Every individual who is earning taxable income is needed to file ITR to report their tax obligations and income. However, the IT laws in our country provide for deduction/collection of tax at source (TCS/TDS) itself.

Nonetheless, this ensures the uninterrupted flow of revenue towards the Indian Government and also curbs tax evasion activities. It is the Taxpayer’s responsibility to deduct tax i.e. TDS/TCS and pay it to the credit of the Government. This article will explore the provision related to the Form 16B.

Obligation on Deductor for filing TDS

Tax deduction of that sort seeks the Tax deduction Account Number (TAN) from the taxpayers. Deductor is also accountable for filing TDS rendering details of deductees, type of the payment made, deducted tax, tax slab rate applied on the income for every quarter of a financial year. The TDS returns filed to allow the IT department to render credit of Tax deduction at source to the right deductees. In addition to that, the deductor is also liable to render a TDS certificate to the deductee for such tax deduction.

Form 16B is referred to as a TDS certificate[1] issued by the deductor as per the rule of IT Act, 1961 to the deductee in the context of TDS deposited to the government.

Nature of Tax Deduction and the Person Accountable for Deducting Tax

The section encloses the following provisions:-

- There is a transfer (apart from compulsory acquisition) of immovable property.

- The immovable property indicates the establishment/land/part of the building. Agricultural land is not included.

- The buyer is accountable for paying deliberation to the seller in the context of such transfer.

- The transfer is for a consideration of fifty lakh rupees or more.

- The buyer should deduct tax at the rate of one percent of consideration while making a payment or at the time of the event.

- If the seller fails to renders PAN then TDS shall be deducted at the rate of twenty percent as per Section 206AA.

Form 26QB and Form 16B

Form 26QB is referred to as a challan for TDS payment to the Government which shall be submitted online for tax deducted as per Section 194-IA.

Due date

Form 26QB shall be submitted within the timeline of thirty days from the end of the month in which deduction took place. For instance, if credit/payment is made on April 16th, Form 26QB shall be submitted by May 30th.

Instalments

In the event of credit/payment in instalments, as TDS is needed for each instalment, Form 26QB shall be submitted such deduction.

Multiple Parties to the Transaction

Form 26QB shall be submitted for each seller combination and buyer.

Example 1: Suppose there are two sellers S1 and S2 and one buyer B1, Form 26QB shall be submitted independently for B1 & S1 combination & B1 and S2 Combination, henceforth overall two forms to be filed.

Example 2: In the view of the above example, if the second buyer, B2 is appended, Form 26QB shall be submitted independently for B1 and S1 combination, and B1 & S1 combination & B2 and S2 combination, henceforth, as a whole, a four form to be filed to address such situation.

What if TAN is Available with the Payer?

As per the above information, availing of TAN is compulsory for all deductors to become eligible for deducting TDS and pay it to the government. It is also essential to mention TAN in all correspondence with the IT (TDS) department.

TDS is needed to be paid via challan no: ITNS 281. But, in the event of immovable property transfer, the involved parties fail to use Challan No. ITNS 281 in the absence of the TAN and availing TAN for a one-off transaction is not viable. Henceforth, as Section 194-IA, the deductors are allowed to file TDS return without TAN. In addition to that, an independent challan form 26QB has been made available to deductors to file TDS return without TAN for Section 194-IA.

Form 26AS – It takes around seven days for the tax credit to have arrived in the seller’s Form 26AS from TDS payment.

Due date for Issuance of Form 16B

Deductor shall furnish Form 16B to the payment within fifteen days from the due date for submitting Form 26QB and Form 16B can be downloaded from TDS Reconciliation and Analysis and Correction Enabling System, also known as TRACES.

