The Government of India introduced the Food Safety and Standards Act 2006 to regulate the import, distribution, storage, manufacturing, sale of food products. Obtaining food licenses, displaying licenses within the premises and on food articles is essential for every food business operator. Similarly, every food business operator must file FSSAI annual returns by using Form D1. But due to the prevailing lockdown for COVID-19 pandemic in India, food business operators face difficulties in submitting annual/half-yearly returns.

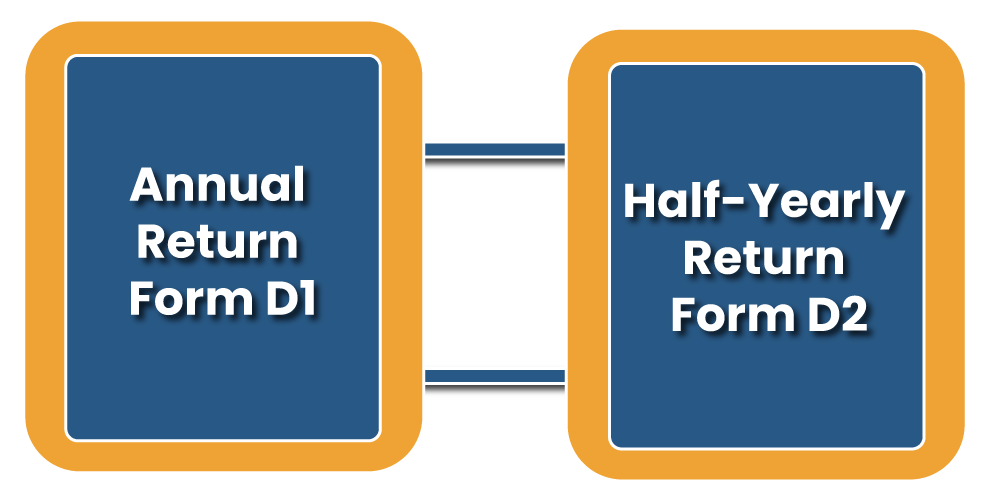

What are the Types of FSSAI Annual Return?

There are two types of FSSAI return filed in India, which are as follows:-

FSSAI Annual Return- Form D1

Form D1 is the annual return to be filed by all Food Business Operators with FSSAI license.

Who Needs to File Form D1?

The individuals discussed below are required to file FSSAI annual returns in Form D1 to the Food Licensing Authority in respect of the category of food products manufactured or sold by them during the preceding financial year.

- Every FBO except the ones dealing in milk & milk products;

- Food manufacturers;

- Importers;

- Labellers;

- Packers

In this form, food products are handled, manufactured and exported throughout the year. The period of annual return filing is from 1st April to 31st March of each financial year.

How much Penal Interest FBO Needs to Pay in Case of Form D1?

As per the section 2.1.13 (3) of FSS, the Penal Interest of ₹ 100 per day is charged on FBO for not filling Form D1 on time. Therefore, it is advisable in time to file the annual return.

Particulars Needed to be Provided in Annual Return

The list of details given below is required to be provided in the annual return:-

- Size of the package and,

- Value;

- Details of the premises from where goods are exported

- Name of the food product;

- Quantity in Metric Tons;

- Sale price per Kg;

- Rate per unit or Kg of packing C.I.F. / F.O.B;

- Export & import quantity (in Kgs)

Read our article:Everything you need to know about FoSCoS – Food Safety Compliance System

Filling Of FSSAI Annual Return

FBOs can file FSSAI Annual Returns as per their convenience. Form D1 is also available in physical manner. Therefore food business operators can file annual returns electronically or physically as appropriate for them.

Provisions of Food Business Operators to File Return Online

In the absence of any online platform for FBO to file returns online, presently, the returns (whether annual or half-yearly) are being submitted physically to the authorities.

In the Covid 19 pandemic phase, the same has been facilitated by allowing the submission by email and the last date has been extended till 31st December vide FSSAI order number 15 (6) 2020 / FLRS / RCD / FSSAI, dated 31st July 2020. FBOs are needed to maintain the record of submission of annual returns for future.

Benefits of Annual Return Online

The revised format of annual return has already been incorporated in Food Safety Compliance System FosCoS[1] and utility for online submission of Annual Return is being used by food business voluntarily.

The provisions of mandatory online submission of returns would not only facilitate the food business operators but also ensure ease of doing business and help in creation of national level database.

- Food business is not required to maintain receipts and records of physical nature.

- Food Business Operator will be protected from inadvertent penalties.

- Reminders will be sent digitally for submission of annual returns.

- Country / State-wise analysis of data will be possible

- Updated data will be available, as all analyzes so far have been based on data provided by the food business at the time of obtaining licenses.

Steps to be Taken to File an Annual Return

Below discussed are the steps to be taken to file an FSSAI Annual return electronically-

- Download the required form as per the food product from the official website of FSSAI.

- Fill all the basic details related to the business

- Information related to the last year sales and quantity produced have to be collated and filled up in the form as per the relevant financial statements

- Fill all other details related to the food product of the business like, the name of the product, size of packaging material, quantity, sale price, imported quantity, name of the country, etc

- If this is your first year of performing business activities then put the details as nil

- Once all data is ready, submit it. However, this return has to be sent via registered post or email to the licensing authority of the concerned jurisdiction.

- FSSAI does not confirm or accept submission of returns. So keep a filing copy with you.

List of Food Businesses Exempted For Filing FSSAI Annual Return

Below discussed food business operators are exempted from filing the FSSAI Annual return:

- Fast Food Joints

- Restaurants

- Grocery Stores

- Canteens

Concluding Remark

FSSAI annual return filing is a difficult and tedious process. Every restaurant, food distributor, manufacturer, handler, transporter, etc. should file an annual return.

With the help of an expert, FSSAI annual return can be filed within the time and appropriately in the applicable forms with the prescribed authority. You may kindly associate with the Corpbiz expert to know more about FSSAI annual return for your business.

Read our article:A Complete Overview of FSSAI Annual Return