Under Goods and Services, Tax Law works contract has been constrained to any work undertaken for Fixed and Immovable property. As per Section 6(a) of Schedule II of the CGST Act, works agreement shall be treated as “Supply.” Therefore, there is a clear differentiation of GST on works contract as a supply of service. In this article, we will discuss GST on the works contract in detail.

What do you mean by Works Contract?

According to section 2(119) of CGST Act “work contract” states that a contract for construction, building, production, completion, erection, installation, fitting out, improvement, alteration, repair, maintenance, renovation, alteration or commissioning of any immovable property where transfer of ownership in goods or services (whether as goods or in some other form) is elaborated in the implementation of such contracts.

Works Contract under Services Tax and VAT

Works contract has elements of both necessities of services and sale of goods. Hereafter, the same was taxable under both VAT as well as service tax.

Service Tax

As per Section 65B of the Finance Act defines Works contract as a contract where transfer of property in goods and executing such agreement in the execution of such under GST for sale of goods are involved. The arbitration should apply for the purpose of carrying out building, erection, commissioning, installation of any movable or immovable property or for any other similar activity or a part thereof concerning such property.

As per section 66E of the Finance Act[1], the services involved in the implementation of works contract shall apply as service. Henceforth service tax applies only to the service element of the works contract. The principle of apartheid of the value of goods was provided in Rule 2A Of theService Tax (Determination Of Value) Rules, 2006.

VAT

The dominant intention of the agreement is the implementation of a service. There is no component of sale of goods (as per Sale of Goods Act). The contract applies as permanent, no changes to levy VAT on the sale of goods involved in the implementation of works contract. The decision controlled by the government to modify the constitution on India and inserted Article 366 (29A)(b) which allowed the state government to levy a tax (VAT) on the transfer of property in goods involved in the implementation of a works contract.

Read our article:How to apply for GST registration certificate online?

Input Tax Credit for Works Contract under GST

According to section 17(5) (c) of the CGST Act, the input tax credit for works contract amenity when provided for construction of any immovable property other than plant and machinery excluding any input service for further supply of works contract service under GST. Therefore, any input tax credit for works contract can be availed by the person who is in the same business line and is using such services received for further supply of works contract service.

Maintenance of Records for Works Contract under GST

According to Rule 56 (14) of the CGST Rules, each and every registered person implementing the works contract should have separate accounts for works contract showing the following details:

- The names and address of the person on whose behalf the works contract are implemented;

- Explanation, value, and quantity of goods or services received for the execution of works contract;

- Description, value and quantity of products or services utilized in the implementation of works contract;

- The details related to payment received in respect of every Works contract;

- The name and address of supplier from where the received goods or services;

- Place of Supply underworks Contract under GST.

- Place of Supply under Works Contracts under GST should involve immovable property. According to Section 12(3) of the IGST Act, the area for the supply of the supplier and the addressee should be located in India only. The place of supply should act as the location of the immovable property.

Valuation of Works Contract under GST

Valuation of works contract service depends upon the contract which includes the transfer of property at location specified as a part of the works contract. In case of the supply of service and valuation of works contracts under GST, involving the transfer of ownership in the area or undivided share of the domain, the value shall be: –

- Value Of Supply Of Service as well as Goods = Total Amount Charged For Such Supply (-) Value Of The Share Of Land Or Undivided Stock Of Land

- The total amount will include consideration charged for the above service, including the amount charged for the transfer of land.

- The value of the land should be deemed to be one-third of the total amount charged for such supply of goods and services.

Place of Supply under GST

Works contracts under GST are connected and associated with immovable property. Where the supplier and recipient both are situated in India, the place of supply should be the location of immovable property situated. In case if the immovable property is situated outside India and supplier or recipient of the goods and services are located in India, place of supply would be the location of the recipient of goods and services. Where either the supplier or receiver is located outside India, place of supply should always be the location of immovable property situated in India.

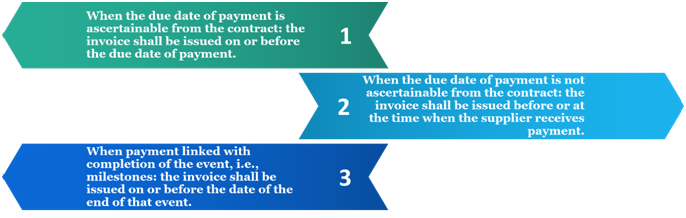

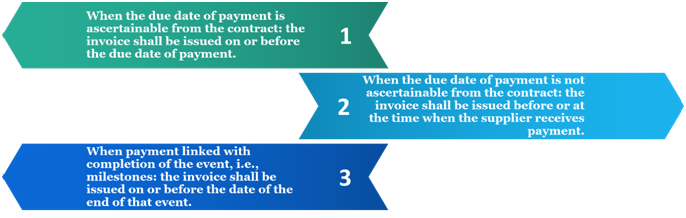

Time Limit to issue Tax Invoice

Works contract under GST should be treated as ‘continuous supply of services’ as the services are provided under a contract with periodic payment responsibilities. In most of the cases, the period for payment exceeds three months.

Time of Supply

No separate provision has been given for the time of supply for works contract, which is treated as ‘continuous supply of services. Time of supply for ‘continuous supply of services’ shall be determined as per general provision given to determine the time of supply of service which will be earlier of: –

- Date when the invoice is issued or required to be issued

- Period of receipt of payment

Conclusion

Tax Law under works contract has been constrained to any work undertaken for Fixed and Immovable property. As per Section 6(a) of Schedule II of the CGST Act, works agreement shall be treated as “Supply.” Therefore, there is a clear differentiation of GST on works contract as a supply of service. In this article, we will discuss GST on the works contract in detail. Our CorpBiz group shall be at your disposal if you seek expert advice on any aspect related with GST Registration along with complete compliance. We will help you ensure full compliance concerning all the requirements based on your anticipated activities, ensuring the productive and well-timed completion of your expectation.

Read our article:Latest: Government unable to pay state’s GST compensation share