The adoption of any business model in India requires registration under the relevant authority. Whether you want to commence a manufacturing unit of electronic items or form a finance company, registration is the primary requirement for all business nature. Anyway, in this blog, we will be looking into the document For Registering Microfinance Company. Microfinance Company is the one-stop destination for the poor and unemployed individuals seeking financial aid without any collateral. Therefore, microfinance companies could be deemed a financial reservoir for those who lack adequate resources to procure funds to meet their basic requirements.

People interested in setting up this business model need to go through a prescribed registration procedure that attracts ample documentation. Microfinance companies can be formed in two ways:-

- NBFC governed by the RBI regulation

- Section 8 companies regulated by the Company Act 2013

Given the form of the business models, the documentation for registering Microfinance companies varies considerably. The given sections would provide a complete briefing on documentations related to the registration of the microfinance companies based on these two business models:

Read our article:Micro Finance Company Registration: Complete Process

Documentation for NBFC-based Microfinance companies

Document For Registering Microfinance Company as NBFC:-NBFC business model is more of a legitimate version of the financial entity as most third-part lenders are regarded as NBFCs. If you wish to opt for this business model to establish a microfinance company, you must provide the following documentation.

Those are as follows:-

- Memorandum of Association exhibiting the company’s goal, work methodologies, and identity.

- Articles of Association containing the company’s rule, hierarchical information, management details, and internal working.

- Incorporation certificate issued by the Ministry of corporate affairs.

- Board resolution copy generated during the AGM in the presence of the board members.

- Receipt of the fixed deposit issued by the bank.

- No Lien certificate* stating detail of net owned fund issued by the bank.

- Banker’s confidential report briefly illustrating the company’s track record related to banking activities.

- The latest credit report of directors issued by respective banks showing existing credit information

- Director’s net worth certificate certified by a Chartered Accountant.

- Documents displaying professional & academic qualification proof of the directors.

- KYC of the existing director

- Director’s income proof such as receipt of ITR or bank statement.

- Document illustrating working experience of the active directors in the financial sector.

- Structure plan of the business premises where applicants proposed to conduct the business activities.

Documentation for Section 8 based Microfinance companies

Document For Registering Microfinance Company as section 8 company:-In case if you want to set up the microfinance establishment under the canopy of section 8 of the company Act 2013[1], you would need the following documents for registration.

- Scanned copy of the PAN card of all directors.

- Documents regarding the address and identification proof of the core members of the establishments i:e directors and promoters.

- Lease deed, rental agreement, or property’s ownership documents.

- NOC issued by the owner in case of the rented property.

- Applicable stamp duty as mandated by the state

- Any other documents as required

Setting up an establishment is one of the most significant financial decisions ever made by an individual in a lifetime. To ensure a seamless establishment of an entity, one has to steak around with prescribed registration procedures. One wrong step could push you month’s ways from being an authorized entity. Therefore, adopting the right approach is hugely crucial for someone who wants to set up a business entity in the first attempt.

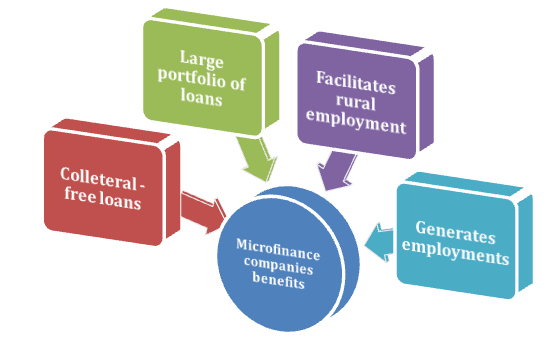

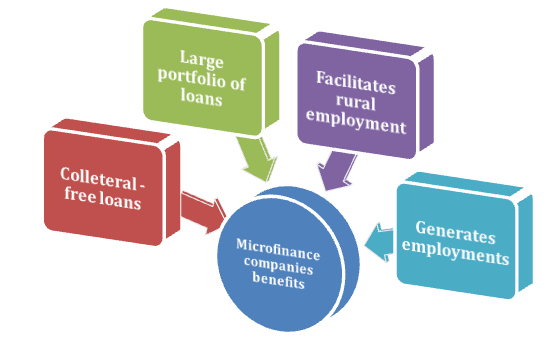

Facts about microfinance companies that worth your attention

- Department of Revenue is responsible for the issuance of a corporate lien certificate*. It typically reflects the liabilities of the entities in the context of corporate tax.

- Under the NBFC business model, the applicant needs to furnish MOA, AOA, and Board resolution copy as a part of the documentation for registration of Microfinance Company.

- RBI is the governing body that regulates the activities of microfinance companies.

- The approval process for microfinance companies is not instantaneous as authority needs some time to scrutinize the documents.

- Microfinance companies primarily provide financial service to the unprivileged section of society.

- Microfinance companies facilitate rural employment at a larger scale.

- Microfinance companies could generate significant employment.

- Most of the financial lending services at microfinance companies are collateral-free.

- Individual with a poor financial background can easily avail loans from these companies.

- Microfinance companies usually offer low repayment rates when contrasted with trading lending companies.

- Microfinance companies exercise harsh repayment protocol for the recovery of their money.

- Their interest rate could be harsh as compared to other financial institutions.

- Microfinance companies usually compromise ethical business practices for the sake of profit and efficiency.

- They usually have large loan portfolios with undercover conditions that are vicious in nature.

Conclusion

Microfinance companies are more vulnerable to cancellation as far as the registration is concerned. The reason is that the registration for Microfinance firms lures a significant number of documentations that are sensitive in nature. You or company members could possibly make a huge mistake while preparing or arranging these documents for the registration process. In those circumstances, we strongly recommend you hire experts to complete the registration formalities with ease.

Read our article:Easy guidelines for starting a microfinance company in India