An Annual General Meeting is that time of the year in a company when all the important officials of the company come together and make important decisions on matters of the company. Furthermore, it is mandatory for every company except OPCs to hold the AGM every year, as specified under Section 96 of the Companies Act, 2013. This blog is a perfect guide for young startup companies who do not know much about company compliances and can help them avoid failure.

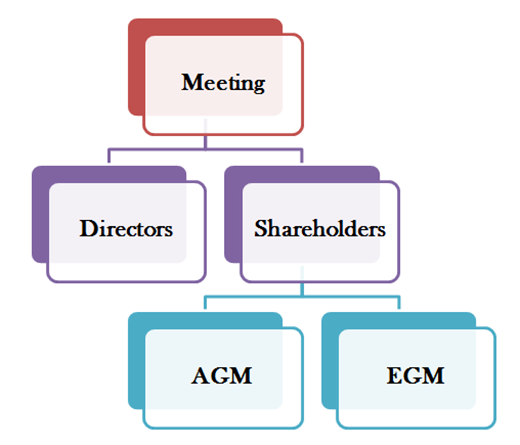

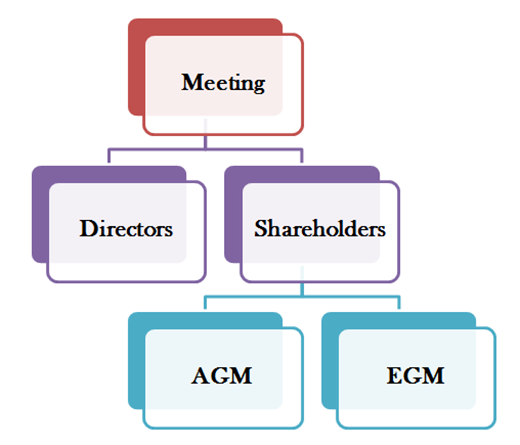

Type of Meetings in a Company

Generally, meetings in a company are categorized based upon the type of members of the company meeting. With this in mind, meetings in a company can be grouped as, one involving the Directors of the company and the second in which the Shareholders of the company partake in the meeting. Furthermore, there are two types of meetings involving the Shareholders are as follows;

- Annual General Meeting (AGM)

- Extraordinary General Meeting (EGM)

What is an Annual General Meeting {AGM}?

An Annual General Meeting, also known as AGM or annual meeting, is a meeting of the general members in an organization. Generally, an Annual General Meeting includes the member associations and companies with Shareholders.

As per the Companies Act, 2013, every company except One Person Companies are required to hold a general meeting called the ‘Annual General Meeting’ every year. For conducting an AGM, a ‘Notice’ is given to all the shareholders, 21 days prior to the meeting. Moreover, the gap between two consecutive AGMs must not be more than fifteen months.

When and where should the AGM be conducted?

The First AGM should be held within a period of nine months from the date of the closure of the first financial year of the company. However, in the case of consecutive AGMs, it should be held within a period of six months from the date of closure of the financial year.

Furthermore, an AGM is conducted at a day which is not a National Holiday. Additionally, such day should be conducted in the business hours, i.e. between 9 AM to 6 PM. Additionally, it should be held either at the registered office of the company or at a place that is within the city, town or village in which the registered office is located.

What is the Purpose of Holding an Annual General Meeting?

The primary purpose of holding an Annual General Meeting is to allow the Shareholders to vote on matters like the company issues, selection of board directors of the company and informing the members about the previous or future activities of the company. Additionally, in big companies, it is the only time of the year where all the shareholders of the company sit and interact on various issues.

Issues Covered in the AGM

The major agendas covered in the Annual General Meeting are as follows;

- Annual accounts

- Dividend among shareholders

- Director’s report/auditor’s report

- Appointment/remuneration of statutory auditors

- Appointment/ replacement of directors

Due Date of AGM

As per the provisions of the Companies Act, there are three conditions for conducting the AGM. These conditions can be listed as;

- The time period between two consecutive AGMs should not be more than 15 months

- It should be conducted every year

- Six months from the date of closing of the financial year

Quorum for AGM

The quorum or number of members for an Annual General Meeting is as follows;

- Private Companies: Minimum of two members within half an hour of the commencement of the annual meeting.

