The Ministry of Finance has opened the Special Window to States for meeting the GST Compensation Cess shortfall. Under the Option-I States were to be provided with a Special Window of Borrowing of ₹1.1 Lakh crore, and over and above that, an authorization for additional Open Market Borrowings of 0.5% of their GSDP.

Key Highlights of the Special Window

Read our article:Latest: Selective Applicability of GST Regulation by AAR

All about GST Compensation Cess

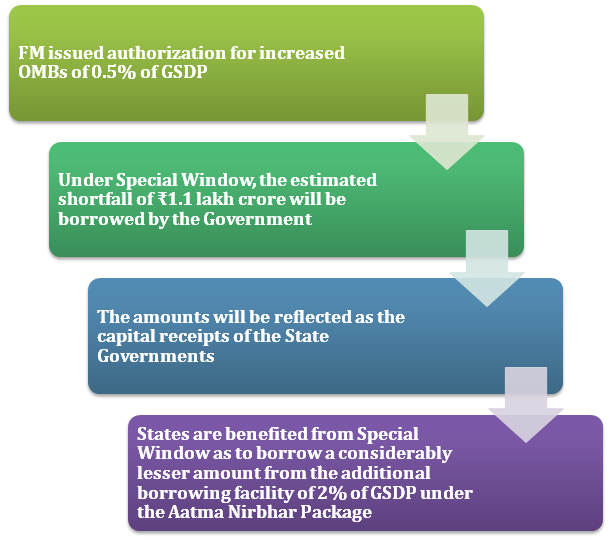

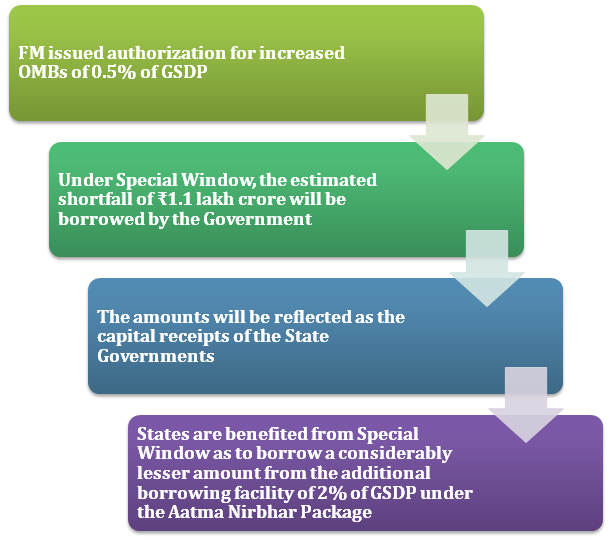

- The Ministry of Finance[1] has issued the authorization for increased OMBs (Open Market Borrowings) of 0.5% of GSDP on 13th October 2020. It is in relaxation of the reform conditions that were stipulated for eligibility. Additionally, under Option-I, the States are also eligible to carry forward their unutilized borrowing space to the next Financial Year.

- Under a Special Window, the estimated shortfall of ₹1.1 lakh crore (assuming all States join) will be borrowed by the Government of India inappropriate tranches. The amount so borrowed shall be passed on to the States as a back-to-back loan in lieu of GST Compensation Cess releases.

- This must not have an impact on the fiscal deficit of the Government. The amounts will be reflected as the capital receipts of the State Governments and as part of the financing of its respective fiscal deficits. This will avoid different rates of interest that individual States may be charged for their respective SDLs, and will be an administratively easier arrangement.

- It has also been clarified that Central Government borrowings will not increase by this step. The States that get the benefit from the Special Window is likely to borrow a considerably lesser amount from the additional borrowing facility of 2% of GSDP (from 3% to 5%) under the Aatma Nirbhar Package.

Conclusion

It has been decided that central government will initially receive an amount and then pass it on back to back to states as loans. As this will enable ease coordination and simplicity in borrowing apart from ensuring favourable interest rate. Hence, it said, the quantum of resources available for state is sufficient to meet an entire amount of compensation which would be likely to payable this year.

Read our article:GST Can’t be Imposed on Services Provided By Court Receiver

PressReleaseIframePage