIT of TDS charge or Investigation Wing has to monitor and ensure that survey does not go beyond the scope as approved by the collegium.

- The TDS charge or Investigation Wing officer will prepare the survey report and upload the same on ITBA as per the Survey[1] Module

- It is also clarified that all the surveys under section 133A of Act conducted by the Investigation Wing independently must be approved by the DGsIT (Inv.).

- In the event of any disagreement between the officers of the collegium, the issue would be resolved by the Pr.CCIT of the region.

Conclusion

It is reiterated that as per an amended section 133A of Act, the surveys can be conducted only by the officers of an Investigation Wing or TDS charge and any such action must be taken only as the last resort when all the other means of verification/obtaining details online/recovery are exhausted.

Read our article:CBDT notifies Guidelines for Faceless Assessment Scheme

Order_us_119_ITAct_1961_Misc_20_10_20