After the advent of GST for NGO, the two taxes, i.e. VAT and Service tax have been combined to reduce the burden on the taxpayers. GST implementation was nothing short of a breakthrough for our country since it has simplified the overall tax structure.

The advent of GST has a considerable impact on avenues that work for society’s betterment, broadly known as NGOs, trust, societies etc.

As per the GST law, any trade, commerce, manufacture, vocation, profession, vocation or not it is for fiscal benefit comes under the GST’s ambit.

In light of this, the fiscal benefit cannot be the only basis for defining the term business under GST. The Charitable & philanthropic undertaking also come under GST as a business.

However, what is exempted has to be determined under GST in the NGO’s category.

GST for NGO

In Non-Governmental entities, GST applies to taxable goods & services. An exemption is accessible to the taxpayer under GST, given in Section 12AA of the Income Tax Act, 1961.

Read our article:How to apply for GST registration certificate online?

Who are eligible for such an Exemption?

- Entities that come under the ambit of Section 12AA

- Such services via charitable activities

Role of Section 12AA

An NGO as per IT Act, 1961 is specified in Section 12AA. It clearly states that any entity working for the charitable cause can avail exemption under IT Act, 1961.

To avail GST’s benefits, it must meet the requirement for registration under the said Act and GST law.

Following are the list of undertakings that are eligible for exemption as per Section 12AA

- Public Health services for

- Critically ill individuals with a severe mental or physical disability.

- Individuals who have HIV.

- Conducting mass awareness programmes for family planning and preventive health measure.

- Advocating holistic awareness, religion, spirituality, or yoga.

- Rendering Education to orphan children, physically or mentally tormented or prisoners or senior citizens.

- The entity conducting an awareness program related to wildlife or environment protection.

- In the purview of the CBDT‘s notification, viz 12/2017 Central Tax Rate, all general exemptions do not apply to the Non-profit entities,

The exemptions which come under the general category of exemptions relating to charitable purposes are:

- Coaching & Training activities- recreational undertakings, such as culture, art, sports in section 12AA of income tax Act, 1961 (1).

- Public library

- Health care[1]

Is GST registration is a mandate for Non-profit entities?

Indeed, it is based on the income generated by the NGOs.

The applicability of GST registration on NGOs is determined using the term Income. The term income is used differently here for non-profit organizations.

Threshold limitation- General Rule

Every Statute facilitates the minimal amount on which a taxpayer is mandated to pay tax.

Under GST, the threshold limit has been capped at Rs 20 lakhs. This implies that if any registered NGO has an overall turnover of less than Rs 20 lakhs, it is unnecessary to avail the NGO registration under the statute.

For this section 2(6) of Central Goods & Services, 2017 has specified the term Aggregate Turnover. The said term implies the taxable supplies, non-taxable supplies, exportation of goods & services at an inter-state level to the estimated pan India.

Therefore, GST registration is a legal mandate for NGOs which are;

- Making taxable supply of goods & services. Those supplies do not come under Section 12AA.

- Earning more than Rs 20 lakhs of Aggregate Turnover

Keep in mind that for the states like Arunachal Pradesh, Mizoram, and Assam, this said limit has been slashed down to Rs 10 lakhs.

