The E-way bill was introduced by the Central Government in April, 2018 under the Goods and Services Tax (GST). A transporter is required to carry an E-way bill under GST when the goods are being transported from one place to another. In this article, we will be discussing regarding an E-way bill, the rules and regulations and how an E-way bill is generated.

What is an E-way Bill under GST?

An E-way bill under GST is an electronically generated bill, and acts as compliance mechanism to move goods from one place to another. An E-way bill can be obtained from the online portal upon filing the relevant and apt information regarding the movement of goods before the commencement of transfer process.

If the amount of the goods being transferred either inter-state or intra-state exceeds Rs 50,000 for sale. It is mandatory for the transporter to carry the invoice along with all the relevant information regarding the goods, consignor, transporter, recipient along with the supporting documents. Under Goods and Services Tax, the concept of check post has been abolished. However, a consignment can be intervened at any point of time during the transmission process for the verification of documents.

Importance of E-Way Bill under GST

The introduction of E-way bill holds great significance, which are as follows-

- The Goods and Services Tax act has unified the Indian market and has eliminated the barrier of Check posts;

- It is found through a survey conducted by the Ministry of Roads and Transport, that an average truck spends approximately 20% of its total life on a check post;

- Implementation of GST is expected to eliminate the issue of delay in transportation, Tax invasion etc;

- Each and every E-way bill that has been generated by the sender or the buyer is supposed to be automatically updated in the outward sales return (Form GSTR-1) of the supplier, thus eliminating tax evasions on shipments.

Read our article:Growth of Alternative Investment Funds (AIF) in an Indian Perspective

Rules and Regulations Regarding the E-Way Bill under GST

The Rules and Regulations regarding E-Way Bill are as follows-

- As per the provisions of the Goods and Services Tax Act for E-way bill, a supplier is directed to register online on the portal before the commencement of the movement of the goods;

- An E-Way Bill can be scrutinized at any point of time during the movement of goods from one place to another by the Tax officials;

Validity of an E-way bill

- An e-way bill for conventional cargo is valid for 200 Kms per day, and the same proportion is followed further.

- Generally, the validity of an electronically generated bill cannot be extended, however, a commissioner can extend the validity of the e-way bill for certain categories of goods.

Penalty for Goods that are caught being moved Without a Valid e-way bill

- If during the movement of goods from one place to another, a consignment is caught without an e-way bill, then the transporter would be liable to pay the penalty of Rs.10,000 or tax sought to be evaded, whichever is greater;

- If during the movement of goods from one place to another, a consignment is caught without an e-way bill, then in such cases, the vehicle can be detained along with the consignment that is being carried by it;

- A transporter can regenerate the e-way bill before the expiry period, however, if the e-way bill has been expired, the system does not allow regeneration linked to the same invoice.

Documents Required to Generate an E-Way Bill under GST

Certain Documents required to generate E-Way Bill under GST are as follows-

- The Transporter should be registered on the e-way bill portal.

- The Invoice/ Bill of Supply/ Challan related to the consignment of goods

- If the consignment is being moved by road, then the transporter ID or vehicle number is required.

- If the consignment is being moved by railways, airplanes, or ship, then the Transporter ID, Transport document[1] number, and date on the document must be present.

By filing all the relevant information regarding the consignment on the E-Way Bill portal, a bill can be generated.

