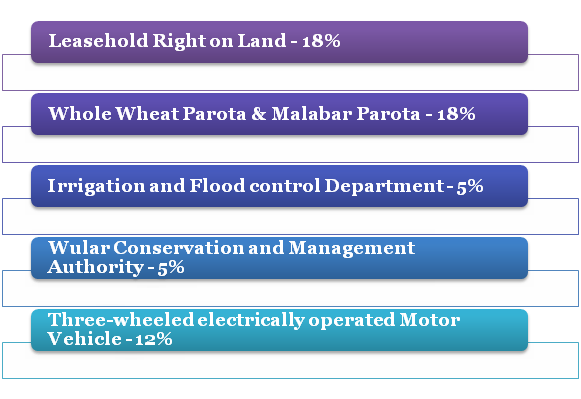

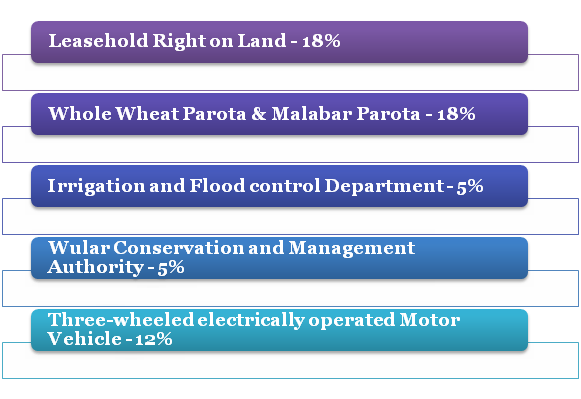

The following are the latest notifications of WB Authority of Advance Ruling for the applicability of GST rate in Various Sectors. Those are explained below-

Leasehold Right on Land

The WB Authority of Advance Ruling directed that assignment of leasehold right on land is taxable at the rate of 18% under Goods and service tax. The NCLT passed an order u/s 33 of the Insolvency & Bankruptcy Code, 2016[1] to start liquidating appointed Sri Dutta as the Liquidator and the corporate debtor. One of the assets that follow the liquidation is the leasehold industry unit along with car parking space.

Facts of the case

The WB Industrial Development Corporation Ltd arranged the applicant possession of the Demised Premises for 99 years as per a registered deed of sub-lease on the payment of an up-front premium of INR 5.07 crore and monthly lease rental of INR 21,000. The Liquidator sought advance ruling on the matter of whether GST is payable on the consideration receivable on such assignment. If so, what should be the applicable rate? The other issue raised was whether he could claim the input tax credit for the GST paid on the transfer fee.

Ruling by the AAR

The AAR further ruled that it does not create new benefit from the land. It is like reparation for agreeing to transfer the rights of applicant to the assignee. It is a service classified under ‘Other miscellaneous service’ and taxable at the rate of 18% under Sl number 35 of the Notification number 11/2017 – CT (Rate).

It is ruled that the activity of assignment is like agreeing to transfer the leasehold rights. It does not mean further sub-leasing, as the Applicant’s rights as per the Deed of sub-lease stands extinguished after assignment.

The authority further held that the Sub-lessor’s transfer fee is the amount payable to the Sublessor for offering a service in the course or furtherance of business, in terms of section 2 (17) (d) of the GST Act. Therefore, the GST to be paid on such a transfer fee is admissible as an input tax credit.

Read our article:Latest : CBIC has notified Provision for Aadhaar Authentication in GST Registration

Irrigation and Flood control Department

The WB Authority of Advance Ruling has ruled that a 5% tax applicable to the Irrigation and Flood control Department, Govt of Jammu & Kashmir. The Irrigation and Flood control Department has granted the Applicant, Reach Dredging Ltd. a contract to construct the channels across Hokersar Wetland along the old alignment of flood spill channel, including the dredging of drainage flowing into Hokersar Wetland and side slope protection. The Applicant submits work allotment order and relevant documents. He provides a price schedule that defines the work and its value and contends that he is furnishing works contract service of earthwork in excavation and re-excavating the drainage channels. It consists more than 75% of the value of the contract.

Issues of the case

The Applicant seeks a decision on whether Sl No. 3 (vii) of Integrated Tax (Rate) has been amended from time to time, applies to the above supply. The Authority of Advance Ruling opined that Entry No. 3 (vii) of the IGST Notification states that a supply is taxable at the rate of 5% if the contract is a composite supply of works contract as defined u/s 2(119) of the GST Act, involving earthwork which exceeds 75% of the contract value.

Ruling of the AAR

The two-member bench ruled that the Applicant’s supply to the Irrigation and Flood control Department is taxable under Entry No. 3(vii) of Notification No 8/2017 – Integrated Tax (Rate) as amended from time to time.

Wular Conservation and Management Authority

The WB Authority of Advance Ruling (AAR) ruled that 5% tax applicable on supply to Wular Conservation and Management Authority. The Wular Conservation and Management Authority conferred the Applicant a contract for the dredging of Wular lake and its feeder channels and strengthened embankments of the lake. The Applicant asks a ruling on whether Sl No. 3(vii) of Notification No 08/2017 Integrated Tax (Rate) dated June 28, 2017, as revised from time to time, pertains to the supply above.

