If you are willing to make a significant investment in Microfinance business, this would probably be your best bet. Microfinance business is thriving rapidly ever since it gets a much-needed boost from the government. But colossal success should not be the only criteria for selecting a particular business model. For long-term sustainability and profit, one has to look into every aspect of this business. In this blog, we will be looking into this business model inside out and try to point out the Advantages and Disadvantages of Microfinance Company.

Microfinance company- General overview

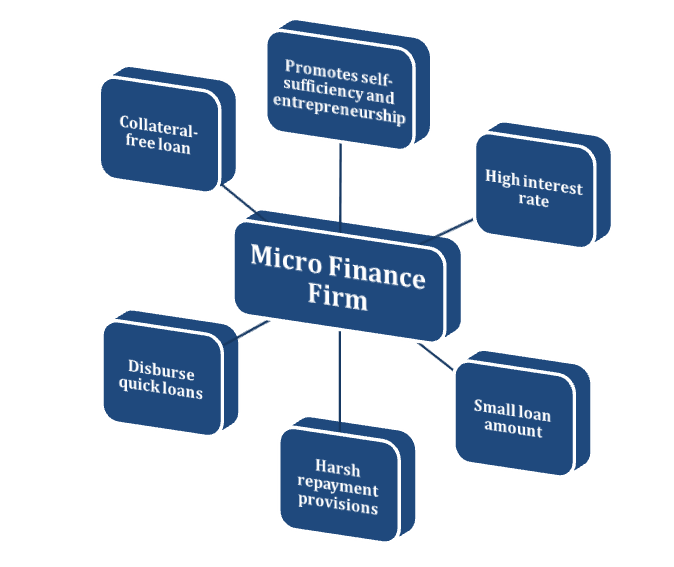

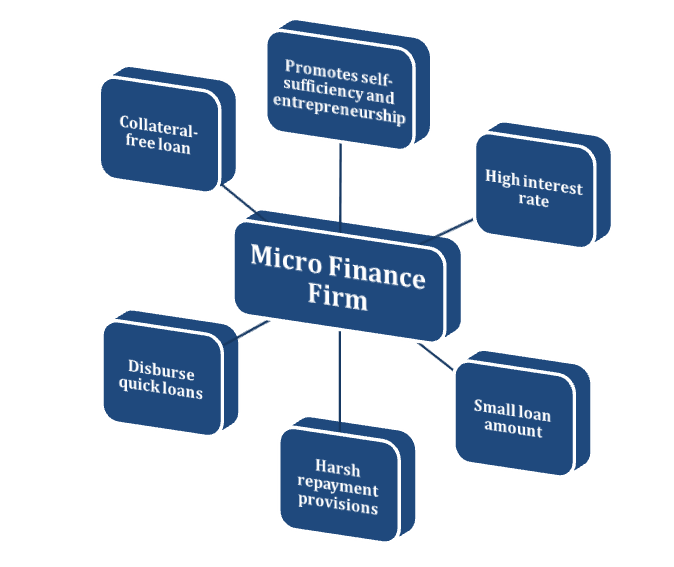

Microfinance companies primarily benefit the low-income group and the underprivileged section of the society. Providing easy funds without the collateral is one major highlight of this business model. They are only eligible to give the credit up to Rs. 50,000 and Rs. 1, 50,000 to people from rural and urban areas. Microfinance companies objectively aid people from low-income groups by providing them credit through relaxed provisions. Microfinance Company can be formed through the following business models:

- NBFC

- Section 8 companies

NBFC based model is quite popular because of its versatility and flexibility in terms of exposure and compliance. Section 8, on the other hand, is preferred by those who don’t have substantial resources to set up a company. Just like other financial institutions, Microfinance firms are also governed by the RBI’s provisions.

There is no way these firms can alter the interest rate or any other services parameter without the permission of RBI. They are liable to execute their business activities under prescribed guidelines. RBI approves the application for registration of microfinance companies and the applicant has to furnish plenty of documents for this purpose. Now let’s move to the next section i.e. Advantages and Disadvantages of Microfinance Company.

Advantages of Microfinance Company

Collateral-free loans

Most of the microfinance companies seek no collateral for providing financial credit. The minimum paperwork and hassle-free processing make them a suitable option for quick fundraising.

Disburse quick loan under urgency

The financial crisis is inherently unpredictable as it could creep up at any point in time without intimating anybody. Thanks to microfinance companies that can provide secure and collateral-free funds to an individual in the demanding situation to meet their financial need.

Help people to meet their financial needs

The renowned financial institute provides unparalleled services when it comes to loans or credit. But the worst part is that they are not accessible to low-income groups. Microfinance companies, however, offer different proposition altogether. They are dedicated to serving a poor and unemployed individual by providing them easy financial credit.

Provide an extensive portfolio of loans

Microfinance companies are not only limited to providing emergency credit but also capable of disbursing housing loans, business loans, and working capital loans with minimum formalities and processing.

Promote self-sufficiency and entrepreneurship

Microfinance companies can provide much-need funds to an individual for setting up a healthy business that seeks minimum investment and offers sustainable profit in the long run. Thus, these companies ensure entrepreneurship and self-sufficiency among the lower-income group.

Read our article:Micro Finance Company Registration: Complete Process

Disadvantages of Microfinance Company

Harsh repayment criteria

In the absence of the legit working protocol and compliances, Microfinance Companies could adopt a harsh repayment approach that someone would not prefer in the state of the financial crisis. Easy debt never comes with relaxed conditions, and that is something true with microfinance companies as well. Since these companies work under strict compliances, they could manipulate their customer for repayment unethically.

Small Loan amount

Unlike mainstream financial banks, Microfinance Companies offers a smaller loan amount. Since these banks don’t ask for collateral against the credit, the disbursement of the large loan amount is practically impossible in their case.

High-interest rate

Another problem with Microfinance Companies is that they were unable to render low-interest based loans. This is because they don’t follow traditional banks’ footprint, where the accumulation of funds is easy. Plus, they have to borrow money from these banks to execute appropriately and allocate some part of it for risk management[1]. Hence operating cost per transaction is quite high for them despite the high volume of transactions per day.

Unlike banks, the microfinance institution accumulates funds through private equity to render financial services. This primarily implies that these firms are under relentless pressure to create more profit for their investor, consequently forcing them to crank up the interest rate.

Conclusion

That’s our take on the Advantages and Disadvantages of Microfinance Company. Microfinance is a great business model for someone who wants to work for the well-being of the underprivileged section of the society. However, there are many hidden challenges that one has to face while conducting such business activities. This business model probably won’t give you higher ROI, but it can ensure optimum growth due to stable demand for credit. Hence, we can conclude that Microfinance business is more of an initiative than a company that works beyond the scope of profit. It’s the replica of an NBFC business model that works in a confined landscape and facilitates financial services for needy ones. If you are serious about investing in such a business model, then applying for registration is the first thing you need to do for the establishment.

Registration could be a daunting errand for someone who is not familiar with compliance requirements. If you want to make your registration journey more comfortable, we would suggest you connect with CorpBiz’s professional as they have years of expertise in this field.

Read our article:A Complete Checklist of Document for Registering Microfinance Company in India