The CBDT has issued clarification in respect to direct tax under Vivad se Vishwas Act, stating that the requirement of making payment by a taxpayer within 15 days of receiving declaration certificate from designated authority; however this will not apply according to new notification now. As the Board has been extended the timeline for making payment without additional amount till 31st March, 2021.

The central government with vide notification no 85/2020 has extended the date for payment without any additional amount paying under Vivad se Vishwas scheme from 31 Dec 2020 to 31st March 2021. The said notification has also been notified the last date for filing declaration under Vivad se Vishwas Scheme as 31st December 2020.

Key Highlights on Extension under Vivad se Vishwas Act

Read our article:Judgement by Karnataka HC – Ground to Invoke Revisional Powers

What is under Vivad se Vishwas Act?

- The Vivad se Vishwas Act, 2020 was enacted by a government with an objective to generate timely revenue for the Government, reduce pending income tax litigation. It is to benefit taxpayers by providing them peace of mind, certainty, & savings on account of time and resources that would otherwise be spent on a long-drawn and vexatious litigation process.

- The provision of Vivad se Vishwas Act has been amended by the Taxation and Other Laws (Relaxation & Amendment of Certain Provisions) Act, 2020 to provide certain relaxation in view of the COVID-19 pandemic[1] and also to empower Central Government to notify certain dates.

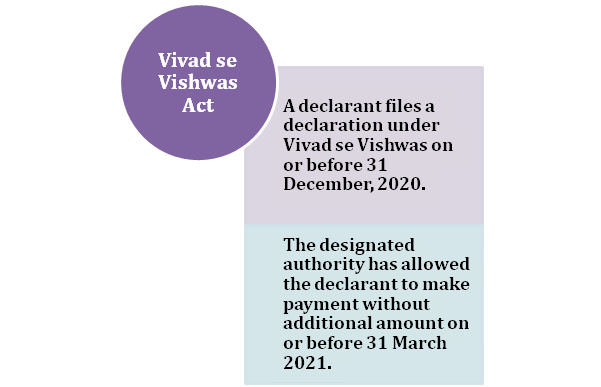

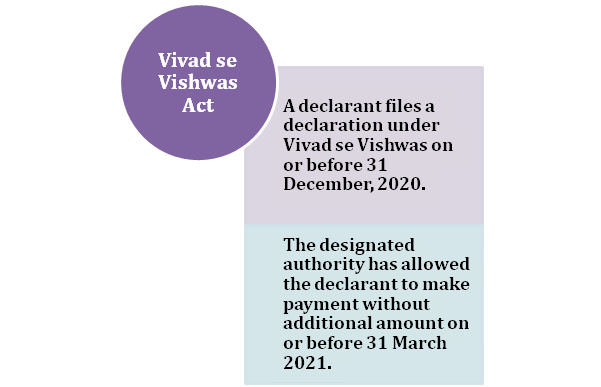

- Under the existing provisions of section 5 of the Vivad se Vishwas Act, a declarant is required to pay the amount within the period of 15 days from a date of receipt of certificate from the designated authority.

- However, according to the notification, the declarant who files a declaration on or before 31 December 2020 can now make payment without paying an additional amount on or before 31 March 2021.

Why this new Notification has come into Force

Under an existing provisions of section 5 of sub-section (2) of the Direct Tax Vivad se Vishwas Act, 2020, a declarant has to pay an amount within the period of 15 days from a date of receipt of certificate from a designated authority.

However, according to the aforesaid notification, the declarant who files the declaration on or before 31st Dec 2020 can make the payment without any additional amount on or before 31st March 2021. Therefore, the required payment by a declarant within the period of 15 days from a date of receipt of certificate from a designated authority may result into an undue hardship for the declarant in whose case a period of 15 days expires before 31st Mar 2021.

In order to mitigate an undue hardship and remove difficulty that may be caused by the requirement of payment within 15 days from a date of receipt of certificate from the designated authority. It has clarified that where a declarant files a declaration under Vivad se Vishwas on or before 31 December, 2020, the designated authority while issuing the certificate under section 5 of the Vivad se Vishwas Act, shall allow the declarant to make payment without additional amount on or before 31 March 2021. It has to be remembered that 31st December 2020 was the last date for filing for a declaration by an assessee who wishes to avail this amnesty scheme. After that, he cannot avail the benefit of scheme unless again extended. However, an assessee shall have the extended period up to 31st March 2021 for making a payment of disputed tax without any additional payment of 10% of the amount.

Conclusion

It is concluded that the requiring payment by a declarant within a period of 15 days from a date of receipt of certificate from the designated authority may result in undue hardship for the declarant in that case the period of 15 days expires on or before 31st March, 2021.

Read our article:Vivad Se Vishwas Scheme: A Complete Overview

Circular_18_2020