For facilitating long term debt instruments and for generating capital, Investors use capital markets that involve ADR, GDR, and IDR. The issuance of these receipts is the most efficient and widely known method of raising capital from foreign capital markets. Also, it provides an opportunity for foreign investors to invest in domestic companies. Here, in this article, we will go through the brief details of ADR (American Depository Receipts) and IDR (Indian Depository Receipts) while we will have a detailed overview of the (GDR) Global Depository Receipt.

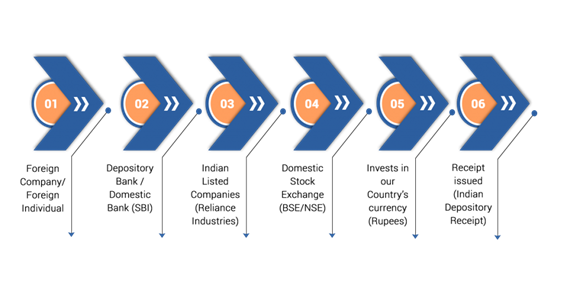

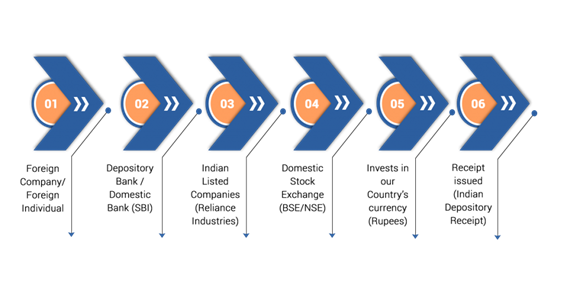

What is Depository Receipt?

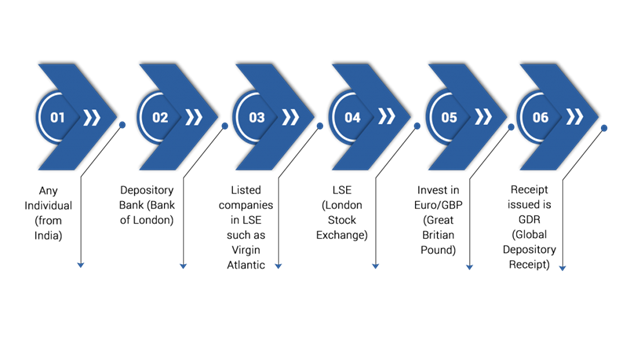

When any foreign company or any foreign individual with the help of Domestic Bank or Depository invests in the Domestic Companies listed in the local stock exchange of that particular country’s currency, the receipt offered to that individual is known as Depository Receipt.

Let us understand this with a simple example

Any foreign individual with the help of a Depository (SBI Bank[1]) invests in the Domestic Company say Reliance Industries listed in the Domestic stock Exchange of our country (BSE/ NSE) in our country’s currency that is Rupees, and then the receipt issued is called Depository Receipt.

The receipt is issued by the Domestic Stock Exchange, such as BSE (Bombay Stock Exchange) or NSE (National Stock Exchange).

Recent Amendment

- The Ministry of Corporate Affairs (MCA) in Gazette of India by notification dated 13th February 2020 notified that the Companies (Issue of Global Depository Receipts) Rules, 2020 new proviso in rule 7 has been introduced that states that the issue of depositories receipt proceeds may be remitted back in an IFSC bank unit and the same shall be utilized according to the instructions issued by the EBI timely.

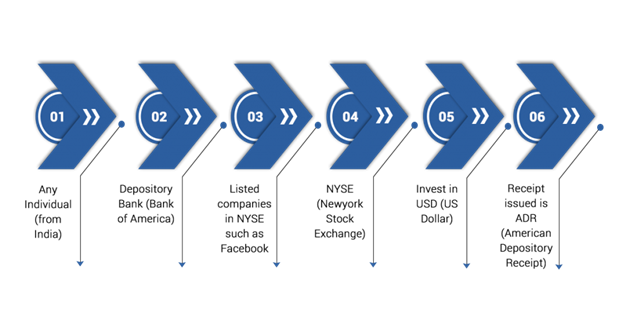

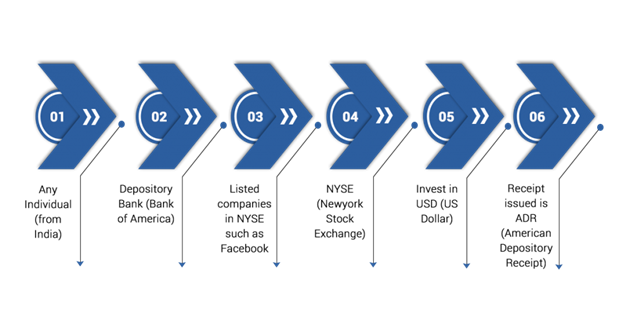

What are ADR (American Depository Receipt) and IDR (Indian Depository Receipt)?

