In this highly competitive environment, everyone wants to grow their business beyond the domestic market. Before going global, there is a need to follow several processes and laws to get different registrations as well as licenses. Online IEC Registration Process is one such license required to import or export your products from India.

What is Import Export Code?

Import Export Code (IEC) is required by any person who is looking to start their import or export business in India. Director-General of Foreign Trade (DGFT) issues the ICE certificate which is of a 10 digit code that has lifetime validity. Exporters as well as importers cannot avail of any benefit without ten-digit IEC.

IEC is required for the Following Situation

- The custom authorities require IEC when an importer needs to clear his shipments.

- The bank requires IEC when the importer needs to send the money.

- The custom port when exports need to send their package.

- When exporter receives money from a foreign country directly into their bank account, the bank requires the IEC.

What are the Features of IEC Registration Process?

The essentials of the Import-Export Code are the following:

Expand business

Business is extended and developed by going global for selling products and services outside India using the Import-Export business that will overall create the growth of thecompany.

Government’s Schemes Benefit

The Government of India supports the entrepreneur for exporting the products out of India. Thus, having IEC code can enable exporters easily claim advantage from customs, DGFT export promotion schemes, export promotion council, etc.

Subsidies

Based on the IEC Code business engaged in import and export activities, it takes advantage of fare supports provided by the Government.

Return filing

There is no requirement for following certification of any return. No compliance is required to be developed for keeping the IEC License valid and therefore, it is just a one-time expense with no additional filling.

Can you start the Import-Export business without Obtaining an IEC License?

Any individual or company or sole proprietor engaged in the business of import-export need to obtain an Import-Export Code license. It is an essential recognition provided by the Government to the exporters as well as importer of goods and services. Though, if the value of the product transacted is low, the authority can permit first export after imposing nominal charges.

What is the Validity for IEC Registration Process?

The ten-digit IEC code has the validity of a lifetime. Therefore, there is no hassle of updating, renewing, or filing for IEC Registration. The validity is till the business exists, or the registration is revoked or surrendered. There is no compliance requirement like annual filing in the case of IEC registration.

What are the Eligibility Criteria to obtain IEC Registration Process?

Business registration dealing with export or Import of goods should register for IEC, irrespective of the size of the business. IEC Registration Process is not required for Import or export of personal use products because they are not connected with trade, manufacture, or agriculture. Setting up a business is not required to apply for IEC.

Who are exempted from IEC Registration Process?

The following category of people cannot take IEC registration-

- Import and export of goods for personal use

- Import and export by the central Government for defense purposes or other lists specified under Foreign Trade Order, 1993.

What are the Documents Mandatory for IEC Registration Process?

Following documents are needed for IEC registration in India-

- Scanned copy of proof of registration for the particular entity. This supporting document is obligatory for Registered Society, Partnership, HUF & Trusts;

- Scanned copy of passport size photograph;

- PAN details of the particular company or individuals;

- ID proof of individuals –

- Aadhar Card

- Passport

- Voter ID

- Mobile Number

- Email-ID

- You should have a Current or Savings bank account in any bank which helps in transactions in Foreign Exchange;

- You should have scanned copy of rent or lease agreement, sale deed, electricity bill for verification of address;

- You are required to submit the scanned copy of RBI approval letter if the applicant is an Non-Resident Indian (NRI);

- You must have ‘Bankers Certificate’ in the approved format or a scanned copy of ‘Cancelled Cheque’ with company’s or Individual’s name printed on the cheque;

- You should have a ‘Debit or Credit card or Net Banking account’ for Online payment of Government Fees of INR 500/- only.

- In case of company you must have the details of owner and all the partners;

- Users must have an active Aadhaar or Digital Signature Certificate (DSC) of the firm’s member for submission.

Online IEC Registration Process in India effective from July 2020

One can apply for IEC Registration on its website WWW.DGFT.GOV.IN as DGFT is an only authority to issue IEC Registration. Director General of Foreign Trade with effect from 1st July 2020 has established an updated process & a new method to apply for IEC online in which Digital Signature Certificate (DSC) will be compulsory to upload. The requirement for DSC has been declared by Director General of Foreign Trade to support IEC issuance process and to stop the prevailing scam.

