Committees or Board Committees as per Companies Act, 2013 are formed to perk up effectiveness and competence, in areas where more focused, specific and technical dialogues are required. These Committees prepare the ground for decision-making and report it in subsequent Board Meeting to achieve the desired results. The Committees as per Companies Act, 2013[1] can be set up for short term basis, temporary or permanent basis. The article will discuss the different Committees as per Companies Act, 2013 and their functioning according to the rules prescribed in the Act.

What is the Different Types of Committees as per Companies Act, 2013?

The different types of Committees as per Companies Act, 2013 are:

Audit Committee

The primary purpose of this Committee is to provide supervision of the financial reporting process of the Registered Company, the audit procedure, the Company’s method of internal controls and compliance with other laws and regulations.

The composition of Audit Committees as per Companies Act, 2013, is as follows:

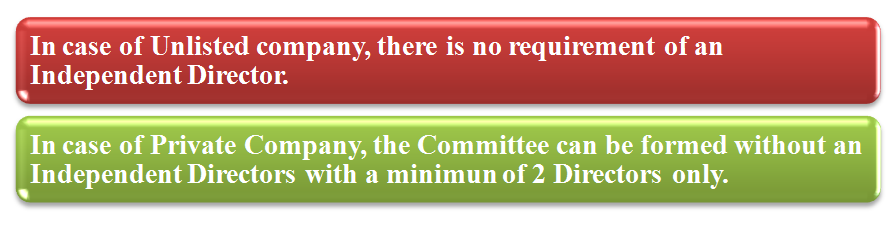

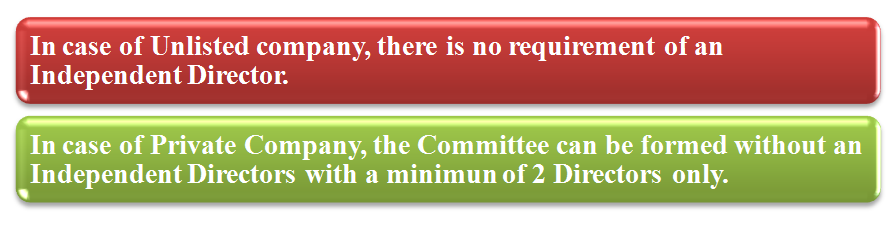

- Minimum 3 Directors with Independent Directors forming majority

- Members including the Chairman of Audit committee should be able to read and understand, the financial statement

The composition of Audit Committee as per Clause 49 of the Listing Agreement is as follows:

- Minimum of 3 Directors of which 2/3rd are Independent Directors

- All members should be financially literate, and at least 1 member shall have accounting or related financial management expertise.

Nomination and Remuneration Committee

The Nomination and Remuneration Committee ensure a fair transparent and equitable remuneration to employees and Directors based quality of people, their presentation and potential to run the Company successfully.

The composition of Nomination and Remuneration Committees as per Companies Act, 2013, is as follows:

- Minimum of 3 Non-Executive Directors and a half shall be Independent Directors.

- Chairperson may be appointed as a member of Committee but will not chair such Committee

The composition of Nomination and Remuneration Committee as per Clause 49 Listing Agreement is as follows:

- At least 3 Non-Executive Directors

Stakeholders Relationship Committee

This Company is formed to settle the grievances of stakeholders. Section 178 of Companies Act, 2013, states that a Company which holds 1000 number of shareholders, debenture holders, deposit holders, and any other security holders at any time during a financial year.

The composition of Stakeholders Relationship Committees as per Companies Act, 2013, is as follows:

- 1 Chairperson who shall be Non-Executive Director and such other members as decided by the Board

The composition of Stakeholders Relationship Committee as per Clause 49 of the Listing Agreement is as follows:

- Chairmanship of Non-Executive Director and such other members as decided by the Board.

Read our article:What is GDR (Global Depository Receipt): An Overview

Corporate Social Responsibility (CSR) Committee

A CSR Committee is a way of conducting business, by which corporate entities visibly contribute to social good. Section 135 of Companies Act, 2013, with Companies (CSR Policy) Rules, 2014 states that every company having a net worth of not less than Rs. 500 crores or more, or turnover of not less than Rs. 1000 crores or more shall constitute a Corporate Social Responsibility Committee.

The composition of CSR Committees as per Companies Act, 2013, is as follows: In the case of listed Company at least 3 Directors, out of which one should be an Independent director

What are the functions of Committees as per Companies Act, 2013?

The primary function of the Committees as per Companies Act, 2013 is as follows:

Audit Committee

- To recommend appointment, remuneration, and terms of appointment of the auditor of the Company.

- At the Annual General Meeting, the Chairman of the Committee should be present to answer the shareholder’s inquiry.

- To establish a Vigil Mechanism Policy

- To call for remarks of the Auditors about the internal control system

- To discuss any issues related to internal and statutory auditors and the management of the Company.

- To inspect in any subject concerning the items or referred to it by the Board.

- To obtain skilled advice from outside sources.

Nomination and Remuneration Committee

- To review the elements of the remuneration package, structure of remuneration package.

- To review the changes to remuneration package, terms of appointment, severance fee, recruitment and, termination policies and procedures.

- To recommend the shortlisted candidates who are qualified to be Director and who can be appointed in senior management

- Recommendation of success plans for the directors

- The Committee is authorized to seek information about any employee, and the management is directed to co-operate.

- The Committee can be present at the Annual General Meeting to answer the shareholder’s queries.

Stakeholders Recognition Committee

- To examine and resolve the grievances of security holders of the Company

- To look into redressal of shareholder and investor complaints like transfer of shares, non-receipt of the balance sheet, etc.

- To expedite the process of share transfers.

Corporate Social Responsibility Committee

- To suggest and devise a CSR Policy according to the Schedule VII of the Companies Act, 2013 to the Board.

- To recommend the amount of expenditure of the devised policy above.

- To monitor the CSR Policy of Company from time to time and prepare a transparent monitoring mechanism.

- Institution of a transparent monitoring mechanism for implementation of the CSR projects or programs or activities undertaken by the Company.

Conclusion

There is an expansion the number of Committees as per Companies Act, 2013 which provide duties for each of them as compared to the 1956 Act. Further, an attempt is made to bring the law laid down for Committees as per Companies Act, 2013, in consonance with the Listing Agreements. It is better to consult an expert to understand the functionality of the Committees as per the Companies Act, 2013. We at Corpbiz have professionals who can assist you with it. Our professionals will plan ideally and will make sure the successful completion.

Read our article:Companies Act 2013 Provides a Procedure for Appointment and Resignation of the Directors