Through this Write-up, we are covering the applicability of GST on Intellectual Property Rights (IPR) related services and other information related to Intellectual Property. Intellectual Property rights are not much different from other property rights. Description of this right is available in Article 27- Universal Declaration of Human Rights.

These rights grant the exclusive rights to the owners or creators of patents, trademarks, or copyrighted elements to gain maximum profit from their investment or any other work. Furthermore, these rights help protect companies’ concepts and discoveries to maintain their brand value. Let’s initiate the trip with the introduction part of Intellectual Property before coming to the main part of applicability of GST on Intellectual Property Right (IPR related services).

Intellectual Property & IPR in Brief

Intellectual property is a property type that involves the physically intangible creation of the intelligent human mind. The creativity of the mind brings artistic as well as literary designs, images, symbols, and inventions, etc. Examples for this type of property are- Trademarks, Copyrights, Patents, etc.

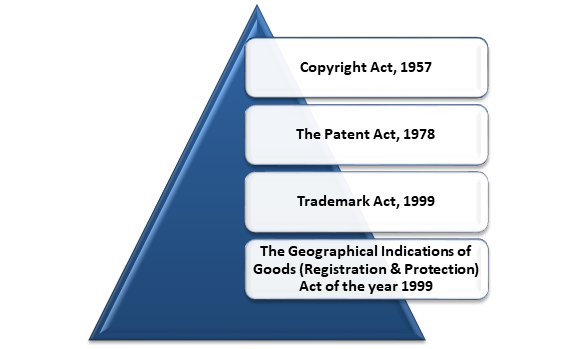

Creators of intangible properties have got the specific rights to protect their property. The appropriate term for these rights is- “Intellectual Property Rights.” Indian legislation has enacted various Acts for the purpose of safeguarding the Intellectual Property of individuals as well as Companies. The Acts with respect to Intellectual Property rights are-

Rights for the protection of Intellectual Property are necessary for bringing transparency as well as fairness in terms of commercial practices. Laws governing and protecting the Intellectual Property ensure that misuse of such property is next to impossible, and also such property won’t get stolen.

Applicability of GST on Intellectual Property

- Applicability of GST on Intellectual Property Right related services is concerned with both the temporary transfer as well as the permanent transfer of IPR. Authorizing the use of IPR is a part of temporary transfer.

- Intellectual Property Rights gets considered as ‘Good’ while license to use the IPR is a part of ‘Service.’

- IPR is a creator’s property, and if the creator permanently makes the transfer of rights on Intellectual Property, then it would get considered as a supply of goods.

- According to Schedule 2, Para C of the CGST Act[1], Temporary transfer of allowing the use of Intellectual Property rights would get considered as a supply of service.

Read our article:GST Applicability on Works Contract for NCBS & Food Services for Exempted Institutions: AAR

Taxability of GST on Intellectual Property Rights

| Description | Bracket | GST Rates | HSN | HSN Classification/Heading |

| Temporary Transfer of Intellectual Property Rights(Other than Software) | Service | CGST- 6% + SGST- 6% | 9973 | Renting along with Leasing Services |

| Permanent Transfer of Intellectual Property Rights | Goods | CGST- 6% + SGST-6 % | Any Chapter |

