Every taxpayer under Goods and Services Tax is bound to file a return for every tax period. It may be possible that during a specific timeline, he/she had no transactions whatsoever. Now, this leads to a common query- Whether such taxpayer has to file GST returns for that period or for that said period or not. According to the GST law, every registered taxpayer is required to file a return even in the case of nil transaction against a period for which the return is supposed to be filed. In light of this, we can conclude that GST NIL return refers to a return that is needed to be filed by a registered taxpayer in case of nil transaction for a given period.

Type of Returns for which GST Nil Return is to be filed

Under the prevailing GST system, GST Nil return is needed to be filed for both GSTR 3B and GSTR 1. In the case of non-filing, the penalty will be levied on the taxpayers.

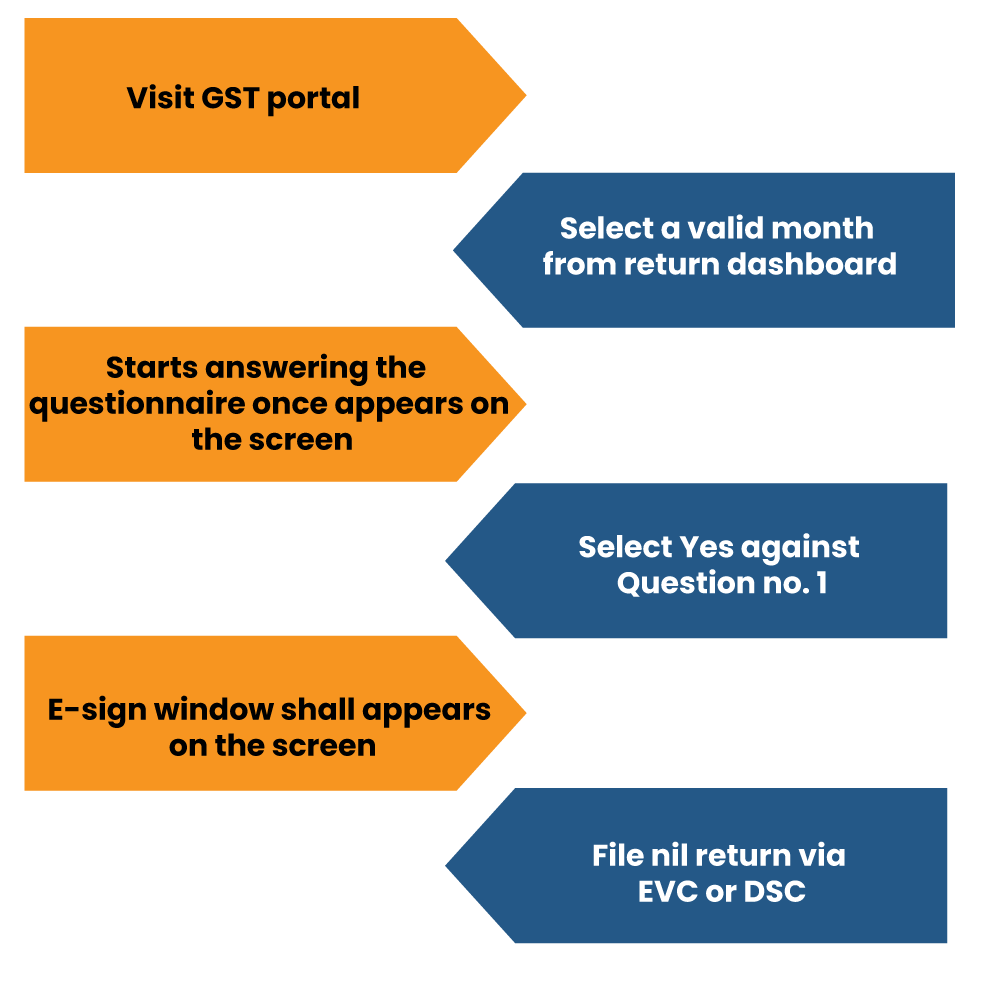

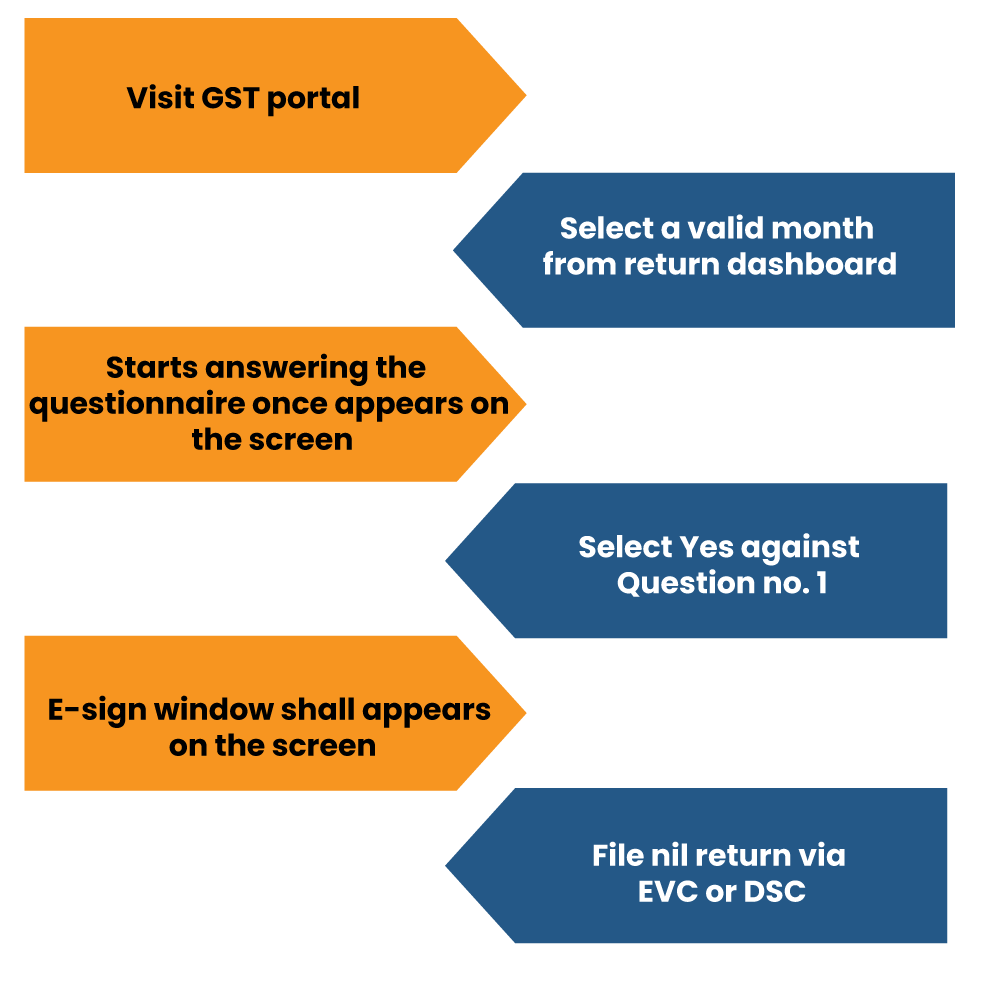

Online Method for filing Nil GSTR-3B Return

- Head over to the GST portal.

- From the return dashboard, select a valid month for which the GSTR 3B is to be filed.

- A list of a questionnaire related to GSTR 3B shall prompt on your computer screen.

- Select Yes against Question no. 1 stating- Do You Want to File Nil Return?

- The portal will then direct you to the E-sign window, where return filing can be done via EVC or DSC

- File nil return with the help of the options above.

What is the GSTR-3B?

GSTR-3B refers to a self-declaration form to be filed by taxpayers for providing detail of outward supplies, tax paid, input tax credit claimed, and tax liability ascertained.

All registered taxpayer under GST has to file GSTR-3B form. Prior to the submission of this form, the taxpayers must reconcile sales and input tax credit details via GSTR-1 and GSTR-2B. GST reconciliation is vital to pinpoint errors in data that may lead to GST notifications in future and even suspension of the registration.

Read our article:Compulsory FASTag to New GST Return: Rules Got Changed from 2021

Web-based Method for filing Nil GSTR-1* Return

- Visit the GST portal.

- From the return dashboard, opt for the valid financial year and month and hit the search tab.

- A list of options shall appear on your screen. Here you need to click on the ‘Prepare Online’ tab under GSTR1

- Navigate to the option, viz B2C (Others) under GSTR -1 & provide the requisite details.

- Opt for the place of supply and provide ‘0’ under all other fields.

- Tap on the Save button and revert to the GSTR 1 Dashboard.

- Tap on the ‘Generate Summary’ option.