Import Export Code is issued by Director General of Foreign Trade, Department of Commerce, and Government of India. IEC has lifetime validity and is also known as “Importer and exporter code” which helps a person to import as well export goods legally. The Importer who doesn’t have a valid IEC cannot import goods. Moreover, the exporter who doesn’t have IEC Registration cannot gain the benefits of Export Scheme Benefit available from DGFT.

The Process for IEC Registration is as follows-

Step 1

Open the website by DGFT by clicking on https://dgft.gov.in/CP. After that, select the “Apply for IEC” icon.

Step 2

You need to enter the Details for registration that is stated below-

- Register User as “Importer or Exporter”;

- First and Last Name;

- Email ID and contact number of the applicant;

- Pin code, District, State and City.

Click on the “Send OTP” button after putting the above-mentioned details. You will receive OTP on your contact number as well as email ID. You will receive a notification consisting temporary password on your email ID after successful confirmation of the OTP that you are require to change on your first login. Click on “Apply for IEC” button. Click on start for fresh application option once the user is registered and login to the “Customer Portal” using the details entered in Step 2.

Step 3

You need to fill in the details for IEC registration form which are bifurcated into two headings, those are as follows:-

1. General Information

- Nature of the Concern

- Name of the Company

- PAN details of the Company

- Enter Name according to PAN Card

- Registration of the Entity

- The category of the exporter has to be mentioned that is whether it is a Merchant exporter or Manufacturer exporter or Service provider or Merchant cum Manufacturer exporter or any other relevant category.

- Select the option, related to SEZ that whether the entity is located in the Special Economic Zone or not.

- Whether the firm is located in Bio-Technology Park (BTP) scheme, Export Oriented Unit (EOU) Scheme, or Software Technology Park (STP) Scheme) Electronic Hardware Technology Park (EHTP) Scheme, select the relevant option

- Enter the relevant CIN or LLPIN in case of LLP or company

- Enter the relevant GSTN

- Enter the contact number and email ID for further communication

- Upload proof of registration for the provided entity. This supplementary document is obligatory for Registered Society, HUF, Partnership or Trust

- Enter the address of the firm: You are required to upload supporting documents as “Proof of Address”. This can be any of the following documents:-

- Rent agreement, Sale Deed, lease deed, mobile, electricity bill, Memorandum of Understanding, telephone bill or postpaid bill.

- Other appropriate documents (for ownership only) such as passport, Aadhar card, and voter ID.

- A No Objection Certificate by the owner of the business premises in favor of the business along with the address proof has to be uploaded.

Select “Save and Next” option after filling in the above information effectively.

2. Now, you are required to add details of director or partner or managing trustee of the entity that consists of the following list of items:-

- Enter Name according to PAN Card

- Enter PAN number of the director or partner or managing trustee of the entity

- Enter Date of birth according to the PAN Card

- Address of the director or partner or managing trustee of the entity

- Contact details of the director or partner or managing trustee of the entity

Select “Save and Next” button after filling in the above- mentioned particulars successfully.

A. Enter Bank Information of the Entity

Bank information such as Account holder’s Name, Bank and Branch, account number and IFSC code are to be provided. You are required to upload cancelled cheque of the bank account according to the prescribed Performa.

Select “Save and Next” button after filling in the above- mentioned information successfully.

B. Now, you need to select other details that are preferred sectors.

Click on the “Save and Next” button after filling the above details successfully.

C. Select the Acceptance of Undertaking along with the Declaration and fill the details herewith.

After that, click on “Save and Next” button to proceed further

Step 4

Click on “Sign” button at the bottom of the page after completing Step 3.

- Now, you are required to select the mode of submission that is either through Aadhaar Card OTP or Digital Signature Certificate (DSC). Enter your Aadhaar Number and click on Get OTP and submit your form;

- Confirm the OTP and proceed to make the payment against your application after getting signature in the prescribed form. The Fee of IEC Application is INR 500 and you will be redirected to ‘Bharatkosh’ Payment Gateway.