- Public Companies: At least five members should be present.

Notice for Annual General Meeting

The notice for the commencement of the AGM should be sent to all the members at least 21 days before the meeting along with the annual report of the company. However, a shorter notice can be provided after taking consent from all the members who are entitled to vote at the meeting.

What are the Legal Requirements for Holding an AGM?

Legally, the company sends a notice to all the members of the annual meeting, 21 days prior to the meeting. However, there is an exception to this rule, and a special notice is issued for a shorter notice period, under specific conditions. Furthermore, the following documents need to be sent along with the notice;

- A copy of the annual accounts of the company

- Report on the company’s position in the provided year, prepared by the director

- Auditor’s report of the annual accounts

First Annual General Meeting

The first Annual General Meeting, as the name suggests, is held in the first year of the incorporation of a company. As per the provisions of the Companies Act, 2013, it should be commenced within nine months from the date of the closure of the first financial year of the company.

Subsequent Annual General Meeting

There is a provision to conduct the Subsequent AGM within six months from the date of the end of the given financial year as per the Companies Act.

Exemption of Holding AGM

Provided under Section 96, Sub-section 1 of the Companies Act, 2013 One Person Companies do not need to hold an Annual general meeting. However, they have to pass a resolution as prescribed in Section 122 of the Companies Act.

Extension of Time for Holding AGM

For an extension of time for holding an AGM the company shall apply with an e form GNL-1 mentioning the reasons behind seeking extension and the time period for which such extension is required by the company. The Registrar of Companies is the competent authority to extend the time by three months to hold an AGM. The RoC shall record the reasons behind giving the extension as it is rare situation and without an urgent reasonable ground no such extension is provided to hold the first annual general meeting.

After the Meeting procedure

- The minutes of the proceedings shall be prepared and recorded and within 30 days from the meeting the minutes have to be signed by the chairman.

- Within 30 days from the appointment of directors an intimation of the appointment shall be sent by filing form DIR-12 to the company’s registrar together with the applicable fee.

- Within 30 days of the meeting the copies of special resolution and others shall be filed together with the form MGT-14 to the registrar of companies.

- It is important to file the balance sheet reports and the profit and loss account of the auditors and the directors and also the notice of the meeting in the form AOC-4 within 30 days from the meeting date.

- Deposit of the dividend distribution tax within the specific time limit and at the appropriate rate under the Income Tax Act.

- They shall forward the copy of the balance sheet to the RBI where public deposits were invited by the company.

- A separate bank account as “Dividend Account” shall be opened and the total amount of dividend shall be deposited within the time period of five days.

- Dividend warrants and a notice of dividend to be signed by the authorised persons.

- Within 60 days of the meeting in form MGT-7 the annual return shall be filed with the registrar of companies and in Form MGT-8 there should be the certificate of the company secretary and to verify that the annual return is signed by the company secretary.

- In the cases of listed companies- Within 30 days of the meeting, in form MGT-15 an annual general meeting report should be submitted to ROC.

Consequences of conducting an AGM after the due date

Under the provisions of the Companies Act, companies need to hold the AGM within the specified time. Additionally, failing to do so may lead to legal consequences, including financial punishments.

Furthermore, the defaulting companies have to pay a fine of Rs. 50, 000. Moreover, a fine of Rs. 2500 is levied per day for continuing the default.

In case if the company is ordered to hold the AGM through a tribunal under section 97, such a company is liable for a penalty. In such a case, the company and every officer of such company is punishable for a fine which may extend to Rs. 1 lakh. Furthermore, in case of the continuance of such default, a fine of Rs. 5000 is levied per day in the company.

In Summary

The annual general meeting is obligatory compliance for companies in India. Moreover, companies not holding or conducting the AGM become liable for legal actions taken against them. Furthermore, at least five members in a Public Limited Company and two members in a Private Limited Company should personally attend the AGM. Also, the Companies Act specifies the time of holding an AGM in the business hours and on a day which is not a National Holiday.

Read our article: Appointment and Removal of Auditor in a Privately-held Organization