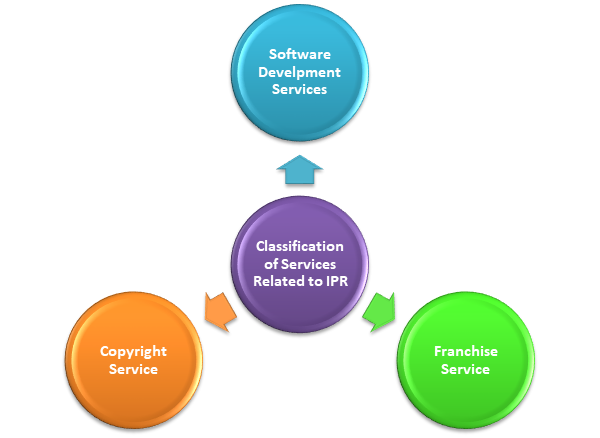

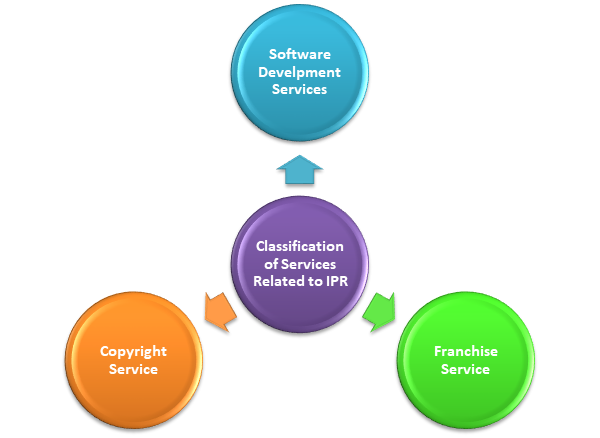

Classification of IPR Related Services

The classification of IPR related services takes place under the following three heads-

GST Liability on Software

- Software is a collection of computer instructions and data that empowers physical hardware so that it can perform computational operations in a particular way, be in the operating system of the computer or web browser, or web processor.

- As per Para 5 subsection d, schedule 2 of the CGST Act, the supply of services under GST encircles the development of software, programming, design, adaptation, and up-gradation, and software enhancement, along with the implementation of IT software.

- Information technology software refers to representation instructions, data, image or sound, comprising object code together with source code recorded in the form of machine-readable, in which a user has got the ability to manipulate and get interactivity related to these instructions either with the help of a computer or an automatic data machine or other equipment or device.

- In Customs Tariff Act- Heading 8523 80 20, the software in physical form and IT software would get considered as goods under goods and service tax.

Cases of the Past that Proves Softwares as Goods

- In the case of State Bank of India Vs. Municipal Corporation 1997, it was regarded that computer software comes under the category of goods as it is a computer “appliance.” Further, the octroi would get imposed on full value and not only on the empty floppy value.

- In another case of Tata Consultancy Services vs. Andhra Pradesh State in the year 2004, it has been held that different types of canned software such as Lotus, Oracle, etc. get considered as goods. The program originator holds the copyright in the program, but after the preparation of copies and getting marketed, they come under the head of Goods.

- Also, there was a case in 2008- Infosys Technologies Ltd. Vs. Special Commissioner, it was held that Customized as well as Non-Customized software both would get considered as goods.

Applicability of GST on Intellectual Property Rights- GST Rates for Software

A similar GST pattern is followed for the GST rate of licensing of software service or development of software service and the GST rate for goods.

GST Rates and HSN in case of Software as Goods

Permanent transfer of the Intellectual Property Rights of software would get recognized as “Goods.” Applicability of GST on Intellectual Property Rights for software as “Goods” is 18% (9% SGST+ 9% CGST) or 18% IGST. Talking about the HSN classification, it is ‘Any Chapter,’ Schedule 3 (Sr. No. 452 P) of Notification No. 1/2017: CT (Rate) as well as 1/2017 – IT (Rate) date for both 28-06-2017. It came into effect from the 15th of November, 2017.

GST Rates and HSN in case of Software as Services

Temporary transfer of Intellectual Property Rights of software would get acknowledged as service. Applicability of GST on Intellectual Property Rights for software as “Services” is 18% GST rate (9% UTGST/SGST+ 9% CGST) or 18% IGST. Temporary or permanent transfer or enjoyment of IPR with reference to software comes under the ambit of service bracket 99733.

Take Away

Intellectual Property Rights are those legal rights that encompass the privileges that the creator or owner of work enjoys with respect to something that they have created by using their artistic and creative mind. They get exclusive rights against the shady practices concerning misuse of work without their prior consent. If you have any concern or your mind is up to something related to the topic, i.e., GST on Intellectual Property Rights, then you must feel free to take the help of our Coprbiz Experts.

Read our article:GST on Legal Services in India: Taxability of Legal Services under GST