- Once you come across the summary on your computer screen, verify the details and tap on the ‘Submit’ button.

- Lastly, file the return via DSC or EVC option.

What is the GSTR-1?

GSTR-1* is a return to be provided for sharing details related to outward supplies of goods &services made. It consolidates the debit-credit notes & invoices raised on during sales transactions for a tax period. All taxpayers registered under GST must file GSTR-1. Even the minor changes made to sale invoices should be reported in the GSTR-1 return by registered sellers and suppliers.

What is the use of DSC on the GST portal?

Digital Signature Certificate (DSC) is a secured digital way of authenticating e-based documents on the GST portal. The issuance of DSC is in the hand of specified authorities that got the recommendation of the Ministry of Corporation Affairs[1].

It’s worth noting that the GST portal only accepts Class 2 and 3 DSC. To validate the user having DSC, first, register the DSC on the GST portal after login into the same.

What is E-Sign in GST?

The E-Sign stands for electronic signature. It is a kind of service that is largely used in GST processes. It enables an Aadhaar cardholder to sign the documents digitally.

The process is pretty straightforward; an OTP is sent to the Aadhaar registered contact number, which enables the person to access the portal and e-sign the document.

What is EVC in GST?

EVC stands for Electronic Verification Code- it is a ten-digit alphanumeric code used for authentication by the users. A person can validate the user via One Time Password on the GST portal. The authorized signatory will get the password on the registered phone number, and they can use the password to proceed further.

Penalty Regarding Late Filing of GST Nil Return

Previously, the penalty was payable at the rate of Rs 200/day. But, the same was minimized via notice released by the Central Board of Direct Taxes. At present, in case of late filing of GST Nil return, the late fees will be payable at the rate of Rs 20/day (i.e. Rs 10 SST & Rs 10 CGST).

Conclusion

Though filing of nil GST return seems irrelevant at times, it should be filed without incurring any delay to avert penalties. Maintaining a consistent track record of filing GST nil return is a good idea as far as the post-filing benefits are concerned. A taxpayer with a healthy track record of filing return, including GST Nil Return, can avail of several benefits such as easy loans, lower taxes, and ease of doing business. Seamless return filing indicates the trustworthiness of the taxpayers.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty