Share Capital is defined as the funds raised by the company through issuing shares to the public. In simple words, you can say that share capital is the money invested in a company by the shareholders. It is a long term source of finance through which shareholders gain a share of ownership in the company. Here in this article, we will have a look at the different kinds of Share Capital.

Which Act States the Nature of Shares or Debentures?

Section 44 of the Companies Act, 2013[1] states that the Share or debentures or other interest of any member in a company shall be a movable property and transferable in the manner as prescribed in the Articles of the company.

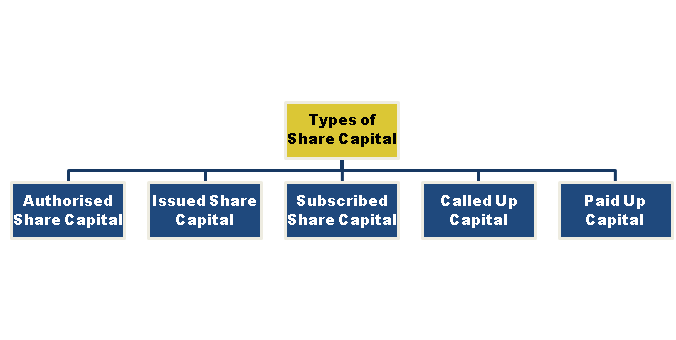

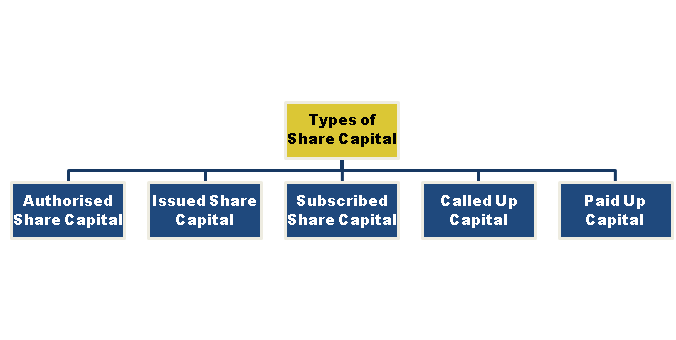

What are the Different Types of Share Capital?

Following are the different types of Share Capital –

1. Authorized Share Capital

Authorized Share Capital is the total Capital that a company accepts from its investors by issuing shares which are mentioned in the official document of the company. It is also called as Registered Capital or Nominal Capital because with this Capital a company is registered.

According to Section 2(8) of the Companies Act, 2013, the limit of Authorised Capital is given under the Capital Clause in the Memorandum of Association. The company has the discretion to take the required steps necessary to increase the limit of authorised capital with the purpose of issuing more shares, but the company is not allowed to issue shares that are exceeding the limit of authorised capital in any case.

Authorized Share = Issued Share + Unissued Share.

2. Issued Share Capital

Issued Share Capital is the part of Authorized Share Capital issued to the public for subscription. And this Act of issuing Share is called Issuance, allocation or allotment. In a simple way, you can say that Issued Share Capital is the subset of the Authorized Share Capital. After the allotment of shares, a subscriber becomes the shareholder.

Issued Capital = Subscribed + Unsubscribed Capital

3. Subscribed Capital

Subscribed Capital is the part of issued Capital which has been taken off by the public. It is not mandatory that the issued Capital is fully subscribed to by the public. It is that part of the issued Capital for which the application has been received by the company. Let’s understand this with an example – If a company offers 16000 shares of Rs. One hundred each and the public applies only for 12000 shares, then the issued Capital would be Rs 16 lakh, and Subscribed Capital would be Rs 12 lakh. Issued Share is equal to the sum total of share outstanding and treasury shares.

4. Called-Up Capital

Called up Capital is the part of the Subscribed Capital, which includes the amount paid by the shareholder. The company does not receive the entire amount of Capital at once. It calls upon the part of subscribed Capital when needed in installments. The remaining part of the Subscribed Capital is called Uncalled Capital.

5. Paid-Up Capital

The part of Called-up Capital which is paid by the shareholder is called Paid-up Capital. It is not mandatory that the amount called by the company is paid by the shareholder. The shareholder may pay half the amount of the called up Capital, which is called as Reserved Capital. As the name reserve means to keep some amount in the treasury of the company. This is quite useful in case of winding- up of the company.

The Companies Amendment Act 2015, has amended that minimum requirement of the paid up capital is not required in the Company. That signifies that at present the formation of the Company can be done with even Rs.1000 as the company’s paid up capital. The paid up capital shall always be less than or it can be equal to the authorised share capital at any point of time and the Company is not allowed to issue shares beyond the company’s authorised share capital.

Read our article:What is Article Of Association and Alteration in AOA?

What is the difference between Capital Reserves and Reserve Capital?

There is a clear difference between Capital Reserve and Reserve Capital. Capital Reserve is the part of profit reserved by the company for a particular business purpose or to finance long term projects. Whereas, the Reserve Capital is the part of the Authorized Capital that has not yet called up by the company and is available for drawing anytime when necessary.

Why do Companies issue Shares to the Public?

Company issue shares to the public in order to raise capital or to finance their business operations, expand the business, and meet other financial needs. After the acceptance of shares by the company, the applicant becomes shareholders in the company, and they get the voting right on the matters of the corporate policy.

Expansion and Strengthening

Startup companies and young corporations issue shares to external investors to raise money for expansion. Equity does not require repayment; hence, stress on the company is reduced. Also, the company issue shares in order to retire existing debts.

Raising Startup Capital

Early-stage companies require funding for various kinds of reasons, either for infrastructure costs, rent, security deposits, insurance, marketing, business travel, equipment, and furniture. This can be achieved by issuing shares to the public.

Why do Investors buy Shares from the Company?

You must have heard from many that shares are the best long term investments for an individual. But at the same time, it involves risk too.

Investors buying shares in companies generate wealth for themselves in the form of return on their investment. Return on these investments comes from dividend distributions that increase the share value.

Representation of Share Capital in the Balance Sheet

In general, the share capital can be seen in the balance sheet of the company under the ‘shareholder’s fund’ heading. The paid-up capital is regarded as the real capital as it signifies the amount as paid by the shareholders. In addition, it is also added to the balance sheets liabilities side to complete the column.

Conclusion

Companies issue shares in order to raise funds by diluting the ownership interest of the original shareholders. The share prices may go high and low at some time. So it’s better to invest in the share market in a wise way. Also, many people get confused between shares and shares capital. Share capital is the fund raised by a company through the sale of equity to investors, whereas Share is the proportion of the amount paid by the shareholder in the company.

Read our article:Provisions for the Allotment of Securities by a Company