On Monday, CBDT took the vital decision in the direction of income tax rule 1962. This time authority makes some changes by implementing Rule 2DB that advocates a couple of conditions that pension funds ought to be met. The Central Board of Direct taxes, aka CBDT issues condition for pension funds for income tax exemption.

Pension Fund According to Clause (2FE) of section 10

From the viewpoint of clause (2FE) of section 10, the pension fund should mandatorily meet the following conditions.

- It is regulated under foreign country law, including the provision incorporated by any of its political constituents from state or local body regardless of its name.

- It is accountable for investing the asset to cater to statutory obligations or any other expenditure projected to render long-term benefit on account of employment, retirement, disability, or social security.

- The assets related to the pension funds should only be utilized to meet regulatory obligations. The asset and the earning of the pension funds should not be exposed to personal expenditure. Instead, it should be utilized to address the statutory obligations or beneficiaries of the fund as per clause II. The earning of the pension fund shouldn’t propagate any sort of advantage to the private person.

- The pension funds are not meant to pursue commercial activities either within the country or in overseas locations.

- The authority must be intimated in case if any investment that was triggered with the help of pension funds. The concerned citizen can take advantage of FORM No. 10BBB to serve this purpose. The intimation must be done within one month from the end of the quarter.

- It must file the ITR before the due date as per the subsection (1) section 139 and a certificate in the Form no- 10BBC regarding the compliance of clause (23FE) of section 10.

Read our article:CBDT Clarifies its take on Non-Furnishing of PAN by Non-Resident

Guidelines for notification concerning Clause (23FE) of Section 10

The amendment takes advantage of Rule 2DC, elaborating guidelines for notification as per clause (23FE) of section 10. Form No: 10BBA, Form No: 10BBB, and Form no: 10BBC will find their way in Income Tax Rule, appendix ii.

Form no: 10BBA

Form no: 10BBA serves as an application for notification under sub-clause (iv) of clause (c) that enclose the explanation regarding clause (23FE) of section 10 w.r.t pension fund.

Form no: 10BBB

Form no: 10BBB act a certificate of accountant w.r.t provisions of clause (23FE) of section 10 of the income tax act[1].

CBDT issues condition for pension funds should benefit the pensioners and employees in the longer run. With that being said, once this amendment comes into effect, the employees have to take care while spending pension fund for any purpose.

Conclusion

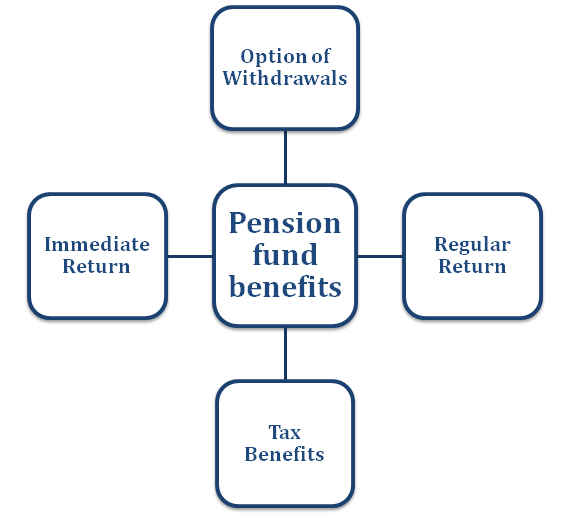

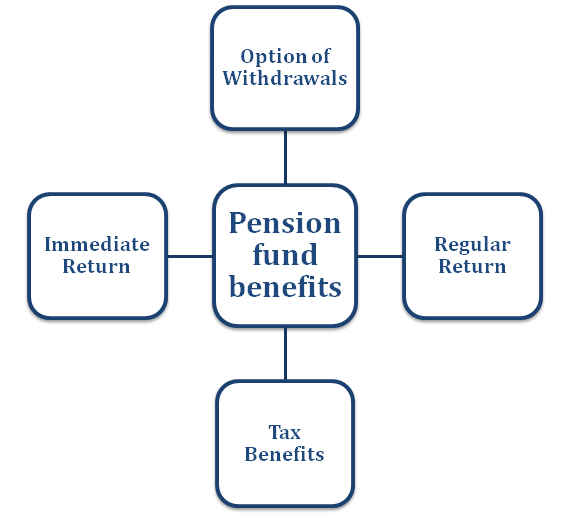

CBDT’s decision toward pension funds seems to be a proactive measure from an income tax viewpoint. Pension funds are the sort of investment undertaking that covers the aspect of employee saving. Their main goal is to provide financial aid in the form of a pension in the retirement phase. It’s important to keep in mind that pension funds are governed by capitalization, unlike public pension funds.

As soon as the member reaches the retirement age, they are supported financially by capital paid by the fund. Pension fund operations revolve around three types of activity: premium collection, benefits paid, investment of sum collected. CorpBiz shall be happy to serve you if you require any assistance regarding Income tax or any of its concerns.

Read our article:Major reforms aimed at Transparent Taxation for ‘Honoring the Honest’ – PM Modi launched.