The Food Safety and Standards Act, 2006 was set up to control the food industry and to formulate laws relating to food and their manufacturing, sale, storage, distribution and importation. As per the Food Safety and Standards Authority of India (FSSAI), taking a food license is the first step to start a food business.

Only after obtaining FSSAI license you can start your food business without any legal hassle. But FBO cannot be considered as the end of process. Each licensee FBO, with an annual turnover of Rs 12 lakh and above, has gone through with the annual return filing process. If FBO fails to file FSSAI annual return within the stipulated time period may result in heavy fines.

Who is Bound to File FSSAI Annual Return?

- Every individual who is engaged in the business of food manufacturing, sale, storage, distribution and importation.

- Each licensee FBO, who has an annual turnover of Rs 12 lakh and above requires going through with the FSSAI annual return filing process.

Kinds of FSSAI Annual Return Filing Process?

There are two types of mandatory FSSAI annual returns filing process from which FBO needs to face.

- FORM D1 for FSSAI Annual Return

- FORM D2

Instructions for Form D1

- FSSAI Form D1 must be filled by all food manufacturers, importers, labelers, re-labels, packers and re-packers etc.

- FBO can file it online or physical as prescribed by the Food Safety Commissioner.

- In addition, regardless of which FBO was produced in the last year, it is compulsory to file.

- The FSSAI Form D1 should be filed on or before May 31 of every financial year to the Licensing Authority which depends on the types of food products that are sold by the FBO in the last financial year.

Instructions for Form D2

- The FSSAI Form D2 is filed by the person who is involved in the business of manufacturers of milk and dairy products.

- FSSAI Form D2 should be filed on an annual year basis as per the revised format online vide notification no. 15(31)2020/FosCoS/RCD/FSSAI

- Thus the time period for filing half-yearly return is from 1 April to 30 September and from 1 October to 31 March of each financial year.

Important Details to Know while Filing the FSSAI Annual Return

It is important for every Food Business Operator to fill the below mentioned details in the form while filing the FSSAI annual return