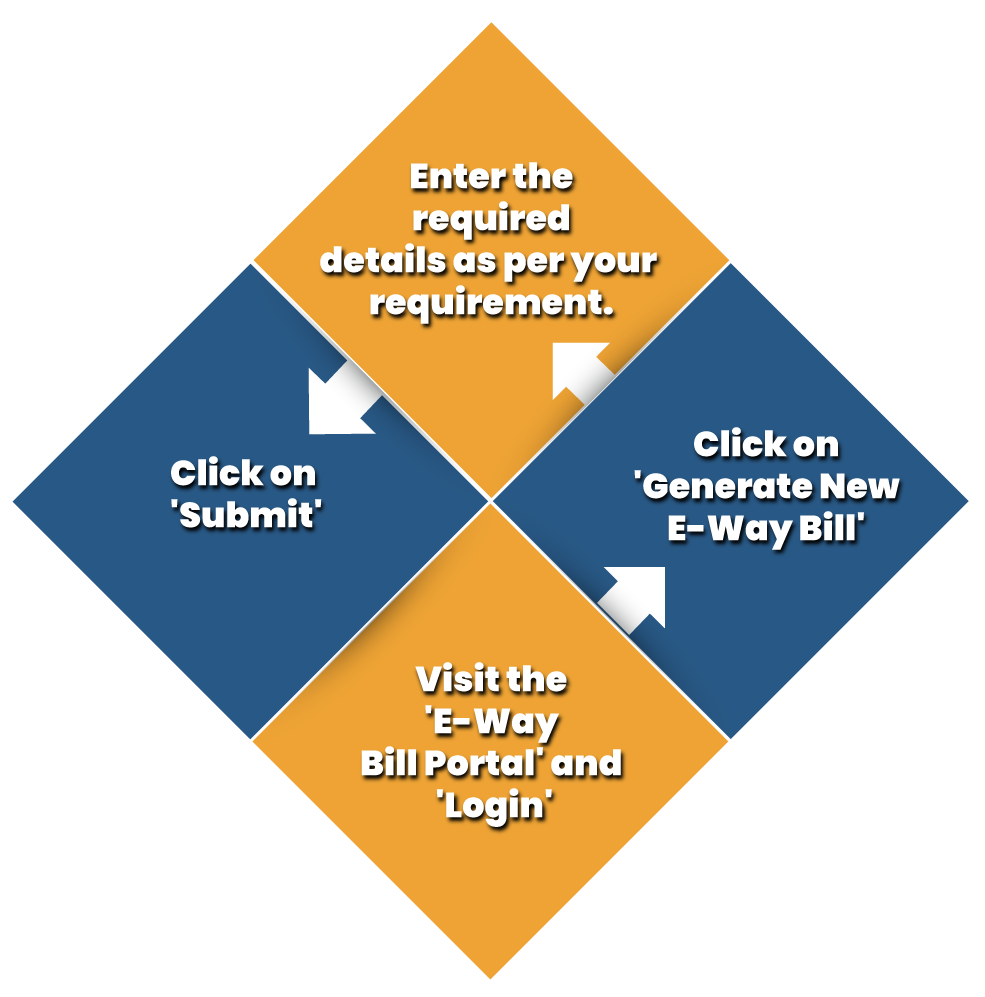

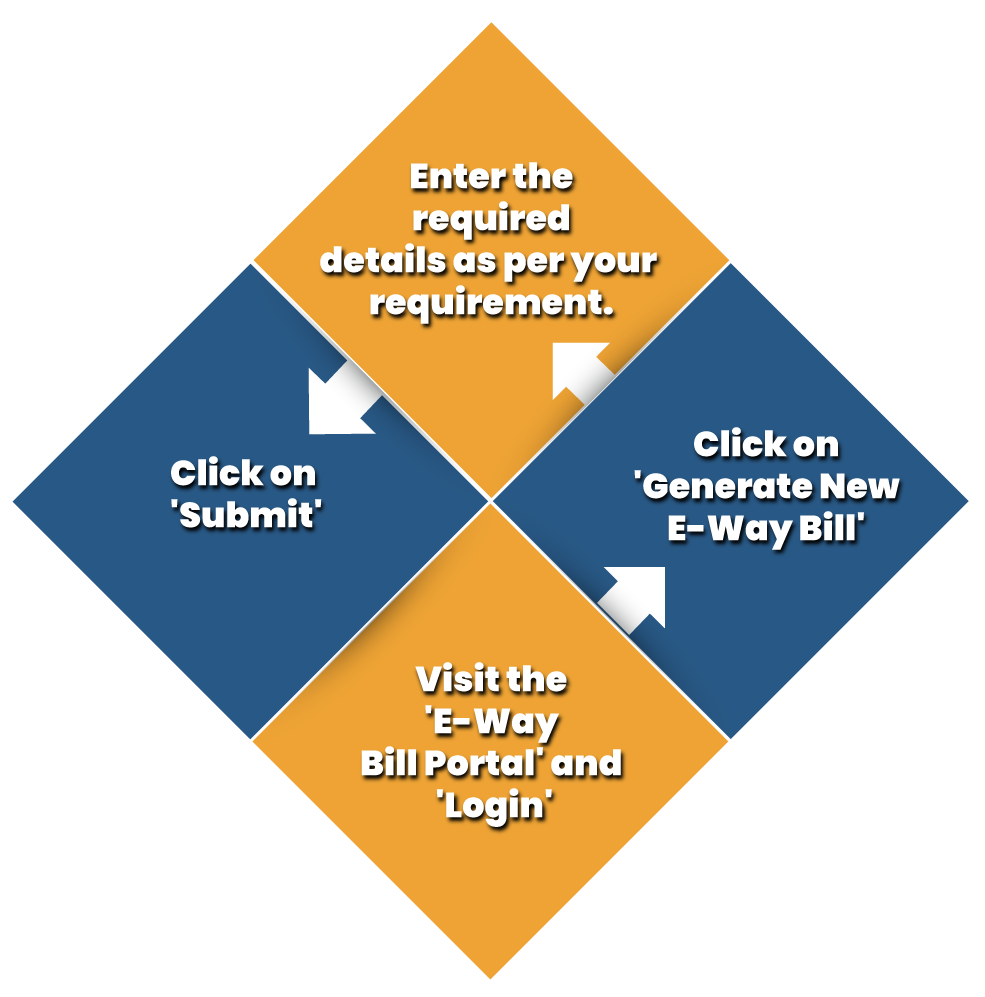

Steps to be Followed to Generate an E-Way Bill under GST

The step by step process to generate E-Way Bill are as follows-

Log in to E-Way Bill Portal

In the first step, Visit https://ewaybill.nic.in/and log into the portal using the username, password and entering the Captcha successfully.

Click on Generate New E-Way Bill

Now, you have to click on ‘Generate New E-Way Bill’ being displayed under the option that appears on the left-side of the dashboard.

Enter the Required Details as per your Requirement

Certain blanks fill appear on the screen that are required to be correctly filled. They are as follows-

Transaction Type

- Select the inward option, if you are the buyer;

- Select the outward option, if you are the supplier.

Sub-type

Under the Sub-type option, fill the blanks accordingly based upon your choice of inward and outward option.

Document Type

Under the document type option, you have to select whether the option is either invoice, bill of exchange, credit note, bill of entry or some other.

Document Number

Under the document number option, you have to fill in the correct document or invoice number.

Document Date

Under the document date, you have to fill in the date of invoice or challan.

Supplier or Recipient

Enter To/From section details depending upon whether you are a Supplier or Recipient

Item Details

Under the item details, you are required to fill in the information regarding the consignment such as

- Name of the Product

- Description

- HSN Code

