IEC adheres to utmost importance for the exporting companies because they won’t be able to ship their products to overseas countries without it. In general, the Import Export Code is supposed to be added to the shipping documents like a packing list, certificate of origin, and bill of lading. In short, it is the doorway to foreign trading and also mandatory on the other hand. On the surface, the registration process for IEC certification seems identical for all business types, but it differs to a considerable extent in reality. In this blog, we would look into the documentation aspect of IEC certification for a partnership firm.

What is the Import Export Code?

Import Export Code is nothing but a 10 digit numeric code that an individual or entity requires availing to commence the international trading of goods and services. Below we have curated a list that exhibits the basic features of import-export code.

- IEC is mandatory for every exporter & importer in India.

- IEC certificate continues to serve the member for a lifetime because it is non-renewal in nature.

- Any proprietor can avail of import Export code with having a registered business in place.

- Export Promotion Council along with DGFT and Custom, renders value-added benefit to the IEC holders.

- No return filing is applicable on the IEC holder or the import/export transactions.

Why must you opt for Import Export Code?

A Partnership firm involved with the EXIM business must register under the import-export business owing to the given reasons:-

- IEC empowers a company to step into the international market and reap additional revenue.

- Business entities having import-export code can take advantage of growth-centric subsidies provided by the DGFT, Custom & Export Promotion Council.

- Registration process Import Export Code is not tedious or time-consuming, unlike other licenses. Moreover, it steak around unlimited validity, which allows the business owner to save a significant amount of spending on code renewal.

- An IEC certification for a Partnership firm provides statuary security, enabling to commence foreign trading activities with the negligible hassle.

- As compared to the other government licenses and registrations, IEC lures no post-compliance requirement in case of registration.

