Fundraising is certainly one of the most challenging phases in a start-up’s business journey. Even the most aspiring business entrant has to clear countless obstacles before availing of required funding. In a nutshell, almost all start-ups have issues in procuring funds from available financial sources. So does that mean that start-ups are unable to counter initial fiscal crunches? Well, the answer is No! Patenting can be a good strategy for attracting a handful of investors, including the mainstream ones. But, unlike, trademark and copyright, obtaining patent is somewhat difficult both in terms of filing and compliances. This write-up explains why tech-based starts-up should harness optimal IP strategies to get the required funding.

Why patenting is an enticing proposition for start-ups and investors?

A patentable asset has the ability to churn out consistent and prolong royalty for the organization. And apart from underpinning a stable revenue stream, the patent is also capable of ensuring tremendous organizational growth. Moreover, the patent registration also attracts valuable investors because of its ability to make a significant difference from a marketing standpoint. Start-ups seeking initial investment can ask their key members to draw an effective IP strategy to procure required funding.

Sadly, Patent is hard to come by owing to its tedious and costly filing process. Most start-ups grapple to cope up with prerequisites for obtaining the new patent. This brings us to another viable and convenient alternative called “Provisional Patenting”.

Why Starts-ups should prefer Provisional Patenting to obtain required funding?

Historically, the patent is perceived as a way to outrank the counterparts offering direct rivalry. Because patent lawsuits are inherently more costly, litigation would not be a practical option for those having a poor fiscal backup.

Provisional patenting is cheap and provides much-needed protection to the invention (for 1 year to be specific). A well-crafted provisional patent application is more likely to offer better value for the start-ups.

Investors might be less reluctant to affordable patenting options like provisional patent applications. Given this, the investor may prefer a provisional patent application because of its ability to postpone the final patenting decision for a year. This timeframe will be sufficient for an investor to determine the success rate of the non-provisional utility patent.

Thus; start-ups must pay extra attention in determining what to safeguard from a market viewpoint. It is because everything is not patentable.

