Since the Pre-GST period, the taxability of gift coupons and vouchers under GST are not considered as unlawful claims but it has been based on the subject of the lawsuit. The SC in the case of “Sodexo SVC India Pvt. Ltd.”, held that Sodexo’s meal vouchers could not be subject to Octroi or Local Body Tax in Maharashtra. The Court held that the coupons are just ‘payment instruments’ and not ‘goods.’

The electronic world or Virtual world is slowly developing and evolving into a new mode of payment instruments facilitating people for the purchase of various goods and services. These so-called “payments instruments” of the future, which are as follows-

- Payment Instrument or Gateways or Hard form;

- E-Wallet;

- Prepaid Cash Cards;

- Prepaid recharge coupons;

- Prepaid Cash Vouchers;

- Prepaid Gift Cards or vouchers;

- Employers are distributing utility coupons, such as Sodexo Coupons;

- Virtual currency like Bitcoins.

Coupons and Vouchers under GST Rule

Vouchers are not well-defined in the Act. A general definition of coupons is “a small printed piece of paper which entitles the holder to a discount or exchange for goods and services.”

‘Voucher,’ in GST Registration, essentially means any instrument which shall be accepted as deliberation wholly or partly for a supply. Consequently, a voucher is an asset for the beneficiary, and without a receiver, a coupon will lose its sense.

Consequently, in a case of a supplier issuing a voucher to a recipient of goods, on his purchasing from the supplier, the coupon is not being viewed as an additional outcome of the supply made to the recipient. As an alternative, it is a tool that can be used in place of money or other consideration that can be used on the implementation of an additional inward supply of goods and services.

Time of supply in case of vouchers

In the case of several coupons by a supplier, the time of supply should be—

- The date of issue of the coupon, if the amount is recognizable at that point;

- The time of the redemption of vouchers.

The government, in its wisdom, in all probability, will treat ‘vouchers relating to goods’ and ‘coupons relating to services’ as different and separate classes of businesses. A layperson would comprehend that vouchers relatable to products would be those classes of operations that can be exchanged for goods. In contrast, vouchers relating to services being distinct and separate can be exchanged only for assistance.

There can be a third class of communications relating to vouchers, namely, a gift voucher issued by a bank that can be exchanged only for cash. But a plain reading of the definition of goods and services designates that they both exclude money. Therefore, such of those vouchers relatable to money or money can be safely assumed to be outside the ambit of GST rules.

Read our article:Latest: Government unable to pay state’s GST compensation share

Rate of GST on vouchers

The rate of tax that will be appropriate to goods or services they are issued in respect of or that applicable at the time of redemption.

Value of supply

In the case of the supply of a voucher, the value will be the redemption value of the voucher.

Example:- Mr.& Ms. Verma purchase ten gift vouchers for Rs. Five hundred each from Crossword, and five vouchers from Four Fountains Spa costing Rs. 1,000 each, and gives them as return gifts to children and their parents for their son’s birthday party. The vouchers from Four Fountains Spa had a special offer for couples – services for both persons at a price chargeable to one.

The value of the supply of goods will be the money value of the goods exchangeable against the voucher.

Thus, in the case of vouchers from Crossword, the value would be Rs. 5,000 (i.e.,Rs.500 * 10) and the value of vouchers in case of Four Fountains Spa would be Rs.10,000 (i.e., Rs. 1,000 * 2 * 5).

Coupons and Vouchers under GST regime

The coupon is not defined under any provision of the Act in any law, can be understood from its following universal definition-“Coupon is a voucher enabling the holder to a discount in a specific product or service.”

Taxability and Legal Provisions of Coupons and vouchers under GST

We will now examine the taxability on the Coupons and vouchers under GST issued to numerous types of customers and the legal provisions.

Valuation Provisions

Section 15 of the CGST Act[1] delivers the following information regarding the valuation of supply.

Time of supply in case of coupons and vouchers

The instrument under deliberation are ‘Vouchers’ which are given for use in the retail outlets of KJIL for purchase of jewelry, i.e., goods and consequently the time of supply is ruled by the provisions as per Section 12 (4) of the CGST Act, which states as follows: In the case of the number of vouchers by any supplier then the time of supply will be:-

- The time of issue of voucher if the supply of goods is recognizable at that point;

- The time of renovation of voucher in all other case.

Therefore, if the vouchers are specific to any particular goods specified against the voucher, then the date of the issue of coupons is the date of supply of voucher to the customer. Though, as per the submission of the applicant, in the mainstream of cases, the gift vouchers or gift cards are saving against any jewelry bought. In such case, the date of supply is the date of redemption of voucher.

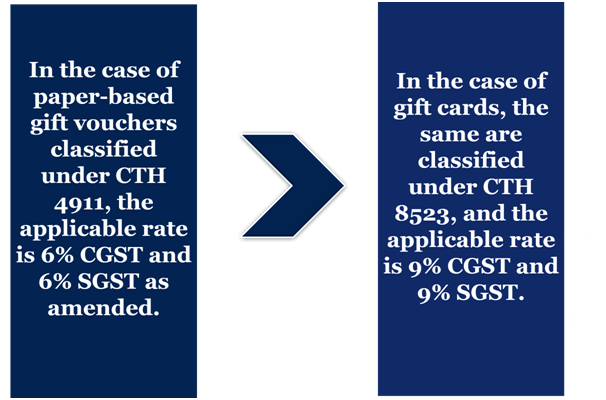

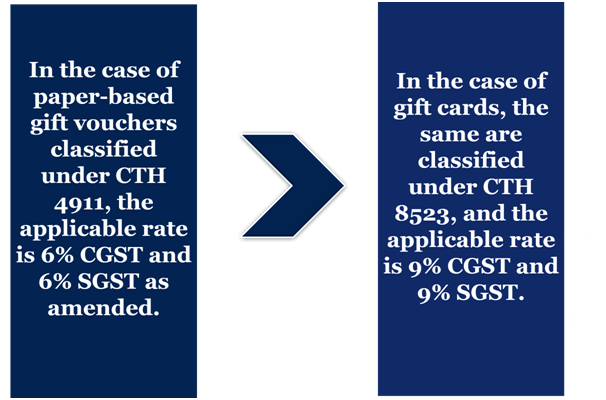

Rate of GST on vouchers

Conclusion

The taxability of gift coupons and vouchers under GST as goods and not unlawful claims has been a subject substance of the lawsuit. The SC, in the case of Sodexo SVC India Pvt. Ltd., held that Sodexo’s meal vouchers could not be subject to Octroi or Local Body Tax in Maharashtra. The Court held that the coupons are just ‘payment instruments’ and not ‘goods.’ The electronic world or Virtual world is slowly developing and evolving into a new mode of payment instruments facilitating people for the purchase of various goods and services.

Read our article:Procedure for Appeals under GST