The Hon’ble Bombay High Court in the matter of Bai Mamubai Trust v. Suchitra [Decided on September 13, 2019] held the office of the Court Receiver is an establishment of the High Court through which the orders are being issued by the Court. Therefore, the services of the Court Receiver considered as services provided by any higher or lower Court. Accordingly, the fees or charges paid by the Court Receiver are not liable to GST as per Para 2 of the Schedule III of the Central Goods and Services Tax Act, 2017 (“CGST Act”).

Bai Mamubai Trust v. Suchitra : Facts of the Case

There was a dispute between the landlord & the tenant. A Court Receiver was appointed by High Court for the maintenance of the property and to collect the rent from Defendant. The Court Receiver collected the consideration amount in the form of fees and also received ad-hoc royalty amount from the Defendant for occupying the disputed premises.

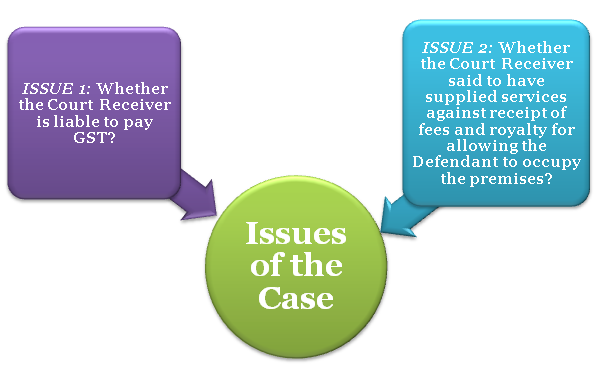

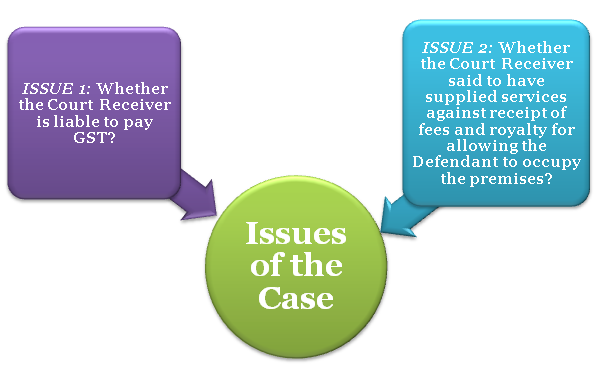

Issues Raised

Read our article:Coupons and Vouchers under GST

Judgement

The Hon’ble HC, Bombay, held as under:

Illustration of Issue 1

It is clarified that the Court has not considered this issue in the context of a remote receiver who may be appointed by the Court under Order XL of the CPC, GST cannot be levied or received on the services rendered by Court Receiver. Under Rule 591 of Bombay High Court (Original Side) Rules describes the fees of Court Receiver. Therefore, GST should not be levied on the amounts directed to be paid by litigants to the office of the Court Receiver.

Since the office of Court Receiver is an establishment of the High Court[1] and a permanent department of the High Court, it is an adjunct of the Court through which the orders of protection issued by the Court. Since in GST, ‘services by any court or Tribunal established under any law for the time being in force’ are to be treated neither as a supply of goods nor a supply of services [Sch. III, item 2], the High Court ruled that the Court Receiver will not be liable to pay any Goods and services tax on such fees.

Illustration of Issue 2

Defendant has the permission to remain in possession of the premises as an agent of the Court Receiver under the agency agreement to be executed with the Court Receiver, on payment of monthly ad-hoc royalty of Rs. 45,000/.

The prima facie finding was that Defendant has no right to be in the occupation of Suit Premises. The permission accessed to the Defendant to remain in possession subject to the payment of royalty in order to balance the equity of the case. The ground for this payment is alleged to have illegal occupation or trespass by the Defendant. Such payment lacks the necessary quality of reciprocality to make it a ‘supply’.

The quantification of royalty towards a claim for damages involves ascertaining the market rent payable concerning the property was alleged to be occupied illegally, the compensation liable to be paid does not acquire the character of consideration to make the transaction a supply.

Analysis

In Bai Mamubai Trust case, the Defendant was allowed to occupy the premises, and in return, he was expected to pay a royalty to the Court Receiver so, in a way, this could have perhaps been considered as a bilateral act or even a reciprocal obligation. Secondly, assuming that if the Defendant were not able to pay or was not agreeable to the amount of royalty fixed, then obviously, he would not have been allowed to occupy the premises. It may also suggest that even in such cases, there is a reciprocal obligation and could amount to supply of services.

The situation could become complicated, if the Defendant is decided, after a few years, to be a lawful tenant, ab initio. In this scenario, the amount of royalty received over these years could acquire the colour of rent, making the landlord liable to pay GST for renting of immovable property, for all these years.

With due respect, it is felt that this judgment could have broader implications and could be argued to have applicability even for liquidated damages in other commercial contracts also.

Read our article:Implementation of Delinking Credit/Debit Notes on the GSTN Portal