Goods And Services Tax has already been implemented in our country and it has affected nearly every sector across the Indian Territory. This includes the well- established and reputed Information Technology sector as well.

Undeniably, Goods & Services Tax has simplified our tax system to a great deal by superseding numerous indirect taxes with a standalone tax system to overcome the cascading of taxes. It will be interesting to know how GST impact IT products and services.

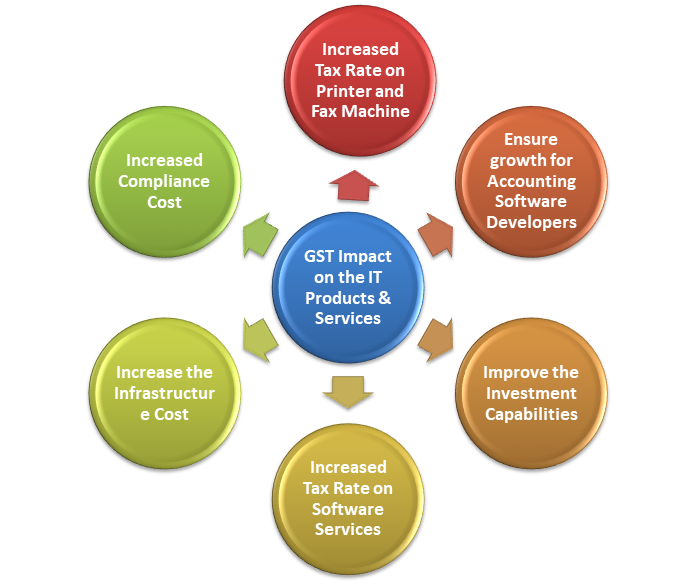

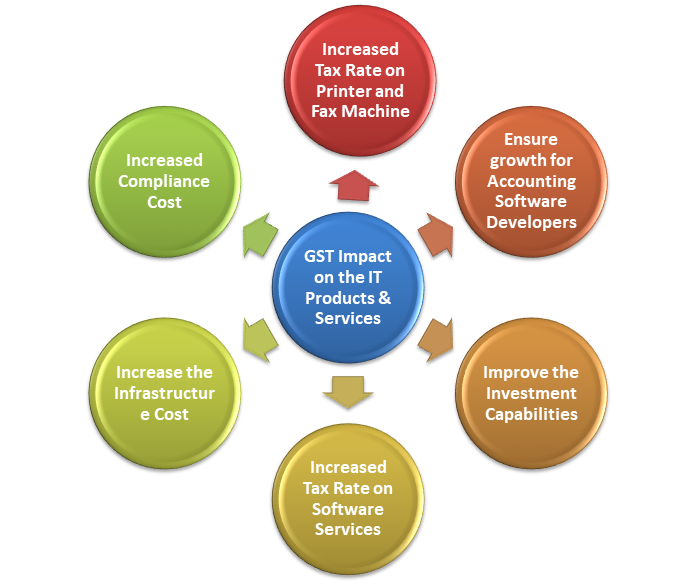

GST Impact on the IT Products & Services

The following significant changes have been witnessed in the tax rates for the IT products and services.

Increased tax rate on Printer and Fax Machine

Under GST law, the GST will be imposed on the IT product such as a printer, fax machine, and cartridges @ 28% compared to the previous 18% tax rate.

Increased Tax Rate on Software Services

The software services will attract 18% GST in contrast to the earlier rate which was capped at 15%. The tax rate on electronic packaged software shall lure 18% of GST.

Increase the Infrastructure Cost

The IT firms have to sync their software and hardware to calibrate their system according to GST. This might impact the infrastructure cost as well as the business ability to expand current facilities.

ITC for IT Traders

There is another bright aspect of GST which is known as Input tax credit (ITC) which shall be accessible to IT traders.

Increased the Operating Cost

Another significant change is for the accounting service providers who now requires to upgrade their ERP system under GST or create a new program like Gen GST. Apparently, this will increase the operating cost of the accounting service providers.

Increased Compliance Cost

The preceding taxation system facilitates the single point of taxation i.e. central service tax. But, under the GST regime, there are 111 taxation points. Now the firms have to address the state as well as the center individually, which will increase the cost of compliance.

Supply of ERP will be Continuous

In the preceding system, the ERP used to serves the long-terms contract which was expanded over the years, and service tax was levied accordingly. In the GST regime, the supply of ERP will be periodic or continuous and the tax shall be imposed accordingly.

Ensure growth for Accounting Software Developers

GST has a positive impact on the accounting software developer firms across the country. Many entities have already unveiled their GST program to help CAs and companies get in line with the new form of the tax system.

Improve the Investment Capabilities

Cascading of taxes has been eliminated after the advent of GST. That means IT companies are no longer required to address various tax liabilities for supplies of their goods and services. GST regime allows taxpayers to confront the aggregated tax amount only. This will help the companies to improve their investment capability.

No GST for BPOs or Software Development Firms

As per the GST framework, IT services like consultancy, software development, and BPO services would not attract any taxes under GST and companies will be able to reap credits on the input tax paid.

More Tax Liabilities for Freelancers

The freelancers engaged with the selling of IT services are now required to confront 18% of the tax rate under GST, which was previously capped at 15%. Bloggers with yearly income less than 20 lakh need not register for GST.

TCS Collection for E-commerce

In the GST regime, all the online sellers have to avail of GST registration and pay taxes, regardless of their yearly turnover. E-commerce firms would not attract any benefits from the GST composition scheme. The eCommerce platforms are liable for the collection of TCS from their sellers and pay it to the government, such activities attract the input tax credit.

Place of Supply in the Event of a Single Contract

In past, IT service providers handle the taxation-related activities from one location i.e. the main office of the business. Under Goods and Services Tax, a provision related to “place of supply” was introduced, which brings the requirement of various invoices and billing in the event of a single contract service where delivery is executing from various branches of the same activity. For that, the IT firm has to register for those states as well as the region where the customer resides.

Multi-Point Taxation

Currently, there are 111 taxation points that a taxpayer needs to access while addressing the process of GST return filing. GST regime consolidates three tax points i.e. central GST, inter-state GST, and state GST. Now, these tax points are supposed to be multiplied by 37 jurisdictions, which make the total 111. This sum is referred to as a taxation point which an IT company needs to address to clear through filing the GST.

GST Rate for IT Products/Services

The tax rates for the IT sector have been increasing gradually since the day of GST implementation. However, the cascading effect of taxes and various tax systems has been completely eliminated. Now customers need not address multiple taxes (service tax + VAT + excise duty) while paying for IT software services. Instead, they have to pay a single GST tax, which is roughly equivalent to the sum of the aforesaid taxes.

Conclusion

The E-commerce marketplace is also encountering significant changes in the new GST tax[1] framework. The GST provision directs e-commerce platforms to deduct TDS (Tax collection at source) from the sellers, and then deposit to the government. Therefore; every seller has to register & file a return via online mode if they intend to claim the credit on TCS paid. This adversely impacts their cash flow and investment capability.

This may disrupt the growth of the industry and can also enforce the sellers to withdraw from the online platform. Connect with CorpBiz’s professional to get more detail on GST Impact on IT products and services.

Read our article:An Insightful Explanation on GST Impact on the Agricultural Sector