There are appropriate provisions for calculating ITC on Capital goods under GST, calculating input tax credit reversal, and availability as well as non-availability of ITC. Besides this, specific provisions are available for ITC on capital goods used for taxable supplies along with exempted supplies. An input tax credit is a tax paid on purchase by a buyer and receives the credit after paying input tax. Input tax is levied on input goods as well as input services.

According to the GST Act provisions of section 2(19), Capital goods are those goods whose value gets capitalized in that person’s account book who is claiming the ITC, which will come into usage or intended to get used in the advancement of a business.

Capital Goods

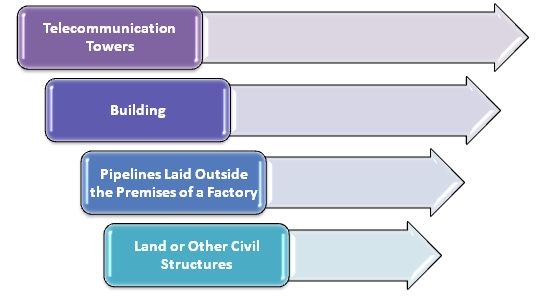

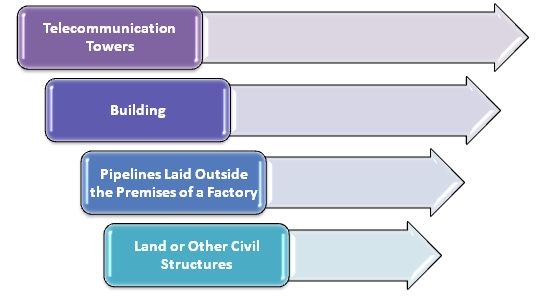

Capital Goods include Machinery, as well as Plants such as equipment, machinery, and apparatus rooted to earth by structural support that is useful in making outward supply of goods/services or even both. It includes such structural support while it excludes the points given below.

ITC on Capital Goods – Types of ITC

The possibility to claim ITC on capital goods is in the months of purchase of goods. As capital goods can be used for both personal along with business purposes, there are three types of capital goods.

Capital Goods for Personal Use or Exempted Sales

Input tax credit won’t get availed for personal use or for capital goods used for exempted sales. It won’t get credited to the electronic sales ledger, and an indication regarding this will be available in FORM GSTR-02.

ITC on Capital Goods used for Normal Taxable Sales

Mr. X has bought machinery for the purpose of manufacturing shoes, and as shoes fall under the category of normal taxable supplies, the goods and services tax, including paid at the time of machinery purchase, ITC will be available in this case. It will get credited to the electronic sales ledger, and an indication will be there in FORM GSTR-02.

Common Credit- Partly Personal or Exempted as well as Partly Normal Sales

- Input tax credit for capital goods would get credited to electronic credit ledger.

- The useful life will be considered as five years from the date of purchase.

- Calculation of proportionate ITC takes place.

ITC on Capital Goods- Calculation Part

In accordance with Section 16(3) as for capital goods which pull the goods and service tax according to section 17(1) along with section 17(2)[1] need to apply the following mode of calculation of goods partly used for different purposes or partially used for causing an effect on taxable supplies, comprising zero–rated supplies–

- Concerning input tax credit, if the taxpayer uses the capital goods or used it for the non-business intent must record in the transaction and also should make an indication in the FORM GSTR-2 and also in FORM GSTR-3B. There is no provision for crediting the amount in the electronic credit ledger.

- All types of capital goods that the taxpayer uses with regard to ITC for effecting taxable supplies along with zero-rated supplies must display in the FORM GSTR-2 and FORM GSTR-3B. The amount must get credited in the electronic credit ledger. Applicability of this is related to Rule 43(1) (b) of CGST Rules and according to the schedule 2 paragraph 5(b) of the same act.

- For goods uncovered under clause (a) and (b) and referred as A, the useful life of capital goods would get registered as five years. There is a provision for crediting this amount in an electronic credit ledger. In case the same goods get covered under clause (a) as well as clause (c), the taxpayer will be calculating the value of A by allowing deduction in the input tax at 5% for every quarter.

- As a result of ITC deduction, the value would get added to the electronic credit ledger. If the capital goods get covered under clauses mentioned above, then the requirement of ITC reversal, according to Section 18(4) of the CGST Act won’t be applicable. As the ITC got deducted before, there will be no applicability of the reversal of ITC.

- The amount in the relation of ‘A’ credited to the electronic credit ledger would get recognized as ‘Tc.’ If the same capital goods that the taxpayer has used got covered under clause (b) and in addition to this, it got covered under clause (d), can calculate ‘A’ value by availing deduction of the input tax at 5% rate in every quarter and then got added to Tc gross value. It will be applicable to goods used at the initial level for taxable supplies but, eventually, got used for exempt supplies.

Read our article:A Coast-to-Coast Coverage of E-Invoicing in GST

Rule 43 of CGST Rules- Latest Amendment in 2020

Refer to Notification No. 16/2020- Central Tax – March 23, 2020

Rule 43 of CGST Rules make out with manner of ITC determination relating to capital goods and reversal in some cases. As GST Council has given recommendations in the 39th meeting held on 14 March 2020, amendments are made in the reversal of ITC method apropos to capital goods partly used for exempt supplies as well as partly used for taxable supplies.

Reversal of ITC on Capital Goods

There are a few situations in which ITC on capital goods availed would get reversed. The conditions are as follows-

- When taxpayers decide to pay tax under composition scheme

- In the case of the supply of capital goods, on which ITC is applicable

- If taxpayer registration got cancelled, ITC engaged in the rest of the useful life in months would get computed on a pro-rata basis. Furthermore, it will get a useful life for five years.

- If there will be an exemption for goods or services supplied by the taxpayer

Take Away

Various provisions exist with regard to the applicability of ITC on capital goods. Apart from this, provisions are also available for capital goods used for taxable supplies as well as exempted supplies. Apart from this, ITC is also applicable to GST paid on capital goods. Our professional GST experts at Corpbiz would help you with in-depth knowledge and endless support on the applicability of ITC on capital goods.

Read our article:Input Tax Credit for Restaurants