Tax Deducted at Source is the advanced tax paid by any person or entity for making expenses, expenses of professional fee, interest, salary, dividends and royalty amongst others as per prescribed tax slabs by the government. TDS return filing assists the government to prevent tax evasions. In this blog, we will discuss everything about the documents required for process of TDS Return filing.

Categories of TDS Return Filing

The employer has a Tax Collection and Deduction Account Number also known as TAN by which the employer files TDS return. For which, following are the categories under which filing of TDS return is done for businesses and individuals-

- Salary of an Individual;

- Income from Insurance Commission;

- National Saving Scheme Payment.

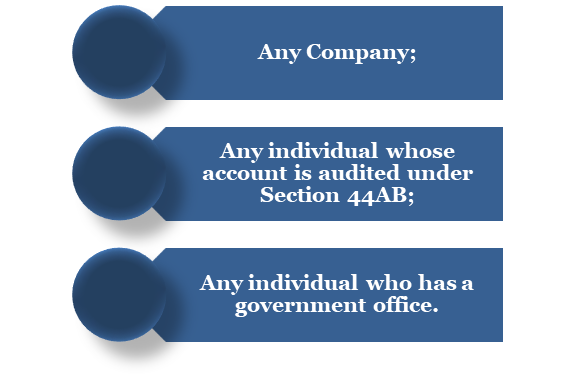

If there is any delay in filing of TDS return by individual or entity, then they will be punished with appropriate fine. The eligible group under which filing of TDS return is done by electronic means are-

Read our article:All about Benefits of TDS Return Filing in India

Documents Required for TDS Return filing

The tax system in India is governed by Income Tax Act, 1961[1]. It states that income tax returns should be filed annually for any individual or business enterprise that has received income during the following year. The income should come from a legal source. If you keep all the necessary documents handy, the process of Filing for TDS return becomes easy and less time taking. The below-mentioned documents are required for TDS return filing.

General Documents for TDS return filing

- TDS certificates;

- Tax payment challans (Self-assessment, advance tax);

- PAN card details;

- In response to a notice received from Income Tax department-You need the details of the Original return or details of notice;

- All Bank account information.

Salary income

- Form 16;

- Salary Certificate.

FORM 26 AS

It is a combination of tax credit statement issued to a taxpayer. It shows that Income tax has been deposited with the government related to the taxpayer and Form 26AS is compulsory to be issued Under Section 203AA of the Income Tax Act, 1961.

Form 26AS consists of all the details of the taxes paid and deposited with the Department of Income Tax.

Interest Statement of the Income

- TDS certificate issued by banks;

- Interest income statement for FDs;

- Bank statement or passbook for interest on savings account.

House Property

- Property Tax or Rent details;

- Interest certificate issued by the bank for housing loan;

- Co-owner details;

- Address proof of the property.

Capital Gains

- Reserve statement in case of trading in shares etc;

- Sale and Purchase Deed of the property consisting of stamp deed of the property for land or building;

- Re-investment purchase deed to claim immunity from Capital Gains;

- Cost of purchase, cost of improvement and value of sale in case of other capital assests;

- Documents for cost of improvement;

- Capital Gains Accounts Scheme consisting of details of investment;

- Details of expense that has incur on transfer.

Section 80 for Investments

Section 80C is a documents used for investment credentials. The investment made under PPF, ULIPS, NSC, LIC, ELSS qualify for deductions under Section 80C.

Tax Savings Investments

- Tuition fees receipts;

- Repayment certificate for housing loan;

- PPF passbook;

- Life and medical insurance payment receipt;

- Fixed deposit receipts;

- Donation receipts;

- Deposit receipts of senior citizen saving scheme.

Other sources

- Rent agreement for plant & machinery given on rent;

- Receipts of any income from winning lottery etc;

- PPF passbook for interest;

- Interest certificates on bonds;

- Dividend warrants/amount;

- Details of accrued interest during the year;

- Bank Passbook/Statement or interest income certificate.

Conclusion

Tax Deducted at Source or commonly known as TDS in India. Any company or any individual making payment needs to deduct tax at source if the payment exceeds the prescribed limit by the government. Documents required for TDS Return filing are to be submitted by tax payers to the government. Tax Deducted at Source (TDS) is the advanced tax paid by any individual or entity for making contact payments, payments of professional fee, interest, salary, dividends and royalty among others as per prescribed tax slabs by the government on behalf of the payee.

Read our article: TDS on Cash withdrawal and Refund of TDS excessively deposited: Latest Orders