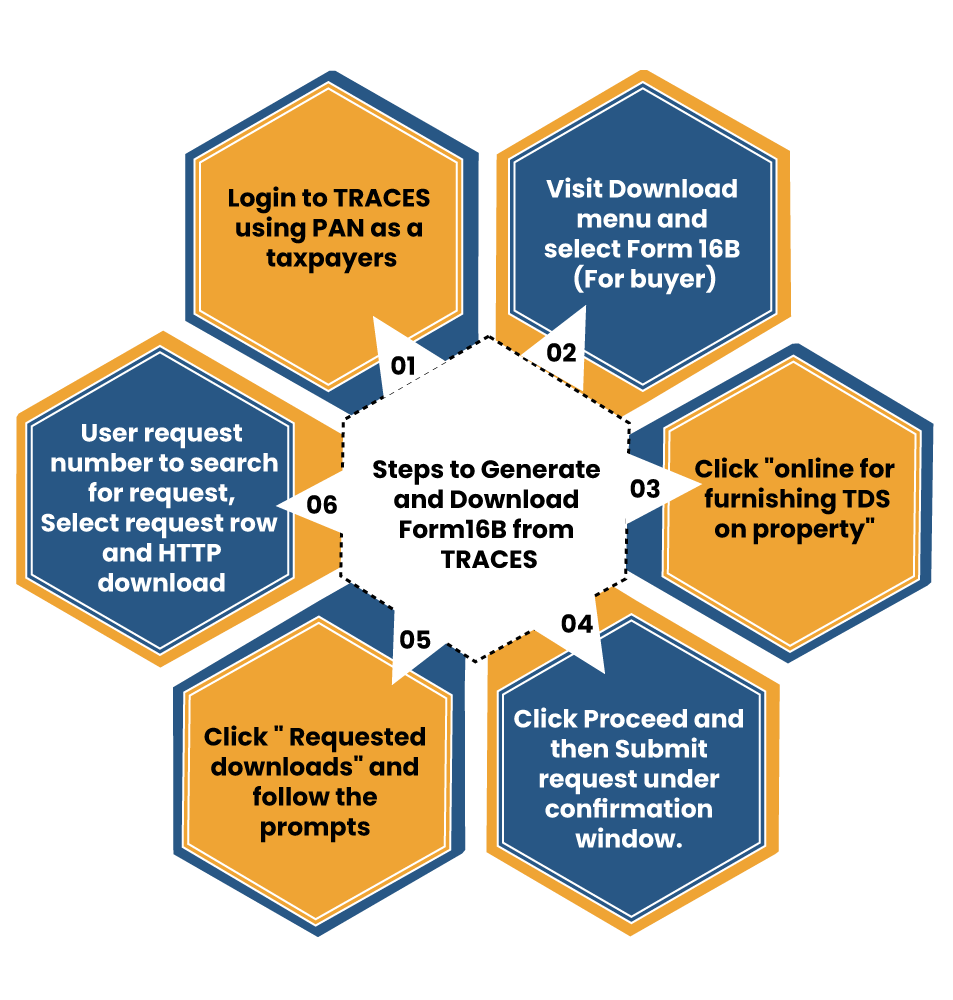

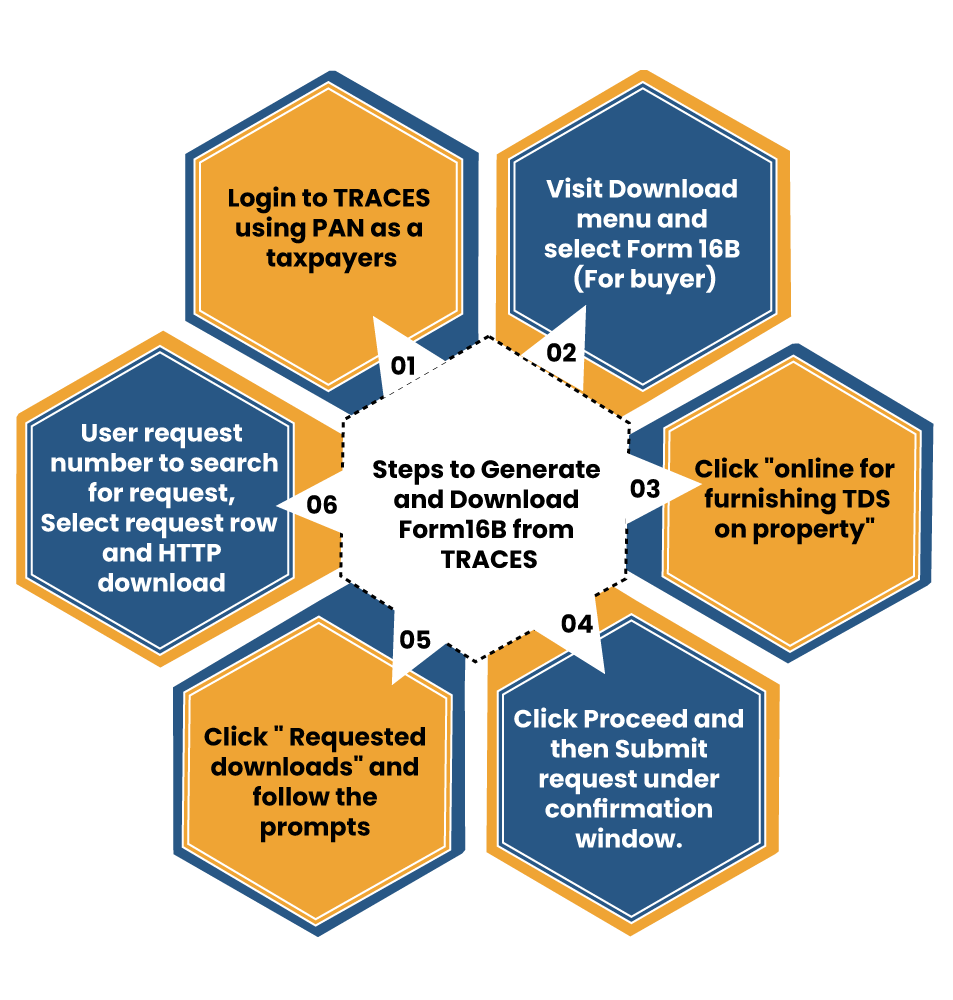

Steps to Generate and Download Form16B from TRACES

- To get started with the downloading process, head over to the TDS website and select Register as New User> Taxpayer.

- Completes the registration formalities.

- Post-registration, try to log-in to the website as an Indian Taxpayer.

- Next, fill in the requested details.

- Just below the download menu, select “Form 16B (For Buyer)” and fill up appropriate information related to the transaction to download Form 16B.

- Fill in the requested details, and tap on the Submit request to furnish a request regarding the generation of Form 16B under TDS.

- After furnishing the required details, a new page prompts on the screen related to the confirmation. You are advised to note down the request number for further correspondence.

- Next, select “Requested Downloads” to download Form 16B with the help of the request number.

- Choose the Row and tap on the HTTP download button. A screen will prompt a long list of forms after a few seconds. Once appeared, all you need to download the form as per the transaction.

Conclusion

The selling immovable property lures a certain amount of tax that has to deduct by the seller. Form 16 is a kind of certificate that is used to serve such a purpose. It consolidates the information about the TDS based on Section 3 of the IT Act, 1961. Drop the mail or message in case you want further clarification on this topic, CorpBiz’s experts will try to address your queries with utmost diligence and care.

Read our article: All about Documents Required for TDS Return filing