- Quantity

- Taxable Value

- Tax Rate of GST

- Details regarding Cess

Details of the Transporter

Under the transporter details, the mode of transport and other relevant information is required to be filed. Apart from this you can also submit one of the following details

- Transporter name, transporter ID, transporter Document Numberand Date.

- Number of the vehicle in which consignment is being transported.

Click on Submit

Once you have filed all the relevant information regarding the consignment, click on submit. Your request is processed and the E-Way bill in Form EWB-01 with a unique 12 digit number is created. If any error is found in the form submission, then it will be displayed on the screen.

How to Print an E-Way Bill?

Once you have successfully generated the E-way bill, it can be printed at any time as and when you want

- Under the E-waybill option, you have to click on Print EWS.

- Now, you have to enter the 12-digit e-way bill number and click on go.

- Now, click on print button that appears on the EWB option.

Conclusion

Generation of an E-way bill is the foremost requirement for the movement of goods from one place to another. The absence of E-way bill during the consignment may result into a penalty of Rs 10,000 and seizure of goods along with the vehicle carrying it. The introduction of E-Way Bill under GST has curbed the tax invasion and delay in transportation of goods. Contact Corpbiz Professionals to know more about GST Registration process and get a hassle free Registration.

Read our article:Key Highlights of GST Updates 2021