Company registration in India is governed by the Companies Act 2013, under the Ministry of Corporate Affairs. The cost of company registration in India differs depending upon the types of business entities – Private Limited Company, One Person Company, small companies Producer Company, etc.

The charge is of Rs.6000 for each form on registration of reports under Section 385 of the Act and expense of Removal of Names of Companies from (ROC) Registrar of Companies under Section 248 (2) of Act is Rs 5000.

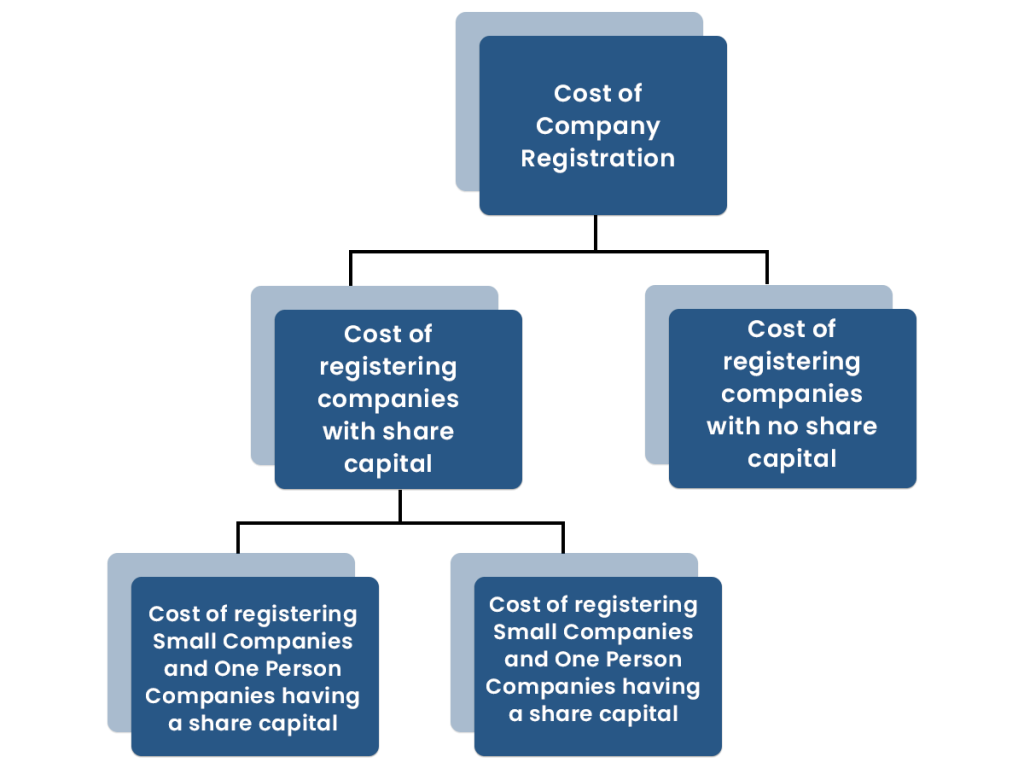

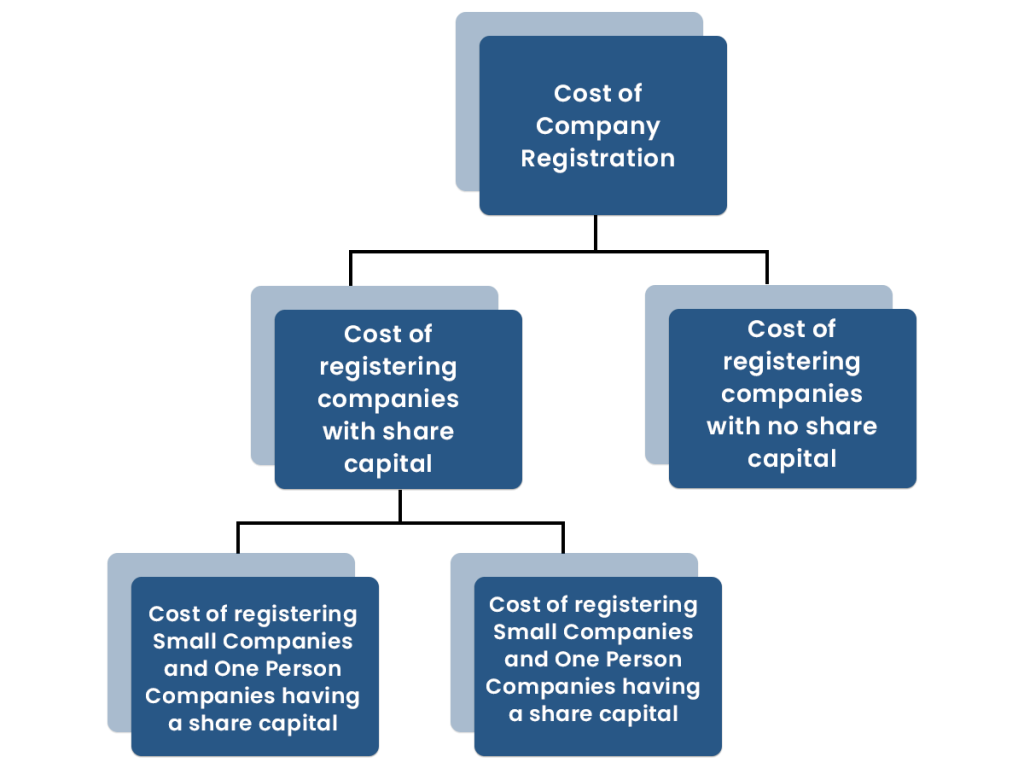

Cost of Company Registration

Under Section-403 of Companies Act, 2013[1] the documents that are submitted & filed for information required to be registered under the Act must be submitted within the time specified in the provision on payment of fees as prescribed here.

