The Central Board of Indirect Taxes and Customs has issued the circular prescribing measures for smooth implementation of faceless assessment. While an implementation has been largely smooth, the Board’s attention has been drawn to some issues impacting the pace of assessment & clearances of consignments. As a prompt and timely assessment of Bills of Entry and clearance of imported consignments are the objectives of Turant Customs, these issues have been examined and remedial measures have been identified.

Key Highlight on Measures for Timely Assessment

Read our article:Latest Highlights on the Industrial Relations Code Bill, 2020

The Board has prescribed the various measures for Faceless Assessment

- Firstly, an aspect of Continuous Assessment, the Board stated that one of the 5 Working Groups established under the NACs will be responsible for timely assessments including resolving the issues related to IT field.

The Board also stated that in the event of increase in pendency for a particular FAG/NAC, the NAC Commissioners heading this Working Group must take urgent measures for co-ordination with other NAC Commissioners/DG Systems for an early disposal & resolution of the issues.

- Secondly, an aspect of rising of queries by FAG Officers, the Board has stated that the Working Group[1] on Prohibitions & Restrictions are advised to identify the item wise CCV requirements for uniformity in the FAG. It must also communicate the same to RMCC for their central enforcement. Once it is done, the Appraising and Assessment officer must no longer need to insert a remark to this effect in a system.

- Thirdly, an aspect of resorting to First Checks, the Board stated that when an importer requests First Check on a regular basis, the FAG officers & the NAC has to take due care that for genuine request and is not being routinely used to avoid self-assessment.

- Fourthly, an aspect of the role of RMCC/LRM in facilitation the Board clarified that all local alerts must be reviewed periodically and continued, only if found absolutely necessary. LRM is also advised to use ICES to insert general instructions and Alerts rather than through the RMS.

- Fifthly, an aspect of re-assessment of B/E the Board highlighted 3 scenarios which are,

- Where the amendment is requested before OOC can impact the assessment;

- Where a re-assessment is requested before OOC but it will not impact the assessment;

- Where a re-assessment is requested after OOC has been given under Section 47 of Customs Act, 1962.

- Sixthly, an aspect of Certificate of Origin the Board stated that the field offices have to ensure that no physical copy of any supporting document has been submitted. Every relevant document must be submitted only electronically via e-sanchit either by beneficiary or by Participating Government Agency.

- Lastly, an aspect of grievance redressal, the Board stated that the details of a nodal officer and the contact details would be made available by Public Notice. In CBIC website for escalation of any issues including the B/Es in FA requiring urgent attention. The Principal Commissioner or a Commissioner at the Port of Import can make other necessary internal arrangements further for co-ordination at appropriate levels for early resolution.

Conclusion

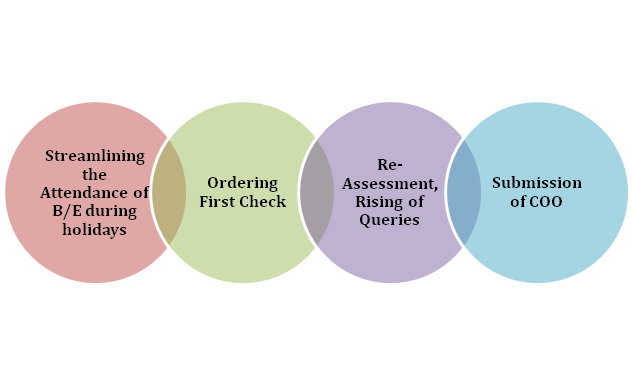

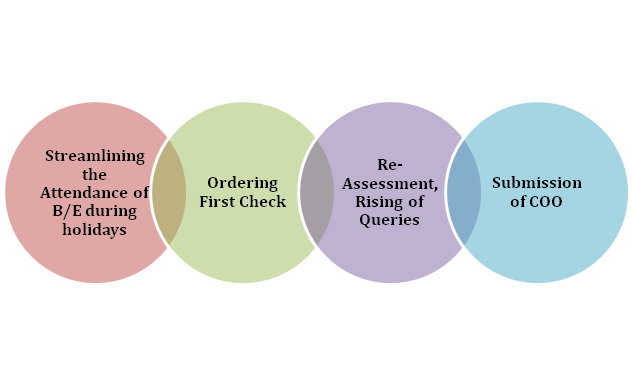

The Board expects that the measures relating to streamlining the attendance of B/E during holidays, ordering First Check, re-assessment, rising of queries, and submission of COO will certainly contribute to a reduction in a time taken for assessment of Bills of Entry and clearance of goods. This is expected that these measures have to be strictly applied by all NACs and all FAGs.

Read our article:An Outlook on the Code on Social Security, 2020: Latest

Central-Board-of-Indirect-Taxes-Customs