Under GST rule, the obligation to pay tax occurs at the time of supply and the Place of Supply. In addition, the type of tax to be imposed is determined by the essence of supply under GST.

That is, if the supply is an intra-state supply, CGST along with SGST is imposed. Whereas, if the supply of goods & services is an inter-state supply, then the IGST is levied. The identification of the location of supply of goods and services is very relevant in Goods and services tax.

Location for Supply of Goods & Services

In the case of such listed services, Section 12 of the IGST Act 2017 lays down the principles for deciding the location of the supply of services.For services other than those mentioned, the place of delivery of the service will be the same as the place of delivery of the service rendered where;

- The service is given to a registered individual; the location of supply shall be that person.

- The service is provided to any person other than registered person, the location of supply should be that of-

- Place of the recipient where the address on record subsists

- Place of the supplier of services in other circumstances.

Section 12 of the IGST Act, 2017 states down the principles for classifying the location of supply of services in case of some specified services.With respect of services other than the specified services the situationof supply of service would be as under:-

- When the service is provided to registered person situation of supply should be location of such person

- When the service is provided to a person other than registered person location of the service should be

- Place of the recipient where the address on record exists ;

- Place of the supplier of services in other cases.

Read our article:GSTR-1 – Everything you need to know about Filings and Voluntary Compliance

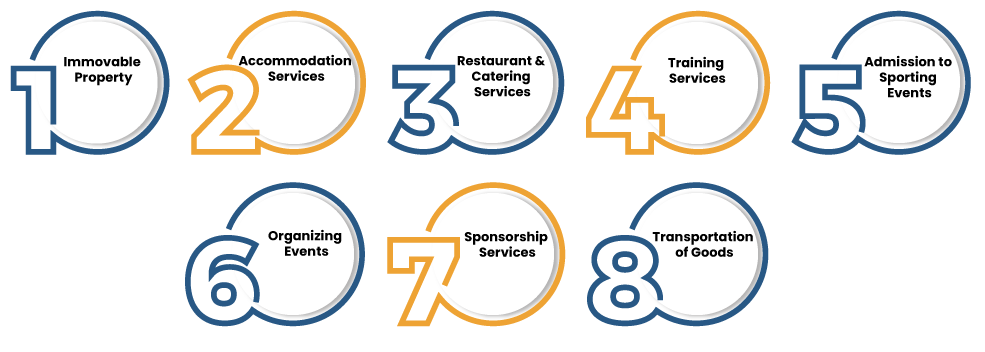

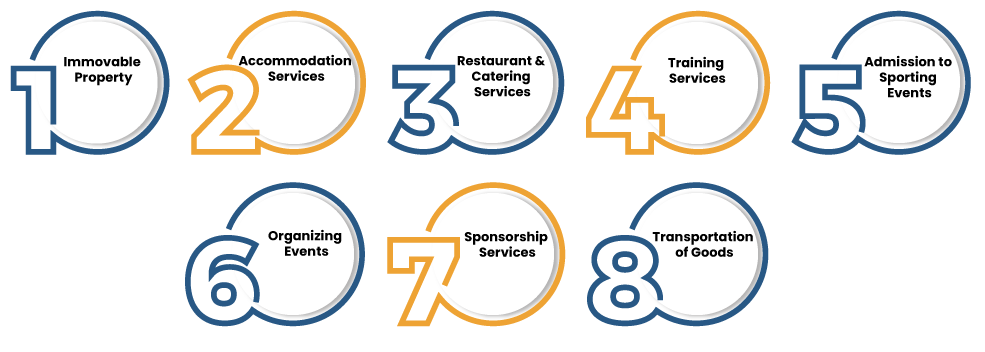

Place of Supply for Specific Services

Section 12 as well as Section 13 of IGST Act explains about the place for supply for several specific services. They are as follows-

In Relation to an Immovable Property

Section 12(3)(a) of the IGST Act, 2017 provides that any service that is rendered directly in relation to immovable property. It can also include services provided by architects, interior decorators, surveyors, engineers and other relevant experts or estate agents. Any service that is provided by the way of granting rights to use immovable property or for the execution or organization of construction should be located at the white site. Where the location of the immovable property or boat or vessel is located or planned to be located outside India, the location of the receiver shall be the place of provision.

Accommodation Services

The location of the hotel, guesthouse, homestay, club or campsite, or houseboat, as referred to in Section 12(3) (b) of the IGST Act, 2017, shall be the place of provision of service in respect of such accommodation service.

In the event of the provision of accommodation facilities for several locations that is located in various states at the time of provision of services. The value of the provision of service should be treated in proportion to the value of the services separately collected or calculated in the terms of the contract or agreement entered into in each of the States.In the absence of such a contract or arrangement, the place of delivery shall be decided on the basis of some other fair basis as may be provided for.

Restaurant and Catering Services

The location where the restaurant and catering facilities are supplied is the place where the services are actually conducted. Section 12(4) of the IGST Act, 2017 specifies that the place where the services are actually performed in terms of restaurant and catering services, personal hygiene, exercise, beauty care, health services consisting of cosmetic and plastic surgery should be the place for the provision of service.

Training Services

Section 12(5) of the IGST Act, 2017 specifies that when a training service is given to a registered person, the place of provision of training services shall be the location of that registered person. Where a service is given to a person other than a registered person, the place of supply shall be the place of actual performance of the service.

Admission to Sporting Events

Section 12(6) of the IGST Act, 2017 offers that the place where the event is essentially held or where the park or any other place that is situated should be the place of provision of services given by way of admission to cultural, artistic, sports, science, educational or entertainment activities or amusement parks or any other place and services ancillary to them. Section 12(7) of the IGST Act, 2017 specifies that if an event is held outside India, the location of the receiver shall be the place of delivery.

Organizing Events

Section 12(7) of the IGST Act, 2017 specifies that, when given to a registered individual, facilities relating to the organization of events shall be the location of such a person. If the service is given to an unregistered individual, the place of provision shall be the place where the event actually takes place.

If the events take place in more than one State and the consolidated sum is paid for the supply[1] of services relating to the case, the place of supply of services shall be taken as proportionate to the value of the services supplied in each State, as calculated by the terms of the contract or arrangement concluded in that regard, in each State.

Sponsorship Services

Conveying of sponsorship to any of the cultural, artistic, sporting, scientific, and educational as well as entertainment event should be the location of the registered person (also known as recipient). If the event is prepared for an unregistered person, then the transfer of sponsorship should be the location where the event is essentially held and if the event is held outside India, the place of supply should be the location of the recipient or the registered person.

Transportation of Goods

As per Section 12(8) of the IGST Act, 2017, the location of the registered person is the means of transporting the goods supplied to the registered person. Such services shall, if given to a person other than a registered person, have a place of supply and a place of delivery for the transport of such goods.

Conclusion

Section 12 along with Section 13 of IGST Act talks about the place of supply for several specific services. Section 13 (2) of the IGST Act, 2017 states the principles for identifying the place for supply of services except in case of certain specified services. When the location of the supplier or the location of the recipient is outside India, with respect to services other than the specified services the location for supply of service should be the placeof recipient of service. When the location of recipient of service is not known, the location for supply should be the location of supplier of service.

Read our article:16 Types of GST Return your Business should be Aware of!