The central government has been announced the Faceless Assessment Scheme, 2019, as the Income Tax Department has embarked on the journey of Faceless Tax Administration. Further, the (CBDT) Central Board of Direct Taxes has also notified the National e-Assessment Center (hereinafter NeAC) at Delhi and various Regional e-Assessment Centers (hereinafter ReACs) across 20 cities in the country for implementation of the faceless assessment scheme. The detailed guidelines for the implementation of the scheme and role of residual charges in this regard are discussed in this article.

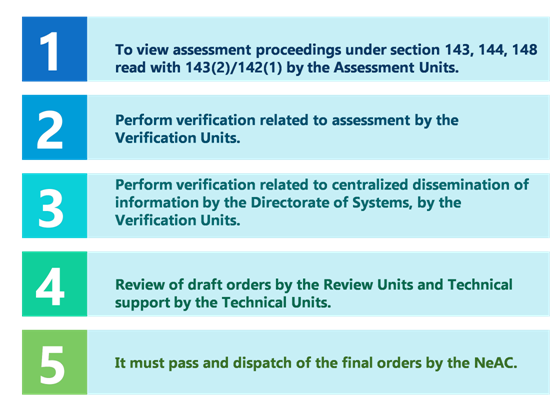

Functions of the Faceless Hierarchy

The NeAC/ReACs hierarchy will be broadly responsible for its functions and tasked with the management of Faceless Assessment proceedings. All these functions will be performed via electronic means for which the NeAC will be the gateway. In the ReACs, the officers and the staff will perform the functions related to the assessment and verification function under the Income Tax Act.

Still, all communications from the department to the taxpayer/assessee/third-party for the Act’s purposes will be in the name of the NeAC. The functions of the NeAC, ReACs are to manage the Assessment Unit (AU), Review Unit (RU), Verification Unit (VU), and Technical Unit (TU)]. It will be delineated in detail separately by the NeAC in consultation with the Board.

Functions described as under

Functions of field formations outside the hierarchy of NeAC/ReACs

- The Principal CCsIT will be the cadre controlling authority for all the officers and staff in the particular area of jurisdiction with respect to field formations that include ReACs, Central Charges, International Tax, Investigation Directorate, Transfer Pricing Charges, Exemption Charges, etc.

The field formations outside the hierarchy of NeAC/ReACs must perform the following functions in a faceless manner such as:-

- Taxpayer education and taxpayer outreach

- Taxpayer facilitation

- Rectification proceedings

- Grievance handling

- Demand Management

- Collection and Recovery of taxes such as Income Tax return filing

- Audit functions, which include handling matters regarding Revenue and Internal Audit and Tax Audit. Also, take remedial actions.

- Judicial functions include implementing the appellate orders of CsIT, ITAT, High Court, Supreme Court, Settlement commission, preparing scrutiny reports, and filing an appeal. Also, a recommendation of SLPs, defending writ petitions, etc.

- Exercise statutory powers under section 263/264 of the Income Tax Act, 1961[1].

- Prosecuting and compounding proceedings and also other related court matters.

- Managing Administrative, HRD, and cadre control matters, including related court matters.

- Management of Case records and custody.

- Management and control of infrastructure.

- In case the communication is required to be made under the income tax proceedings with the taxpayer/assessee/third-party, the same must be made via electronic means using the ITBA/ Department Portal.

- The Investigation Directorates will exercise the power of the survey under section 133A of the Act, and the TDS charges only. In case of surveys of the International Taxation charge, the same will be conducted in collaboration with the Investigation Directorates.

- For the implementation of the scheme, for the faceless assessment charges, the Board has diverted the existing manpower at all levels of the department. The hierarchy in the faceless assessment scheme will work with 30 CCsIT, 154 PCslT, 565 Additional Joint CsIT, 645 DCsIT/ACsIT, 2830 ITOs, and the attendant staff. The Board has diverted these posts as a result of which the residual jurisdiction will now rest with 32 CCsIT, 96 PCsIT, 252 Additional Joint CsIT, 261 DCsIT/ACsIT, 1274 ITOs, and the attendant staff.