- Page will be forwarded to the DGFT Website after successful payment and the receipt will be displayed on your screen. You can download the receipt for further reference. On the other hand, wait for an hour for the payment to be reflected from the ‘BharatKosh’ Payment Gateway in case of failure of payment.

What Are the Precautions that should be taken while filling For IEC Registration Process?

- No need to apply for additional IEC in India against the same PAN

- You need to be specific while providing information about the business. The applicant can be punished for delivering actionable and incomplete information.

- It is essential to update business information once in every year after receiving e-IEC. The update shall be provided on the DGFT website.

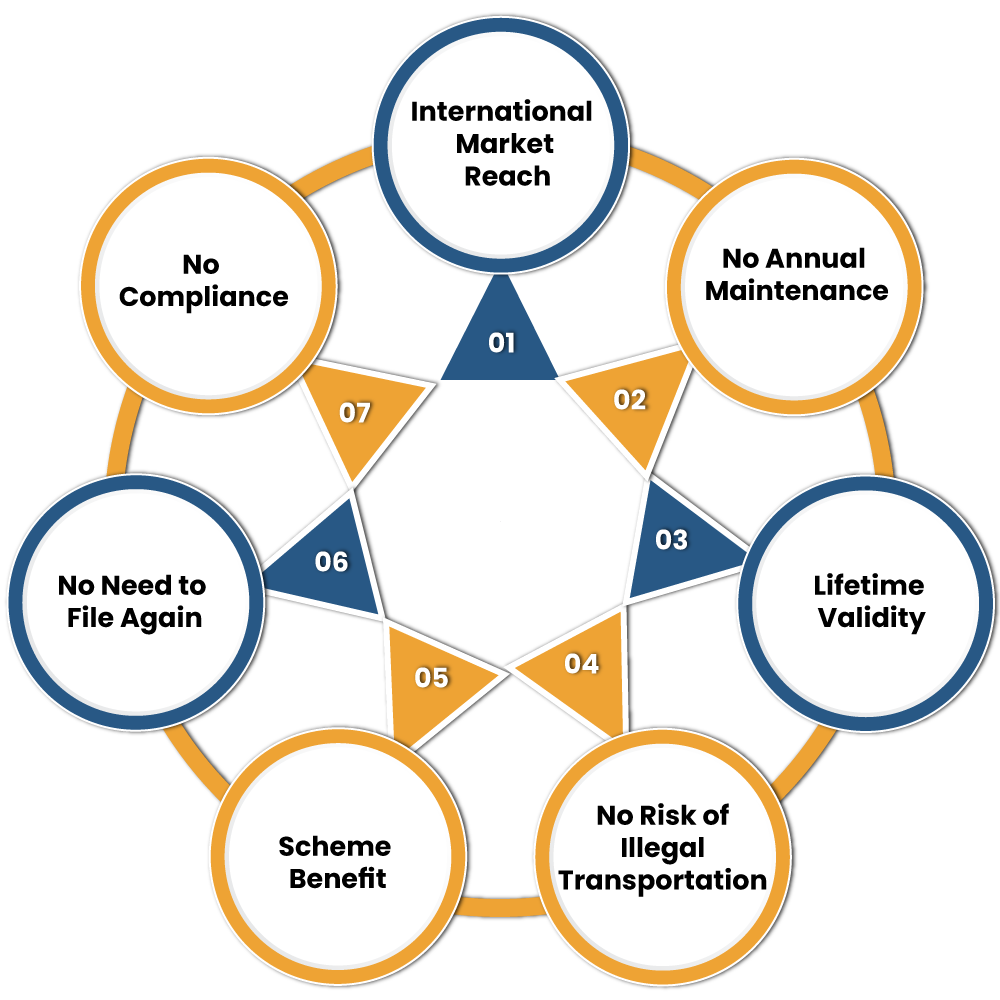

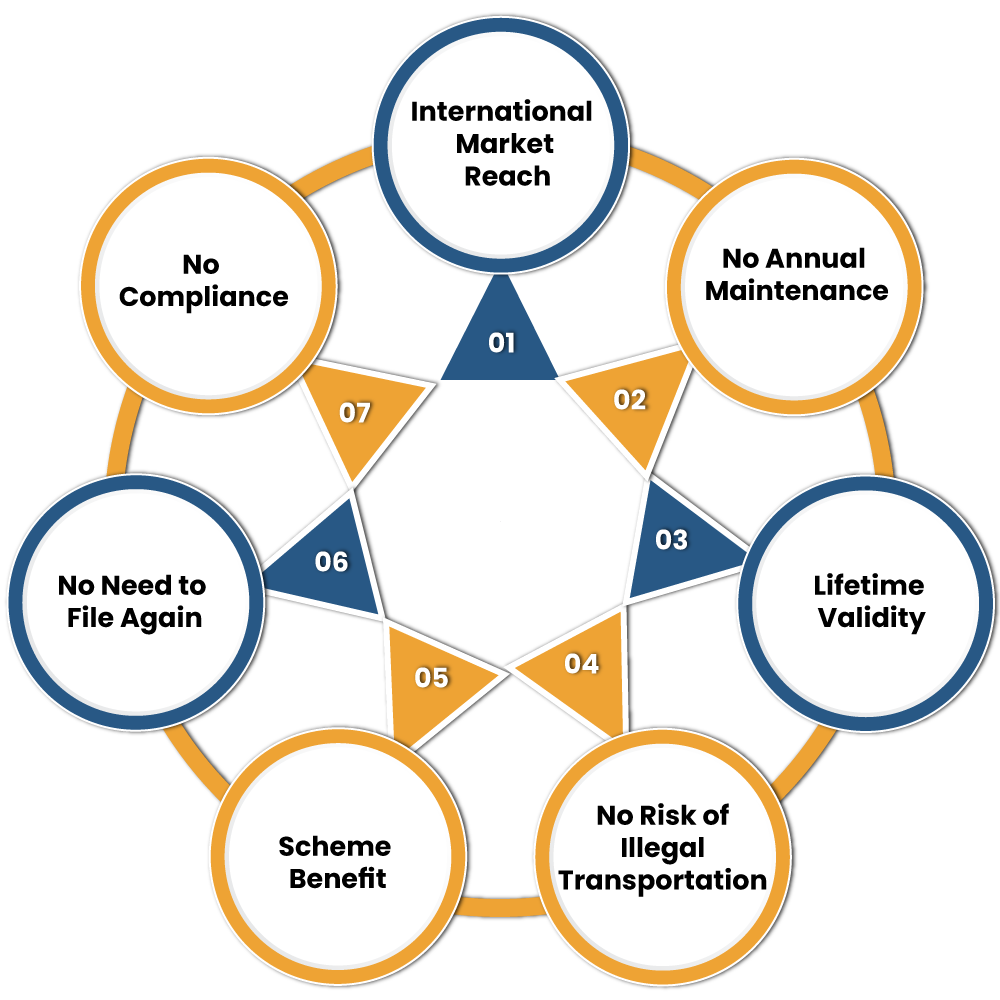

What are the Advantages of IEC Registration Process?

The advantages of IEC Registration are-

International Market reach

IEC helps you to take your business to the global level, and it will increase the growth as well as revenue.

No Annual Maintenance

There is no need for any yearly maintenance fee once you have obtained IEC.

Lifetime Validity

IEC is permanent documentation having lifetime validity.

No Risk of Illegal Transportation

IEC is centralized which helps the officials to manage the cross border business.

Scheme Benefit

The IEC registered firm can avail of the benefits as well as subsidies declared by the customs.

No need to File Again

There is no need to register IEC again.

No compliance

There is no need for filing any annual fining or return.

What are the Standards for IEC Registration Process?

- IEC holder should not apply more than one IEC against the same PAN card and business.

- Every applicant should provide authentic information to avoid any penal and legal actions for furnishing the wrong or incomplete information.

- On receiving IEC code, applicants are required to furnish their details on the DGFT web portal. In the case where any changes are being made, needed to update the on the web portal.

Conclusion

Obtaining IEC becomes mandatory for commencing import-export business. Online IEC Registration Process makes the process more simplified and hassle-free. There is no need to file for the renewal of IEC because the code has lifetime validity. DGFT has various regional offices in the whole of India.

Read our article: How to Export Goods from India to Overseas Markets?