Read our article:A Complete Guide on Documents Required For IEC Registration

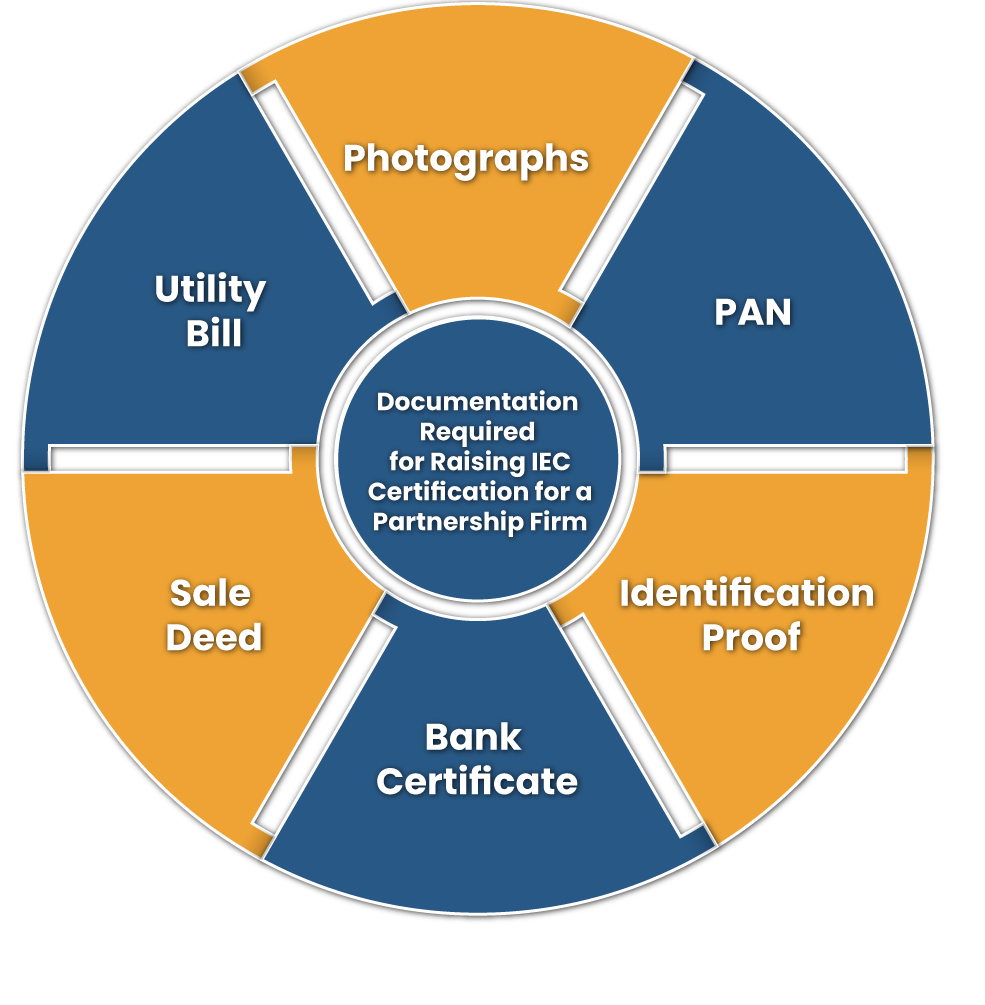

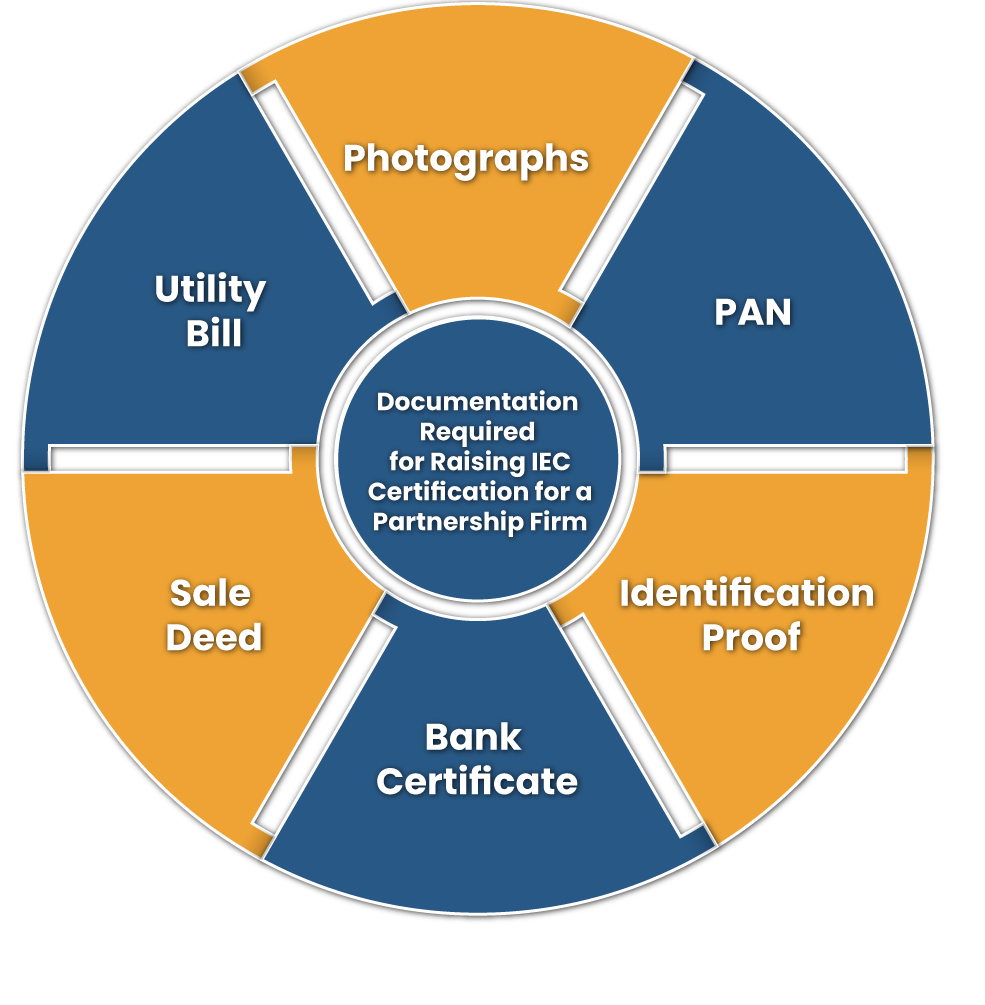

Documentation Required for Raising IEC Certification for a Partnership Firm

Correct documentation is the key to a successful registration process. If the applicant holds ownership of the partnership firms, he would be required to arrange the following documents.