Cost of Registering One Person Companies and Small Companies having the Share Capital

- When a nominal share capital is within Rs 10,00,000- Rs 2,000

- When a nominal share capital is more than Rs 10, 00,000 and within Rs 50,00,000 then Rs 200 for every Rs 10,000 or part thereof nominal share capital.

- When a nominal share capital is more than Rs 50, 00,000 and is within Rs 1 crore to Rs 1, 56,000. then Rs 100 will be added for every Rs 10,000 thereof.

- When a nominal share capital is more than Rs 1 crore to Rs 2, 06,000 wherein Rs 75 will be added for every Rs 10,000 subject to a maximum of Rs 250 crore.

Cost of Company Registration other than Small Companies and One Person Companies having a Share Capital

- When a nominal share capital is within Rs 1,00,000 – Rs 5,000

- When a nominal share capital is within the range of Rs 1,00,000 and Rs 5,00,000 then Rs 400 for every Rs 10,000 or thereof.

- When a nominal share capital is more than 5,00,000 and within 50,00,000 then Rs 300 for every Rs 10,000 or thereof

- When a nominal share capital is between Rs 50,00,000 and Rs 1 crore – Rs 100 for every Rs. 10,000 or thereof.

- When a nominal share capital is more than 1 crore and within Rs – Rs 75 for every Rs 10,000 and thereof.

Cost of Company Registration with no Share Capital

- The companies that are registered with the 20 members the charge will be of Rs 2000.

- The companies that are registered with the members more than 20 in number the charge will be of Rs 5000.

- The companies that are registered with the members more than 200 but not stated to be unlimited members the charge will be of Rs 5000 plus an additional fee of Rs 10 for every member after first 200.

- The companies that are registered with the unlimited members the charge will be of Rs 10000.

Fees of Company Registration

The fees of a company are determined by the company having share capital and company without share capital as mentioned below:

For companies with a Share Capital

- Rs 200 will be the fees for a company registration for the organizations whose nominal share capital is limited to 1, 00,000.

- Rs 300 will be the fees for the organizations whose official share capital adds up to Rs at least 1,00,000 yet it is constrained to not as much as Rs 5,00,000

- Rs 400 is the fees of company registration for the organizations whose official share capital adds up to Rs 5,00,000, however, is restricted to not as much as Rs 25,00,000.

- Rs 500 is the fees of company registration for the organizations whose official share capital adds up to Rs 25,00,000, however, is constrained to not as much as Rs1 crore.

- Rs 600 is the fees of company registration for the organizations whose official share capital adds up to Rs 1 crore or more.

For companies without share capital

- The online company registration charge for the organizations without share capital is set at Rs 200, regardless of their turnover.

Fee Applicable for the Delayed Filing of Forms

Companies will have to pay additional fees for the delays in filing of forms other than for an increase in nominal share capital. The following will be implied of delay:

- For a delay of up to 15 days, the fee will constitute an amount of normal filing fee.

- For delays of about 16 to 30 days, the fee will be 2 times of the normal filing fee.

- For delays of about 31 to 60 days, the fee will be 4 times of the normal filing fee.

- For delays of about 61 to 90 days, the fee will be 6 times of the normal filing fee.

- For delays of about 91 to 180 days, the fee will be 10 times of the normal filing fee.

- For delays of more than 180 days to 270 days, the fee will be 12 times of the normal filing fee.

Fee on Applications Furnished to the Central Government

Fee for applications furnished to Central Government varies according to the type and size of the organization. The fee structure is specified below:

- An application fee for companies whose authorized share capital is limited to Rs 25,00,000 has following fees:

- Rs 1,000 in case of Small Companies and OPC’s

- Rs 2000 in case of other companies.

- An application fee for companies whose authorized share capital is above 25,00,000 but is limited to Rs 50,00,000 has following fees:

- Rs 2500 in case of Small Companies and OPC’s

- Rs 5000 in case of other companies.

- An application fee for companies whose authorized share capital is above 50,00,000 but is limited to Rs 5 crores has following fees

- No fee for Small Companies and OPC’s

- Rs 10000 in case of other companies

- An application fee for companies whose authorized share capital is above 5 crores but is limited to Rs 10 crores has following fees

- No fee for Small Companies and OPC’s

- Rs 15000 in case of other companies

- An application fee for companies whose authorized share capital is above Rs 10 crores has the following fees

- No fee for Small companies and OPC’s

- Rs 20,000 for other companies.

Conclusion

Companies holding a valid license issued under section 8 of the Act will be levied with the fee of Rs 2,000. Small Companies and OPC’s are exempt from making any payments as they will not be charged with any fees. We at Corpbiz our professionals can guide you with detailed analysis about your cost of company registration.

Read our article: How can a person Check Company Registration Status on MCA website?

tableoffee_01042014