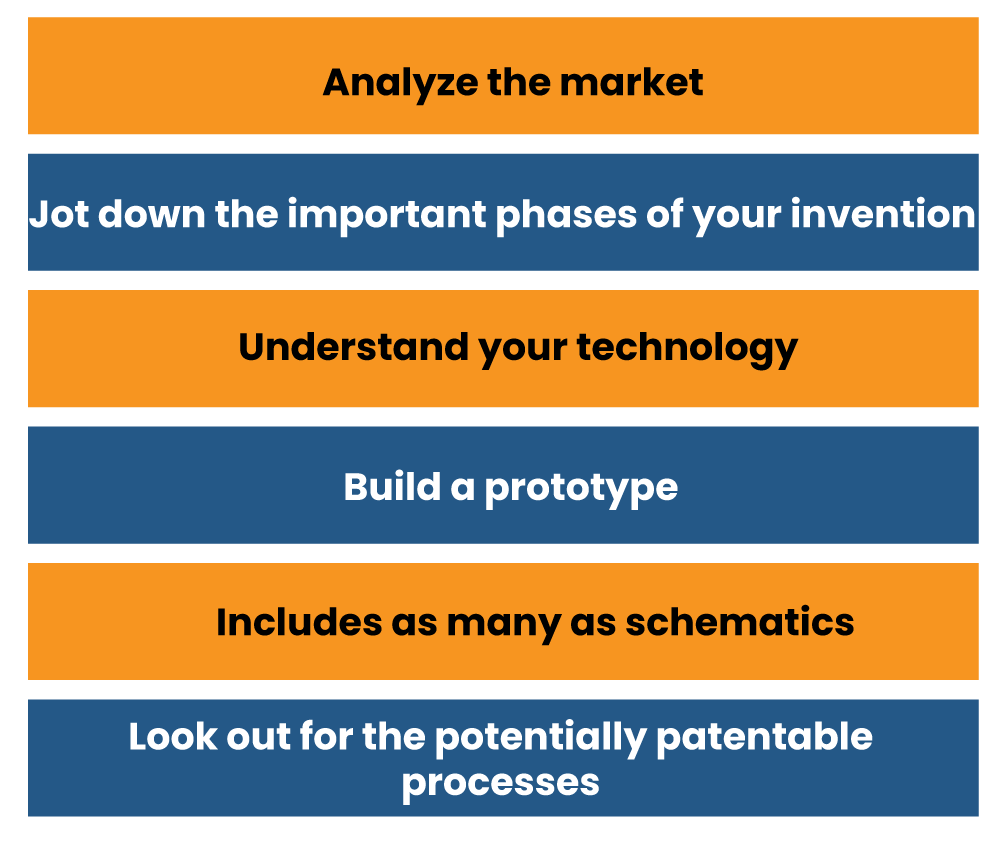

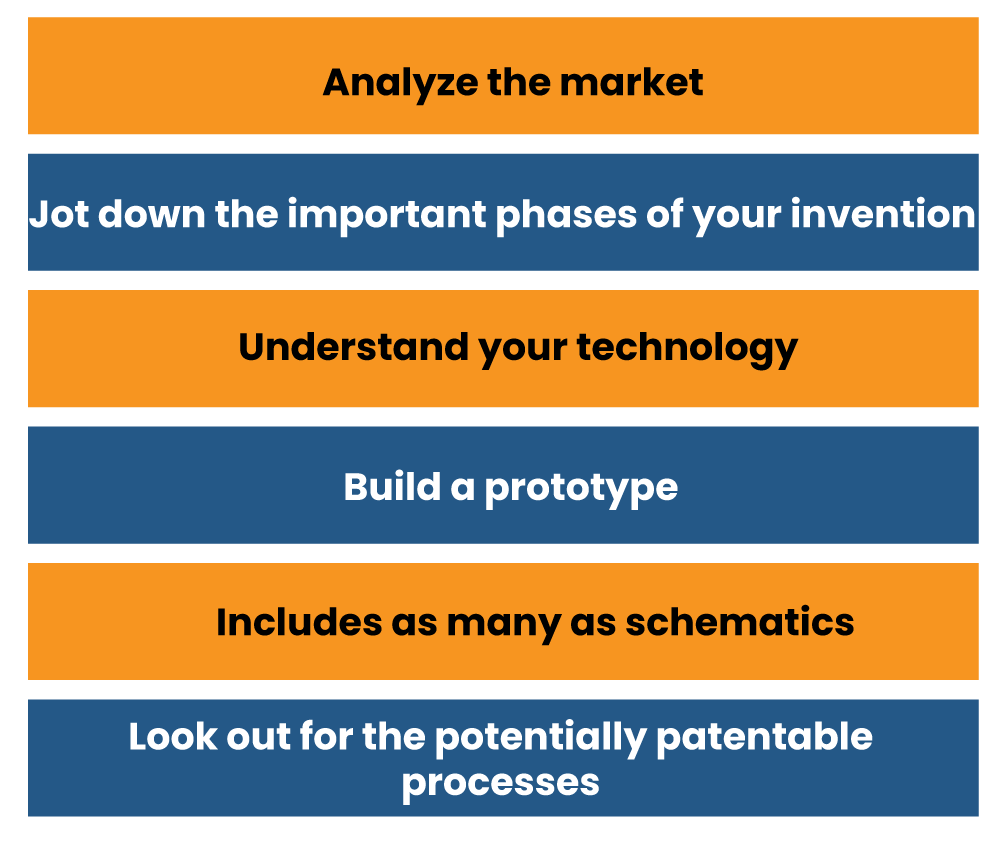

Pro tips for creating a well-crafted provisional patent application

Here are some pro tips for writing effective provisional patent applications which further help you avail of required funding.

Analyze the market

Delve deeper into your market niche to identify the degree of competition.

Jot down the important phases of your invention

From design scheme to functional aspects, here you need to brief out everything about your invention. It’s really important for you to know every minuscule of details of your invention before you rushed out to file the said application. Covering every aspect that plays a vital role in the creation of the invention will eventually ease out the discrepancies in the validation phase.

Understand your technology

This can be of huge importance, particularly if you are involved with something that is entirely unique and ground-breaking. Since this info is practical, it renders your IP value and credibility. The insights you avail could let you safeguard the minute’s details.

Build a prototype

Find out what works and what does not. You may discover attributes of your technology that are useless for the overall vision, but could be patentable and act as a source of revenue. Make sure to list down every component.

Includes as many as schematics supporting your invention

Schematics embrace clarity, even when it comes to complicated invention. Make sure to add them in a sensible order to ensure better lucidity for inspection purposes.

Look out for the potentially patentable processes

Are you leveraging some processes or methods that are unique and time-saver? – Probably they could be patented. But to ensure that they are patentable or not, you would require obtaining professional help. Consider connecting with CorpBiz’s professional in case you have some skepticism in this regard.

Now let’s talk about the IP protection[1] strategy which also plays a vital role in the start-up’s fundraising campaign

Patent strictly favours the inventive attribute and that is why it is hard to come by. Knowing its applicability could give you a clear picture of what is patentable and what is not. However, it could be only possible if you have a sound IP protection strategy in place. The section below can let you outline an optimal IP protection strategy for your start-up.

Viable steps to outline a tailored IP protection strategy

The section below will let you outline an optimal IP protection strategy which is also beneficial from fundraising standpoint.

Assess your industry as well as vertical

Go through the prevailing patent stats in your niches. The applicability of the patent is limited as it is not available to all industry verticals. For example, Biotech firms are the primary contender for patent protection because every new drug they developed seeks to patent to ensure competitive advantage. Increase the scope of your assessment and get deeper into your vertical to get a better picture.

Examine your competition

Do your rivals have a wide portfolio of patents? Then you should consider filing some applications. By determining what type of IP strategies are being utilized by your rival, you will be able to find a viable path to get started with your IP processes. Harnessing a good portfolio of patents is not only good for your growth but is also profitable when it comes to attracting investors to procure required funding. It’s good to have as much as a patent at your disposal to maintain the competitive edge.

Try identifying the prevailing trends of potential investors

Delve deeper into the investment portfolio of some of your chosen investors. If possible, identify their preference criteria. If you see that most of them are favouring firms with ample patent protection, then you must act accordingly, i.e. to assess your patentability options.

Search for Patents

Lastly, search for patents mentioned in your application via patent databases. The idea is to check the legality of your invention and see if it adheres to the underlying conditions mentioned by the respective bylaws.

Conclusion

After following the aforementioned steps, you will surely get a clear picture regarding the feasibility of your patent both in terms of competition and legality. Getting a patent isn’t going to be an easy journey considering the complications involved in the process. However, if you opt to stay committed to your company’s objective and avail precise expertise then there will be no stopping for you. And once you get the patent, your journey of procuring required funding would become more seamless.

Read our article:Learn about the Landmark judgements on Patent in India