- Name of the products

- Quantity of the products

- Selling price of the product

- Rate of the product

Read our article:A Complete Overview of FSSAI Annual Return

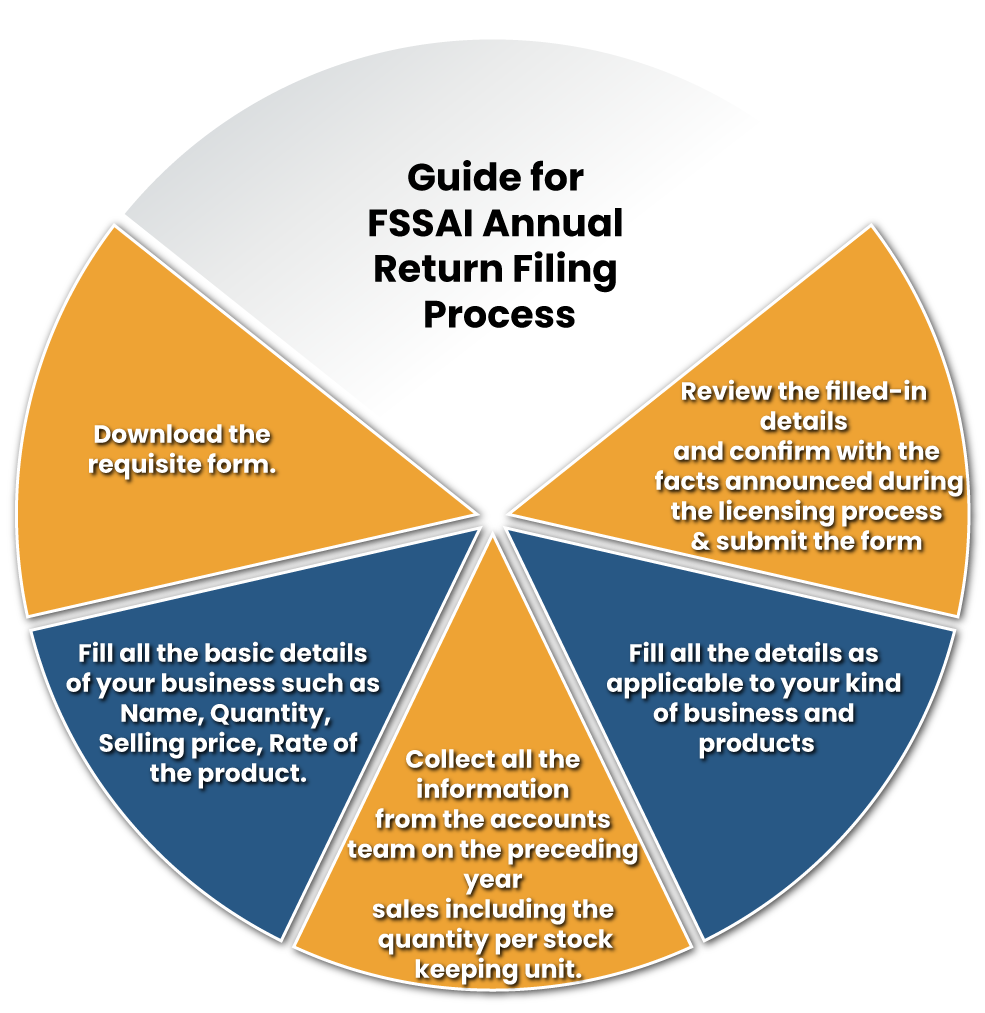

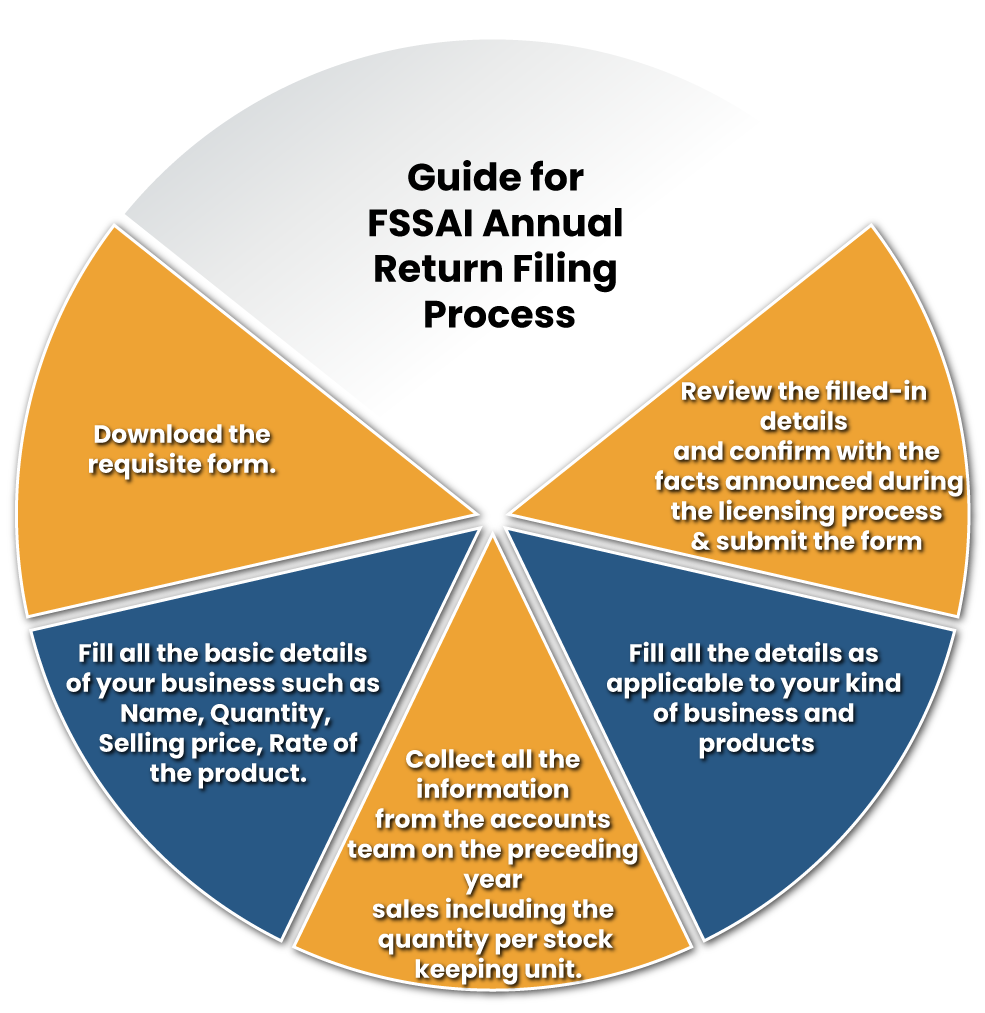

Guide for FSSAI Annual Return Filing Process

The below listed are the steps to be required while filing the FSSAI Annual Return by FBO

Step 1

On the basis of nature of business, you should download the requisite form.

Form D1

FSSAI Form D1 must be filled by all food manufacturers, importers, labelers, re-labels, packers and re-packers etc

Form D2

The FSSAI Form D2 is filed by the person who is involved in the business of manufacturers of milk and dairy products.

Step 2

Fill all the basic details of your business such as Name, Quantity, Selling price, Rate of the product.

Step 3

Collect all the information from the accounts team on the preceding year sales including the quantity per stock keeping unit.

Step 4

Fill all the details as applicable to your kind of business and products. If you do not have any business in last year then type “Nil” there.

Step 5

- Review the filled-in details and confirm with the facts announced during the licensing process.

- In case of any deviation, update the license by applying for modification.

- On finalizing the details, FBOs can send the details either through registered post or email to the licensing authority within their respective jurisdictions.

What if FBO Forgets to File the FSSAI Annual Returns?

According to the section 2.1.13 (3) of FSS Act 2006[1], deletion of license terms will always be penalized. Therefore, any delay in filing of FSSAI annual returns before May 31 of each year will attract a penalty of Rs 100 per day.

FBOs who are Exempted from FSSAI Annual Return Filing Process

Listed below FBOs are exempted from process of filing the FSSAI Annual return:-

- Fast Food Joints

- Restaurants

- Grocery Stores

- Canteens

Benefits to File Annual Return Online

The revised format of FSSAI annual returns has already been incorporated into the Food Safety Compliance System FosCoS and the utility of online submission to submit annual returns is being used voluntarily by the food business.

The mandatory provision of filing returns online will not only facilitate food business operators but will also facilitate ease of doing business and will assist in the creation of national level databases. This will lead to further gains, which are

- Food business is not needed to keep receipts and records of physical nature.

- FBOs will be secured from inadvertent penalties.

- Reminders for submission of annual returns will be sent digitally.

- Updated data will be available, as all analyzes so far have been based on data provided by the food business at the time of procuring the food license.

- For the food business engaged in the manufacture of milk and milk products, half-yearly returns will be discontinued. They have to file annual returns for the manufacturers as per the revised format.

Concluding Remark

It is the duty of every food business operator whose business turnover is 12 lakhs or more to file FSSAI annual returns. FSSAI’s annual return file by the company which is registered as per the requirements of FSSAI will enhance the overall reputation of the company in public domain. FSSAI annual returns increases the brand value of the company. You may kindly associate with the CorpBiz expert to know more about the FSSAI annual return filing process.

Read our article:FSSAI Annual Return Filing – Form D1 Due Date 31st May