Read our article:Submitting of Audit Report with Income Tax Return is not Compulsory – ITAT

The Approach adopted for the Restructuring

The overall manpower for the NeAC / ReACs must consists of 30 CCsIT, 154 PCsIT, 565 Additional Joint., 645 DCs/ ACsIT and 2830 ITOs. The order for setting up of the office of NeAC and ReACs has been issued. The norms that have been adopted for the creation of hierarchy in each ReAC are as follows:

- Each ReAC (AU) must have 1 PCIT, 4 Additional/Joint CsIT, 4 DCs/ ACsIT and 20 ITOs

- Each ReAC (VU) must have 1 PCIT, 4 Additional/Joint CsIT, 4 DCs/ACsIT and 20 ITOs

- Each ReAC (RU) must have 1 PCIT, 3 Additional/Joint CsIT., 6 DCs/ ACsIT and 9 ITOs

- Each ReAC (TU) must have 1 PCIT, 3 Additional/Joint CsIT, 6 DCs/ACsIT and 9 ITOs

Notification for the Diversion of Posts

The notification for the diversion of existing posts of CCIT, PCIT, and CIT to NeAC/ReACs has been issued. It is important that the Principal CCsIT now issue orders for diversion of posts of Additional CIT/Joint CIT, DCIT/ACIT, ITO up to all levels of staff to the newly created NeAC/ReACs in their jurisdiction. The following guidelines have been adopted in the identification of the posts for diversion:

- In every building, at least one office is retained in the residual hierarchy to ensure continued ownership and responsibility of case records.

- The jurisdiction of AOs posts selected for the diversion to NeAC/ReACs hierarchy is proposed to be given to another AO in the same building to avoid any transfer of case records between buildings.

- In the residual hierarchy, each Range will have at least one DC/ACIT. The actual number of ITOs have been increased or decreased depending on the number of ITOs and buildings in jurisdictions that have been merged.

- While merging the jurisdictions, there might be shortages or excesses depending upon the charge and manpower management as per the enclosed list.

- In the case of excesses or shortages in the rank of Additional CIT/JCIT/DCIT/ACIT, the same can be added to or drawn from the Special Ranges and headquarters.

- In case of excesses or shortages in the rank of ITO, the same can be added to or drawn from TRO.

- Renumbering of the residual charges in serial order will be done later once the new jurisdiction settles down and facilitates easy retrieval of records in the interim period.

- In the case of three LTUs which have been diverted from Delhi, Mumbai, and Chennai, the cases will be transferred vide order under section 127 by the Principal CCIT.

Detailed lists of Posts Identified for Diversion

The detailed lists of posts identified for diversion are enclosed along with a list of residual charges that will be merged. The orders for the transfer of jurisdiction and diversion of posts at the level of Additional CIT/Joint CIT, DCIT/ACIT, ITO to NeAC/ReACs units must be issued expeditiously.

It must be also be ensured that the attached PDF list for diversion of posts of Additional CIT/JCIT/DCIT/ACIT/ITO must strictly be followed, and the summary sheet must enclose with the list for detailing purpose while passing the diversion order. It also has to be submitted that while diverting and mentioning that a particular Additional CIT/ JCIT /DCIT/ACIT/AO is converted to a particular Assessment Unit (AU), Verification Unit (VU), Review Unit (RU), and Technical Unit (TU).

Guidelines for Administrative Efficiency and Optimization

While finalizing the diversion of posts to ReACs, the following guidelines may be followed to achieve administrative efficiency and optimization of resources:-

- The technical and review units can be kept together (to the extent possible) in bigger buildings.

- The verification units must be spread out to cover large geographical areas.

- All the orders must be passed with effect from 13 August 2020.

- The following orders can be passed by the field charges latest by 19th August 2020 in order to give effect to the changes:-

- Diversion of posts from the Additional/Joint CsIT to the level of ITOs by the Principal CCIT.

- Order under section 120 to be passed by PCIT (Residual) giving jurisdiction to Range Heads (Template of an order under section 120 and the list of residual offices of Ranges is enclosed; rest are to be merged with the residual ranges)

- Order under section 120 to be passed by Range Head (Residual) g1vmg jurisdiction to AOs. (Template of an order under section 120 and the list of residual AO charges is enclosed; rest are to be merged with the residual AOs).

- Posting orders of officers.

Conclusion

Board has issued the notifications and orders for a faceless assessment scheme. These are also available on either the irsofficersonline or incometaxIndia websites of the department. The guidelines requested All Principal CCsIT to communicate to the board any discrepancy or omission in respect of any order/notification of ReAC/ residual hierarchy/ jurisdiction etc. latest by 17 Aug 2020, so that any corrigendum/amendment to the notification/order can be passed without any further delay.

Read our article:CBDT Rolled Out New Conditions for Pension Funds for Income Tax Exemption