Entry No. 3 (vii) of the Notification states that supply is payable at the rate of 5% if the contract is a composite supply of works contract as specified u/s 2(119) of the GST Act, including earthwork surpassing 75% of the contract value and the recipient is the Central Government, State Government, Union Territory, government authority or a government entity.

Issues of the Case

The AAR opined that Notification No. 311 dated September 25, 2012, of the Forest Department of State Government that the recipient is constituted as an authority u/s 3(1) of the J & K Development Act, 1970 for preservation and conservation of Wular Lake. The Board of the recipient, constituted the same day by Notification No. 314, ensures 100% control of the Union Territory.

It broadly adheres to the function of developing urban forestry, conservation of ecology and evironment delegated to the municipality under article 243W of the Constitution. Hence, the recipient is a Governmental Authority within the ambit of para 5(ix) of the IGST Notification.

Ruling of AAR

The two-member bench ruled that the Applicant’s supply, to the Wular Conservation and Management Authority, is taxable under Sl No. 3(vii) of Notification No 8/2017.

Three-wheeled electrically Operated Motor Vehicle

The WB Authority of Advance Ruling (AAR) ruled that 12% GST applicable on three-wheeled electrically advanced motor vehicles. The Applicant submitted that the goods it manufactures are supplied with the battery pack and, therefore, should be classified under HSN 8703, is an electrically operated three-wheeled motor vehicle.

Facts of the case

The Applicant asked the authority of advance ruling on the concern of whether such a three-wheeled vehicle must be classified as an “electrically operated motor vehicle” under HSN 8703 when supplied with a battery pack.

Issue of the case

The two-member bench noted that the motor vehicles for carrying less than ten passengers are categorized under the Heading 8703 of the First Schedule of the Customs Tariff Act, 1975, which is affirmed in the GST Act for classification.

The authority further remarked that Sub-heading 8703 10 covers the vehicles specially designed for travelling on snow, golf cars, and similar vehicles. The term ‘similar’ narrows the extent to specific use other than carrying passengers on hire on regular roads.

“A three-wheeled motor vehicle without a battery pack does not have the requisite character of an ‘electrically running vehicle.’ However, it is neither a vehicle outfitted with an internal combustion engine. Except it is equipped with any device like solar panels that supply energy from locomotion, the vehicle is not classifiable as a vehicle under Sub-heading 8703 of the Tariff Act.

Ruling of AAR

The authority ordered that a three-wheeled motor vehicle is classifiable under HSN 8703 as an electrically advanced vehicle, provided it is fitted with the battery.

Decision by the Karnataka Appellate Authority of Adavance Ruling on Whole Wheat Parota & Malabar Parota

The Karnataka Appellate Authority of Advance Ruling (AAAR) when setting aside the order of Authority of Advance Ruling (AAR) ruled that 18% GST is applicable on Whole Wheat Parota and Malabar Parota is void ab initio.

Facts of the case

The Applicant is a food products company in the preparation and supply of a wide range of ready to cook, fresh foods including idli & dosa batter, Parotas, Chapatis, curd, paneer, whole wheat paratha, and Malabar Parota. The Appellant manufactures Parotas applying natural ingredients. The Parotas need to be cooked on a pan or Tawa, before consumption, for improved taste and crispiness.

The Malabar Parotas can be kept in a cool and dry place and have a shelf life of up to 4 days. The wheat parottas are recommended to be refrigerated for retaining the freshness up to 7 days.

Issue of the case

The Appellant proposed the AAR seeking a ruling on the issue of whether the preparation of Whole Wheat paratha and Malabar parotta be incorporated under Chapter heading 1905, attracting GST at the rate of 5%. The AAR vide its order ruled that the product parota is listed under Chapter Heading 2106 and is not covered entry No. 994 of Schedule I to the Notification No.1/2017-Central Tax (Rate), as amended vide Notification No.34/2017-Central Tax (Rate). Hence,18% of Goods and Service Tax is applicable.

Ruling of AAR

The appellate authority ruled that the ruling given by AAR wherein 18% GST applicable on Whole Wheat Parota and Malabar Parota is void ab initio because it was vitiated by the process of suppression of material facts.

Conclusion

The WB Authority of Advance Ruling ruled that 12% GST applicable on three-wheeled electrically advanced motor vehicles. The WB Authority of Advance Ruling also ruled that 5% tax applicable on supply to Wular Conservation and Management Authority. The WB Authority of Advance Ruling ruled that a 5% tax applicable to the Irrigation and Flood control Department, Govt of Jammu & Kashmir. The WB Authority of Advance Ruling (AAR) ruled that 5% tax applicable on supply to Wular Conservation and Management Authority. The WB Authority of Advance Ruling ruled that 12% GST applicable on three-wheeled electrically advanced motor vehicles.

Read our article:List of Goods and Services where GST is Applicable: Latest Rates