- A passport size photographs of the partner

- Permanent Account Number, i.e., PAN of a Partnership Firm

- Identification Proof such as a DL, Passport, PAN, Voter ID, Aadhaar Card of the partner who posts the application’s signature

- Bank certificate enclosing the name of the firm and bank account number

- Sale deed or lease agreement if the firm is operating on rented/leased premises.

- The firm must also add the latest utility bill with the form of registration

Situation under which a Partnership Firm seeks an Import-Export Code

Directorate General of Foreign Trade has mandated the adoption of IEC number for EXIM firm established as a partnership firm in cases like:

- If the firm keen to commence an EXIM business, then IEC registration is compulsory.

- During the inspection of shipment by custom authorities, a company requires Import Export Code.

- During the clearance of shipments from Custom Authorities, a Firm requires IEC Code Number.

- A bank demands an IEC Number in case an importer makes the payment abroad from his bank.

- When an exporter gets the payment for his shipment in foreign currency, an IEC Number is demanded by the exporter’s bank.

Cases where Import Export Code would not be required

As per the latest notification published by the DGFT, Import Export Code is not mandatory for the cases listed below:

- Import Export Code isn’t compulsory for those entrepreneurs who are registered under Goods and Service Tax. In such cases, the traders’ Permanent Account Number shall be treated as the new import-export code export and import activities.

- Any department of the Government of India[1] or ministries can be engaged with export business in the absence of IEC registration.

Attributes to Consider Prior to Making an Application for Import Export Code

There are instances when an applicant makes some minor mistakes during the registration process for obtaining an import-export code. Therefore, keep the attributes listed below in mind to overcome such situations.

- Do not apply for several Import Export Codes against the same permanent Account Number (PAN).

- Always render legit information in the application form. Remember, inaccurate detail in the application attracts severe penalties.

- The new platform introduction by DGFT for IEC registration enables the applicant to apply offline mode.

- After applying for IEC registration, the portal generates the reference number (aka ECOM number) against the same.

- Update your profile on the DGFT’s portal once the allocation of the Import Export Code.

A Step By Step Procedure to Avail IEC Certification for a Partnership Firm

Follow the given instruction carefully to obtain the IEC registration for the Partnership firm in one goes.

- Go to the online portal of DGFT and click the “Apply for IEC” button on the home page.

- Next, fill in your personal details in the e-form that appears on your screen.

- Click Send OTP once you are done with the aforesaid requirement.

- The portal will then send you the one time password on your email and phone number.

- Go back to the portal’s home page and reselect the option called “Apply IEC” and try to login with available credentials.

- After a successful login attempt, an eform will appears on your screen related to the IEC registration.

- In the form, first select the suitable ownership option from the given options: Director / Partner / Karta / Proprietor / Managing Trustee of the Entity.

- Then, enter the bank related details mentioned in the eform.

- Upload canceled cheque copy as requested by the form and then click Next

- Next, enter the detail of the sector you are engaged with when filing the application.

- Select the Acceptance of Undertaking/Declaration and then click “Save and Next” followed by the Sign button.

- Submit the fees on the payment gateway to wrap up the registration process.

Conclusion

Import Export Code is mandatory for every business type dealing in international trade. Indulging in the activities of export and import with an IEC registration is unlawful from the legal perspective. So, to avert legal complication, we suggest you connect with CorpBiz, a one-stop destination for the help seekers seeking professional assistance to avail of government registration and licenses including IEC certification for a partnership firm.

Read our article:What is the IEC Registration Process in India?