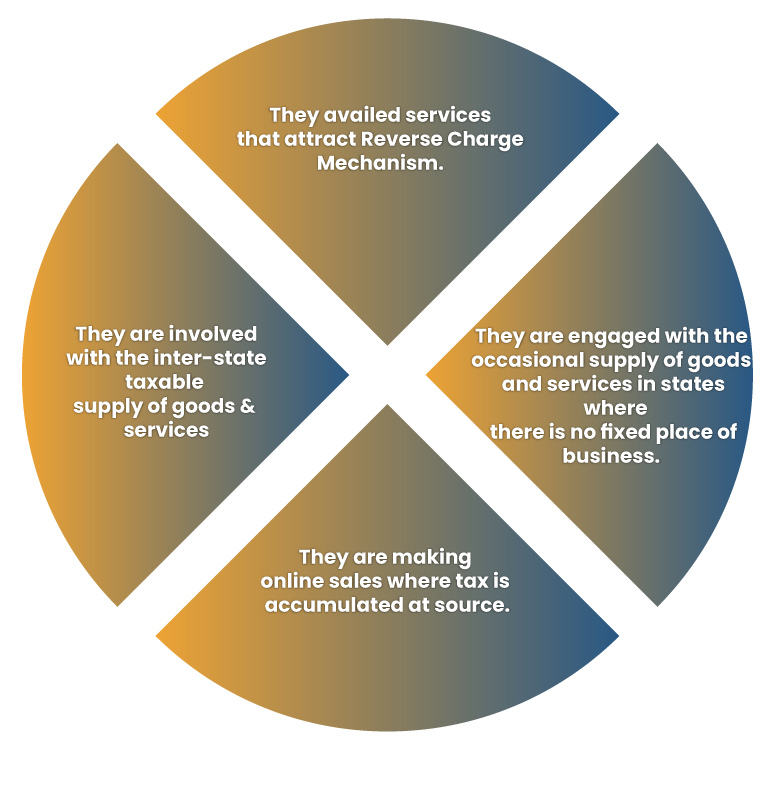

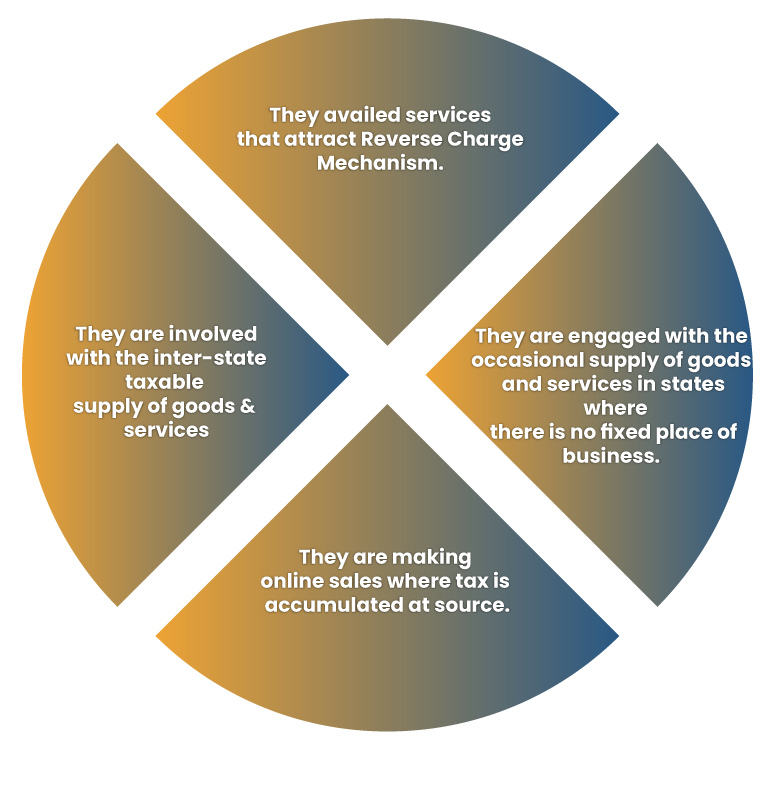

Compulsory Registration

NGOs generating less than 20 lakhs of aggregate turnover is also liable to avail GST registration, if

No registration required

- An NGO is dealing with the goods and services that fall outside the GST regime.

- Non-registered NGOs need not avail registration

An overview on past notifications waiving off GST for NGOs

In past, the government has released several notifications that aims to isolate NGOs from GST provisions

Charitable trust

If the charitable trust facilitates services like residential or non-residential yoga camps by procuring funds via donation, it will be subjected to GST taxation. Unlike spirituality, yoga, procuring donation is a different undertaking altogether because it is attached with an element of commercialization.

Health care facilities

No taxation will be levied on clinical establishments which facilitate legitimate medical services such as transportation of patients to hospitals. Furthermore, veterinary services offered by the charitable trust are not taxable.

Donations received

The donations received by charitable trusts and NGOs shall not be subjected to taxation. Since the contribution has nothing to do with term business, the taxation paradigm doesn’t fit this context.

Interest income

The interest income generated by NGOs by way of loan extension or deposits is taxable. However, the incomes received under recurring deposits/FDs/savings are not subjected to taxation.

Training or recreational activities

Training/Coaching facilitated by the institution in art, dance, music, institution or any sports shall confront no tax liabilities under GST.

Participation in events

If the organization participates in the events like theatre, plays, a drama that involve some monetary transactions in terms of fees, it shall come under the ambit of GST.

Conclusion

The impact of GST for NGO is more or less a positive one, considering the provisions that exist under the general bylaws. GST doesn’t necessarily tax NGOs in a harsh way. It keeps the core social activities out of the equation and taxes only areas that fit with existing norms of the GST laws.

Read our article:How To Obtain GST Registration in India?