American Depository Receipt

ADR (American Depository Receipt) is a negotiable financial instrument which is issued by a US bank representing securities of a foreign company listed on the US stock market. The domestic investors invest in the companies outside their country where the dividend is paid to the ADR holders in US Dollars.

IDR (Indian Depository Receipt)

IDR (Indian Depository Receipt) is a negotiable financial instrument which is issued by the Indian bank representing the securities of a foreign company listed in the Indian stock market. The US investors invest in the companies outside their country that are in India, where the dividend is paid to the IDR holders in Indian Rupees (INR).

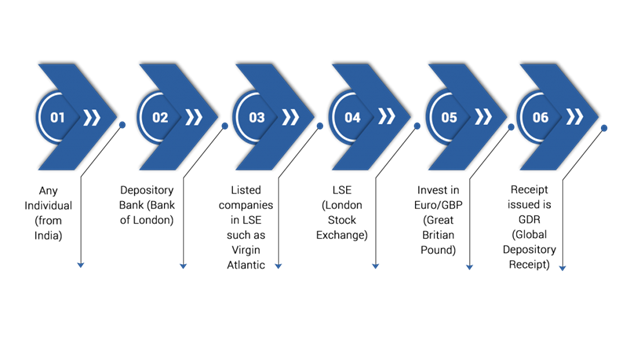

Global Depository Receipt (GDR)

GDR (Global Depository Receipt) is a negotiable financial instrument that is issued by a foreign bank other than the US representing securities of a foreign company listed in any country’s stock market other than the US. The domestic investors invest in the companies outside their country where the dividend is paid to the GDR holders in Euro or GBP.

Characteristics of GDR (Global Depository Receipt)

- Exchange-Traded

GDR is exchange-traded instruments where the intermediary buys a bulk quantity of a foreign company and creates the GDRs which are traded on the local stock exchange. These GDRs are then traded on the multiple stock exchanges of multiple countries other than the US.

- Conversion Ratio

Conversion ration means the number of shares a GDR can hold. Usually, it varies from a fraction to a very high number. Although 1 GDR certificate holds ten shares, the range is flexible.

- Unsecured

GDR is unsecured securities and is not backed by any asset other than the value of the shares that are held in that certificate.

- Price Based on Underlying

The price of a GDR is based on the price of the share that it holds, the supply and demand of a particular GDR.

- GDR is denominated in any foreign currency

The fundamental shares shall be denominated in the local currency of the issuer but GDR is always denominated in foreign currency.

- The holder is entitled to dividend and bonus

On the basis of value of shares under the GDR the holder of the same is entitled to bonus and dividend.

Advantages of GDR to Issuing Company

- There is accessibility to foreign capital markets.

- There is an increase in the visibility of the issuing company.

- Rise in the capital of the issuing company because of foreign investors.

Advantages of GDR to Investor

- It provides more transparency since competitors’ securities can be compared.

- There is the capital gain payment.

Disadvantages of Global Depository Receipts

- Violation of any regulation can lead to serious consequences against the company.

- In GDR, the dividends are paid in the Domestic country’s agency, which is subject to volatility in the forex market.

- GDR is an expensive source of financing for any company.

- It is beneficial to the investors who have the capacity to invest a high amount in GDR.

Procedure for the Issuance of GDR in a Company

- Approvals

For the issuance of GDR, you first need the approval of the Board of Directors, Shareholders, Regulatory Authorities, and Financial Institutions.

- Appointment of Intermediaries

After the approval, intermediaries like Lead Manager, Co-Manager, Overseas Depository Banks, Legal Advisors, Auditors, and Underwriters are appointed as Intermediaries during the creation of GDR of the company.

- Documentation

Principal Documents like Subscription agreement, Depository agreement, and Trust deed are made.

- Pre and Post Launch

In the end, additional key actions like timing, pricing the issue, the closing of the issue are done.

Conclusion

Through Depository Receipt, any foreign individual or company can enter and tap multiple markets to raise funds and establish the trading presence in the foreign markets. Every country across the world wants to expand its business and mark its footprint in the International Market. Global Depository Receipt is one such receipt through which any company can issue shares in another country stock exchange except the US. It provides companies in emerging markets with opportunities that will help in rapid growth and development.

Read our article:10 Simplistic Ways to Manage Accounts Receivable Process Effectively